European ABS Outlook 2024

2023 proved to be a second year where European ABS gave investors the strongest returns in fixed income with the benefit of very low volatility. As risk-free rates grew to what we expect to be the peak, income was maximised whilst the various market pivots on rates came and went in the rear view mirror.

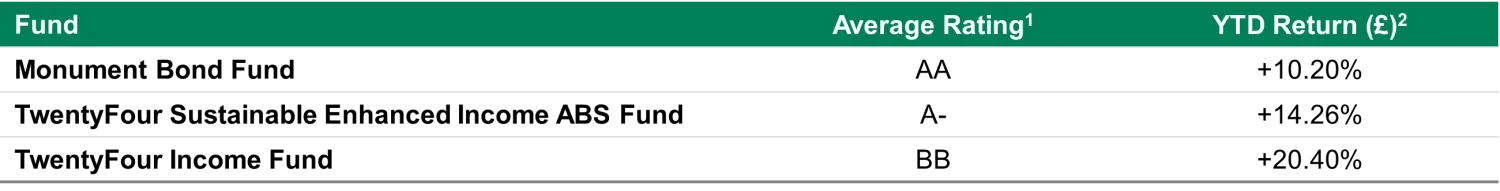

To frame the moves, the Pan European Floating ABS Bond Index has returned +6.21% (£) to end of December, an index with 96% in AAA/senior bonds. TwentyFour managed funds achieved the following:

1. Based on an internal ratings methodology.

2. As at 31st December 2023. Based on the I Gross Acc share class for the Monument Bond Fund, A Inc share class for the TwentyFour Sustainable Enhanced Income ABS Fund & NAV for the TwentyFour Income Fund. Past performance is not a reliable indicator of current or future performance. The performance figures shown are on a mid-to-mid basis inclusive of net reinvested income and net of all fund expenses. Performance data does not take into account any commissions and costs charged when shares of the fund are issued and redeemed, if applicable. The return of the fund may go down as well as up due to changes in exchange rates.

In our flagship strategy note ( The Rodney blog 2024: strong returns ahead ) we outlined how fixed income had broadly delivered its advertised yield during 2023 (with thanks to a powerful December rally), whilst ABS had outperformed against this backdrop. We also noted that the global economy has been more resilient than the market expected, allowing for more aggressive hikes but also drawing caution from investors as to the timing and extent of lag effects. These too have been slow to materialize, though a normalization of performance without artificial quantitative easing support is evident in most parts of European ABS. Our conclusion was that whilst the timing remains divisive, we certainly expect a weakening of the global economy in 2024 and that fixed income looks attractive for investors tempted to leave cash ‘behind’ but caution is warranted.

