What We Can Learn From Spread Differentials

It is quite rare that we recommend playing in the very bottom of the credit spectrum because CCC rated bonds are where at least 95% of all defaults come from, and are significantly more volatile than we would like. But at the start of this year, we felt quite confident that the best returns would likely come from CCCs this year. However, in our opinion, anything but a small allocation brings a bond strategy a little too close to the equity market for comfort. Hence despite our view, we were only lightly exposed to the dynamic.

Our call on CCC was a cyclical one, and we were at the point in the cycle when investors get paid a lot to own risk while upgrades typically outpace downgrades, and default rates drop steeply. Consequently, spreads compress across ratings bands, leaving assets rated CCC the top performers.

Typically in a cycle, the low point in spreads comes first for CCC, then single-Bs before finally reaching BBs. For example, in the previous cycle, CCC’s troughed in 2014 while BBs contracted all the way to 2017 when they hit their cycle lows.

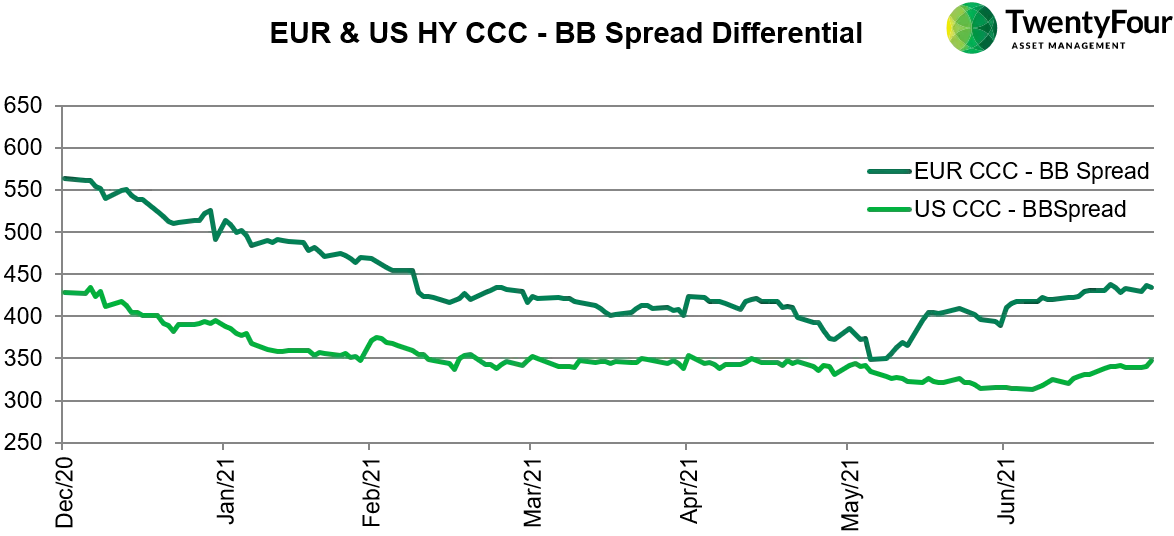

The graph below shows that the spread between CCC and BB assets has been compressing rapidly this year, leading to the strong performance from that rating cohort.

However, since early June, this compression has reversed, particularly in Europe, where CCCs have widened versus BBs by 85bps, which is quite significant. Moreover, it is quite unusual for a reversal to occur so early in the cycle, but, as we know, everything about this cycle is so much quicker than the last.

So what can we learn from this?

Well, firstly, there is still extra value in Europe versus the US. Secondly, with upgrades still outpacing downgrades in this quarter (32 upgrades vs 13 down in European high yield according to Moodys), and the default rate set to drop to below 2% by year-end, we think the rise in CCC spreads is merely evidence of the market de-risking a little as the rally continued. That said, with so much cash on the side-lines, we think any further dips will entice those buyers still looking for favourable fundamentals to step in. However, as we mentioned, this is not a riskless trade, and it is likely to be the first to play out in this short cycle, so buyers need to exercise diligence around their credit selection and timing.

Finally, we think investors may have a less fraught experience by considering single-B rated assets, which have also widened by 40bps since the middle of June. Additionally, single-B spreads are as far away from their 10-year tights as CCC spreads (180bps). Therefore, we believe buying single-B bonds on dips might prove a more durable trade from a risk-reward perspective as the cycle progresses.