Can ABS Close The Gap on Corporate Bonds?

Last week we wrote about yield curves, and the realisation that there is virtually no difference between fixed and floating rate risk any more, at least out to the mid-point on the curve.

With base rates as low as they are, yield has become a scarce commodity again. A number of companies have cut their dividends, equity valuations in some sectors have gone through the roof, and many investors will conclude the only way to get a reasonable defined income is to look at credit markets; AT1s, CLOs and RMBS still offer a decent income are among our top picks today. In this blog we’re going to have a look at where the income is in what we regard as one of the safest parts of the fixed income credit market, namely ABS.

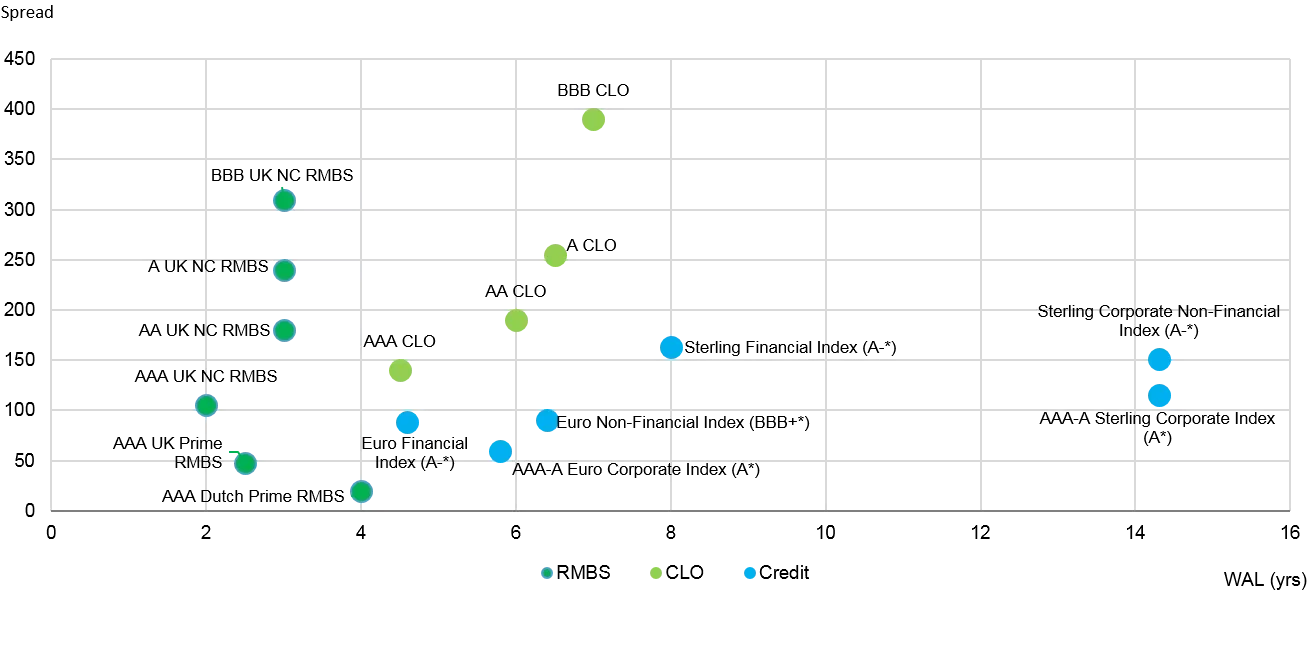

In recent months we’ve seen spreads tighten gradually as investors looking for income have shifted towards credit, but more so because the central banks have provided an abundance of liquidity through their various asset purchase programmes. The scatter plot below compares spreads over base rates for corporate bonds versus ABS and CLOs.

Source: Morgan Stanley, Citi Velocity, BofAML, 7 Sept 2020, * is the average credit rating

What we can see is that ABS and CLOs stand out in terms of spreads, rating and because they tend to be a lot shorter. RMBS in particular is a lot shorter, and since 6yr-8yr Gilts have the same rate as Sonia/Libor, one could easily prefer the floating rate nature of RMBS. The Euro Non-Financial index, with six years of duration and a BBB+ average rating, is looking relatively expensive; investors only get paid 90 basis points of spread here, less than on a two-year AAA Non Confirming RMBS bond and about half a percent less than AAA CLOs.

Clearly there’s a significant difference in spreads here, but RMBS and CLOs have always tended to trade cheaper than corporate credit. Why is that?

Away from it being a more complex and smaller asset class, ABS tends to lag when the markets rally after a significant sell-off, as we saw after the global financial crisis, the Eurozone sovereign crisis and the more recent sell-off in Q1 2016. The ABS market also tends to miss some price guidance from the primary market in periods of volatility. as issuers can be patient to come to market. However, the biggest reason is the ECB’s purchase programmes. Since the start of 2020 the ECB has net added €43bn of bonds in its Corporate Sector Purchase Program (CSPP), a relative increase of almost 25%, while the ABS Purchase Programme (ABSPP) balance has increased by just €1.1bn in the same period to a current balance of €29.5bn (as recent amortisations outpaced purchases).

What we can see from the data the ECB releases on its website is that the central bank supported secondary liquidity in both markets in March, when they most needed it, which in itself is a good thing. The ECB ABSPP is constrained in what it can buy, and is most active in AAA Dutch and French Prime RMBS and German AAA Auto ABS; this is why Dutch AAAs are so much tighter than UK Prime AAA RMBS. In a normal market we would expect a much tighter basis between ABS/CLOs and corporate credit, and clearly one of the two has to move. So which one could it be?

The ECB won’t stop its purchases for now, so corporate credit looks pretty well anchored at these levels, which in our view leaves a lot of room for ABS and CLOs to catch up in the coming months. Prime UK RMBS is unlikely to see an increase in issuance due to ongoing funding support programmes, such as the Bank of England’s revamped Term Funding Scheme (TFSME), which should preserve a positive technical for the remainder of 2020.

We expect September to be relatively busy with new ABS deals, but there’s a very strong technical developing in favour of ABS and CLOs, which should help performance in the coming months. We are already seeing that develop in the secondary market as dealers and investors have started to bid aggressively on paper with very few sellers, which should help close the gap on corporate bonds.