Primary markets and technicals

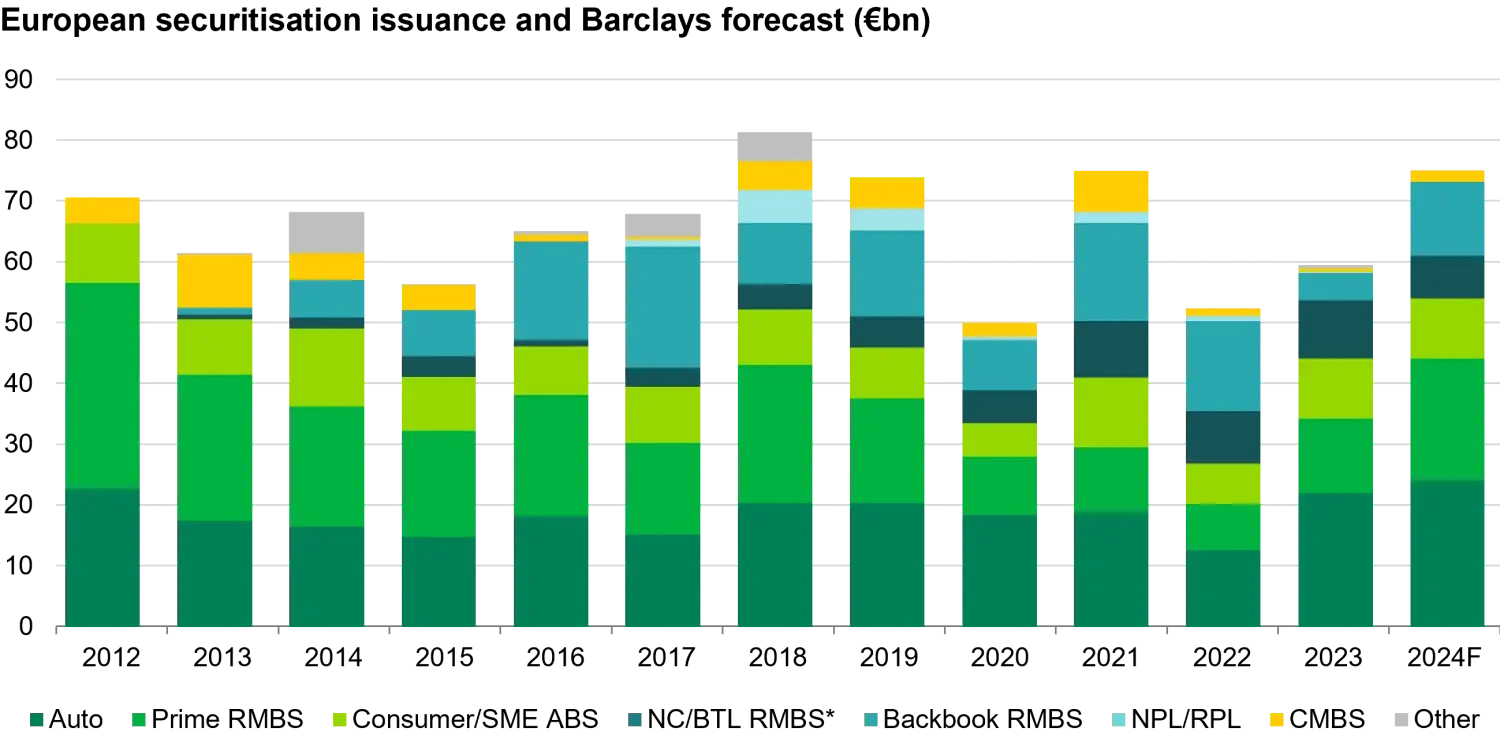

2023 saw a 36% increase in primary volume vs 2022, totalling €90bn (including €26bn of CLOs)3, with the Australian market contributing a further A$46bn4. Despite a volatile backdrop we saw 7 new CLO managers enter the thriving market from the like of M&G and newcomers Arini. The other primary change was our predicted shift of banks to restart or re-enter the market, typified by record levels of auto ABS issuance and returns to the market for Lloyds with two deals in quick succession following a 4 year absence, and ING printing a Green Dutch RMBS with an even more impressive second deal in 17 years alongside a commitment to be in the market routinely going forward. In addition to this, the more opaque Significant Risk Transfer market has responded to banks’ needs to have alternative sources of capital, with growing demand and an expectation that transactions will easily outstrip the 118 issued in 2022. Aside from a short period during the US regional bank issues and the Credit Suisse AT1 write off in March, we saw healthy and varied issuance providing a landscape which allowed us to pivot our allocations to suit conditions.

3. Morgan Stanley

4. Citibank

*Frontbook only.

Source: Bloomberg, Concept ABS, Barclays Research

The Bank of England’s Term Funding Scheme will see £50bn of the £160bn outstanding mature in 2024 whilst the bulk of the ECB’s TLTRO has already matured. As a consequence, an urgency for wholesale funding by banks is expected to see ABS feature more heavily in plans, with UK issuers likely bigger users of RMBS than continental peers who have recently generally preferred Covered Bonds.

Issuance then will breach €100bn in Europe in our view and push close to the 2021 post-GFC record. This will be helped by a steady €25bn of new CLO supply with 66 active managers now and a few more expected. We expect a further €10-15bn of existing CLO deals with expensive debt being reset during the year albeit some equity holders will likely prefer to liquidate pools instead; we are already seeing an increasingly strong bid for shorter CLOs in December. We only saw 3 EU CMBS deals in 2023 and expect H1 2024 to remain quite, although we do feel that a floor has been set on spreads and activity in the CRE market which will pick up with some issuance along with it. Challenges in CMBS remain and relate to loan extensions and we saw a default in a Blackstone sponsored Finnish office transaction albeit a successful restructuring has since occurred. Finally, in Australia, a largely EU compliant market, we are seeing growing diversity from auto, SME, CMBS as well other non-prime mortgages offering something different and we think we may see modest growth continue.

Public ESG-labelled issuance has been subdued this year at only €1.6bn (three green RMBS and one social ABS). However we have seen a couple of interesting issues such as an auto transaction backed by 100% hybrid vehicles and the first solar ABS deal (although this was a private placement). In addition to this, on the regulatory side the European green bond standard (EuGB) was approved. Even if there is still time for implementation we believe it will help boost supply and we expect higher volumes of ESG deals next year as the market matures.

Liquidity and relative value

The test of liquidity for our market came during the UK LDI crisis in Q4 2022, which left spreads wider to other fixed income sectors coming into 2023. We think this provided compelling evidence to dispel the myth that ABS is less liquid than IG corporate markets. Spreads have tightened through 2023 but continue to offer an excess premium to IG and HY markets which have also tightened materially.

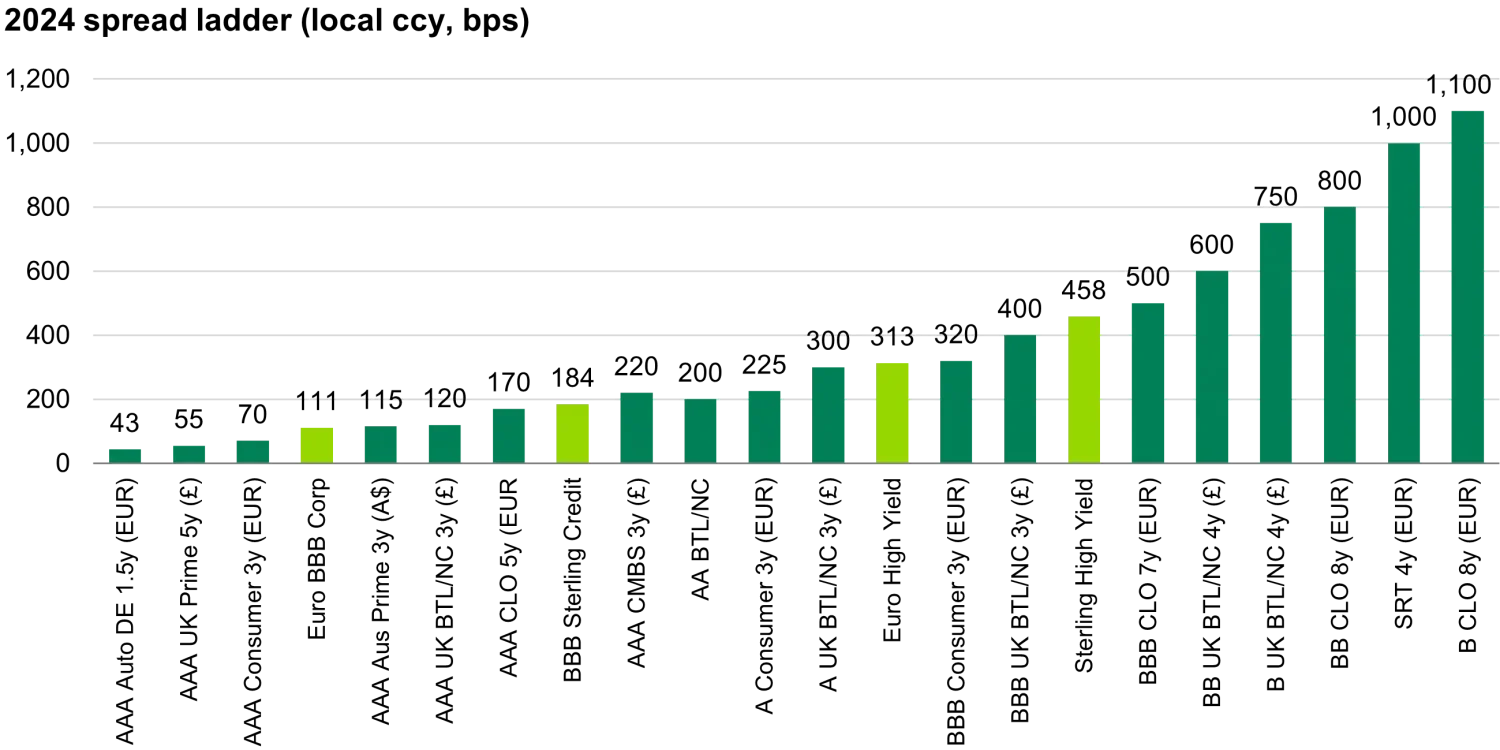

As we enter 2024 spreads remain interesting, some of which are highlighted below:

Source: ICE Indices, Bloomberg, PSL, CitiVelocity, Intex, TwentyFour, as of 18th December 2023

Spreads have settled down and start 2024 at elevated levels compared to historic averages but we expect that post-QE era valuations necessitate this and that this will therefore remain the case over the medium term.

European ABS can also reward investors for moving into more specialised sectors or down the rating curve. Spreads are near the 70th percentile which is wide to other fixed income markets. Take for example single-A rated BTL RMBS, in GBP this carries a spread of +300bp with BBBs +400bp while the equivalent BBB sterling credit is materially tighter at +184bp ; BBB rated ABS gives us a spread that is broadly the same as HY bond indices, whereas you need to delve down into CCC rated high yield before you pick up more spread than the +500bp offered on BBB rated CLOs. Equally, we think the marked pick up in spread that you can get is particularly appealing for a late cycle environment, with BB rated RMBS typically giving you a 200bp pick up vs BBBs; on the CLO side its nearer 300bp.

We also think that AAA bonds are generically interesting for investors in 2024 looking for yield and superior liquidity. This is partly because we have seen increased bank supply but also with the ECB having ceased purchases in July under its ABS Purchase Programme. The remaining holdings total a mere €15bn currently (down from a peak of €31bn) and with a further 50% expected to mature in 2024. Whilst a tiny programme, the ECB’s purchases alone accounted for 29% of average supply during its life, so the impact on AAA spreads was material. The result of these factors has been a rebasing in spreads. One example being VW’s German Auto ABS where the latest printed at Euribor+42bp vs tights of +10bp. In other sectors, AAA CLOs at +170bp and CMBS at +220bp currently offer the highest spread in European and Australian ABS, with CMBS spreads clearly impacted by sentiment around the health of the overall commercial real estate market, but liquidity in this area has improved recently.

Fundamentals

The key macroeconomic elements that impact ABS can be characterised fairly simply in our view, better than we expected at this point.

Labour markets are slowing as is growth in wages across Europe, but with inflation also descending rapidly, real incomes have improved in the second half of 2023. We think this explains why consumer confidence is strengthening, albeit from a low base, with spending patterns having proved robust.

We expect a managed deterioration to both consumers and corporates in 2024 and beyond, something that ABS bond structures are designed to cope with. House prices should continue to weaken slowly until wage growth creates a new affordability equilibrium at higher interest rates (albeit somewhat mitigated by a structural shortage of housing supply), corporates earnings will likely continue to slow and more expensive financing will start to bite.

A normalisation in performance looks to be underway and we think underappreciated is the positive benefit (even after a decade of QE) that Covid gave to households and corporates who were able to save more and borrow cheaply, and particularly relating to households, their reduced debt burden. Much of the weakening in 2023 has been limited to where the underlying loans are floating rate (therefore taking all of the brunt of hikes) and very old pre-GFC vintage non-prime loans where underwriting was at its weakest (but borrowers have certainly seen benefits from significant wage inflation during the year). This can be seen across the arrears levels in the below example UK RMBS deals which have more than doubled over the past 18 months. Meanwhile Dutch and French RMBS performance has remained more stable, supported by cheap long term fixed rates, but elsewhere on the continent we did see a deterioration of performance in the German unsecured consumer, notwithstanding we are seeing early signs of stabilisation in arrears levels now.

Source: Bank of England MLAR 1.4.C (All regulated and unregulated) as at September 2023; Investor reports as at December 2023.

What to look out for

Due diligence is fundamental in identifying, assessing, benchmarking and underwriting opportunities in ABS. In 2023 we conducted over 120 formal due diligence engagements taking us across the continent. We invest in senior, junior, public and private opportunities and we believe this is a key source of differentiation, particularly when markets are softening. The result of this has been several investment changes, from CLO platform disinvestments, new investment in a less favoured RMBS shelf following major bond structure concessions, to lobbying for environmental data from one of the world’s largest auto manufacturers. Given its importance we expect to be equally busy with our due diligence engagements in 2024.

An additional threat and opportunity we expect to see more regularly is tiering. For CLOs tiering is evident by manager, deal vintage and performance based and can be actively traded. In 2024 we think it is likely we see some consolidation in managers so we’ll be keeping a close eye on this, but equally of interest will be following how weakening pools are managed.

Tail mortgage portfolios (pre-GFC vintage) are also a source of market debate as the loans near maturity dates and arrears are higher as a result of asymmetric selection (the stronger loans repaid gradually over time). A good example being Irish RMBS deal Shamrock 2022-1, with severe arrears at 20.1% and the majority of mortgages already having seen some form of forbearance in the last decade, it’s not surprising that these kinds of borrowers are the first to see payment problems. We tend to be cautious on such opportunities despite the very strong structural protections, especially for AAA, given we expect liquidity may fall and in our view this hasn’t been priced in appropriately yet.

Both of the previous two scenarios give rise to call risk; 2023 saw a small handful of deliberately missed calls in Europe in a period where markets have been functioning perfectly well enough to support a refinance. The commonality here was tail portfolios and weakly structured bonds, affirming our view that bond structure discipline is key and this risk will grow in 2024.

ABS ratings project performance of the asset pools to maturity, informed by historic data and this has again been more stable than corporate bonds. 90% of ratings actions in 2023 were upgrades which signals expected resilience. The exceptions have been a very limited number of downgrades to sub-IG CLOs (typically limited to 1 notch) and CMBS where property valuations have dropped. That said within CLOs the growing number of deals out of their reinvestment period is increasingly driving upgrade bias as leverage drops.

One final thing we are seeing in consumer deals is lower excess spread, that is that with rapidly increasing risk free rates and wider bond margins, the yield on the asset pool has not kept pace and created lower net interest margin. This has impacted the strength of deals in some cases and led to us being very selective. This has meant that revolving deals (where new loans can be added for a period subject to quality tests) can be beneficial as more recent loan originations have had progressively higher rates. Whilst ratings take into account the lower excess spread on day one, we do not think they give credit to the increase that we expect to see as new loans revolve in and that this will be beneficial for more junior bonds, all things being equal.

Focus opportunities

As a result of recently reducing inflation numbers, the rates market is now fully pricing in a significant number of rate cuts (5 cuts by the BoE and 6 by the ECB), this now means that SONIA (very closely trailing the BoE base rate), is now paying a material 1.7% more income than 5 year Gilts. The team feels the rates rally is at risk of being overdone or at least susceptible to volatility and correction making the income in floating rate ABS a useful counterweight.

In summary, in 2024 we like the book ends.

AAA rated bonds have seen spreads adjust and we see them being rangebound through 2024 given elevated supply. With the risk free rate expected to be held at peak for some time and moderating gently, it means that AAA BTL RMBS with a £yield of ~6.4% is going to be hard to beat in most rates products, with a similar story in AAA CLOs given a circa €5.5% yield. Both can provide the foundations of a compelling portfolio in our view and with strong liquidity and de minimis credit risk, a strong safe harbour allocation.

At the other end, our team felt strongly that sub-investment grade bonds remain attractive, especially with BB-rated RMBS at a spread of around +600bp and +800bp for BB CLOs. Private ABS opportunities also look compelling to us, particularly with bank lending constrained by higher cost of funding and capital, making the prominence of the Significant Risk Transfer market as well as junior ABS investments a likely focus for the team in 2024; we believe it is possible to achieve mid-teen returns here on a long term basis.

The dark horse opportunity comes via a selective look at CRE backed investments but this will be highly contingent on deal structure and being satisfied property valuations have stabilised. We are seeing more data to inform initial investments but we think it is still by and large too soon to draw concrete conclusions and therefore likely a H2 deployment. We expect to see a slow pick up in transactions in this space and are cognisant that debtholder concessions tend to be greatest at this point in the cycle.

Conclusion

Spreads in ABS remain attractive for a late cycle environment, it’s one of the few areas of fixed income where we have confidence that risk will be rewarded as you venture down the credit curve.

Risk free rates, despite the market changing expectations in recent weeks, we think will stay at peak rates for a while longer and then settle at levels that provide fixed income and ABS a nice yield platform to work from (SONIA at 4% and Euribor 2.5% is our base case). Excessively high rates would eventually weaken fundamental ABS performance and slow economic growth potential so a compromise on risk free rates is no bad thing in our view.

In short, we think 2024 will continue to provide the carry that has been so welcome but we see market growth and diversity continuing to make European ABS increasingly scalable.