ESG's tipping point

Creating a truly sustainable bond fund is no mean feat. Unlike the listed equity universe, where ESG data is more readily available, it is often sorely lacking in the fixed income space. At the same time, the problem for fixed income managers is exacerbated by the complexity of a bond’s structure, consisting of multiple parts which must all be individually assessed.

This was the challenge facing Chris Bowie, partner and portfolio manager at TwentyFour Asset Management, when he decided ESG could and should be part of the firm’s investment process.

“We first convened a steering group and met every month for two years to decide on what we thought was the best way to combine ESG metrics with our strategies,” explains Bowie, who had been struck by studies as far back as 2017 which had started to show for the first time how environmental factors were becoming correlated to the future performance of credit. “It led to us deciding after a year that we were going to need to change our investment process and create our own research processes to identify sustainable parts of businesses.”

The team began by accessing an ESG database created by Research Financial, called Asset4, which allowed the firm to integrate ESG factors across all of its investment decisions. However, they didn’t think this alone was enough to build a truly sustainable bond fund. The third-party database did not cover around 40% of the firm’s investment universe.

A large part of the research work had to be conducted in-house. It was a process that ended up taking several years, thousands of hours of research and the complete overhaul of a tool unique to TwentyFour – a proprietary relative value system named Observatory.

The group’s Observatory platform combines data from Asset4 and uses the team’s own extensive in-house ESG research to fill in the gaps. The end product is a database which scores every company in the universe from 0 to 100 based on a range of quantitative and qualitative ESG metrics.

The approach to ESG for Bowie and TwentyFour was twofold: ESG integration across all of its strategies as well as focusing on launching a number of sustainability-focused bond funds. The difference between the two is significant, as it is only within the sustainable fund range that the firm applies a careful combination of negative and positive screening to create a product that they believe can offer a similar level of risk-adjusted returns to its non-ESG counterparts.

This approach resulted from rigorous quantitative testing, which applied various negative and positive exclusionary screens to the firm’s existing Absolute Return Credit fund to determine what the return profile of the fund would have been were TwentyFour to have turned it into a sustainable product.

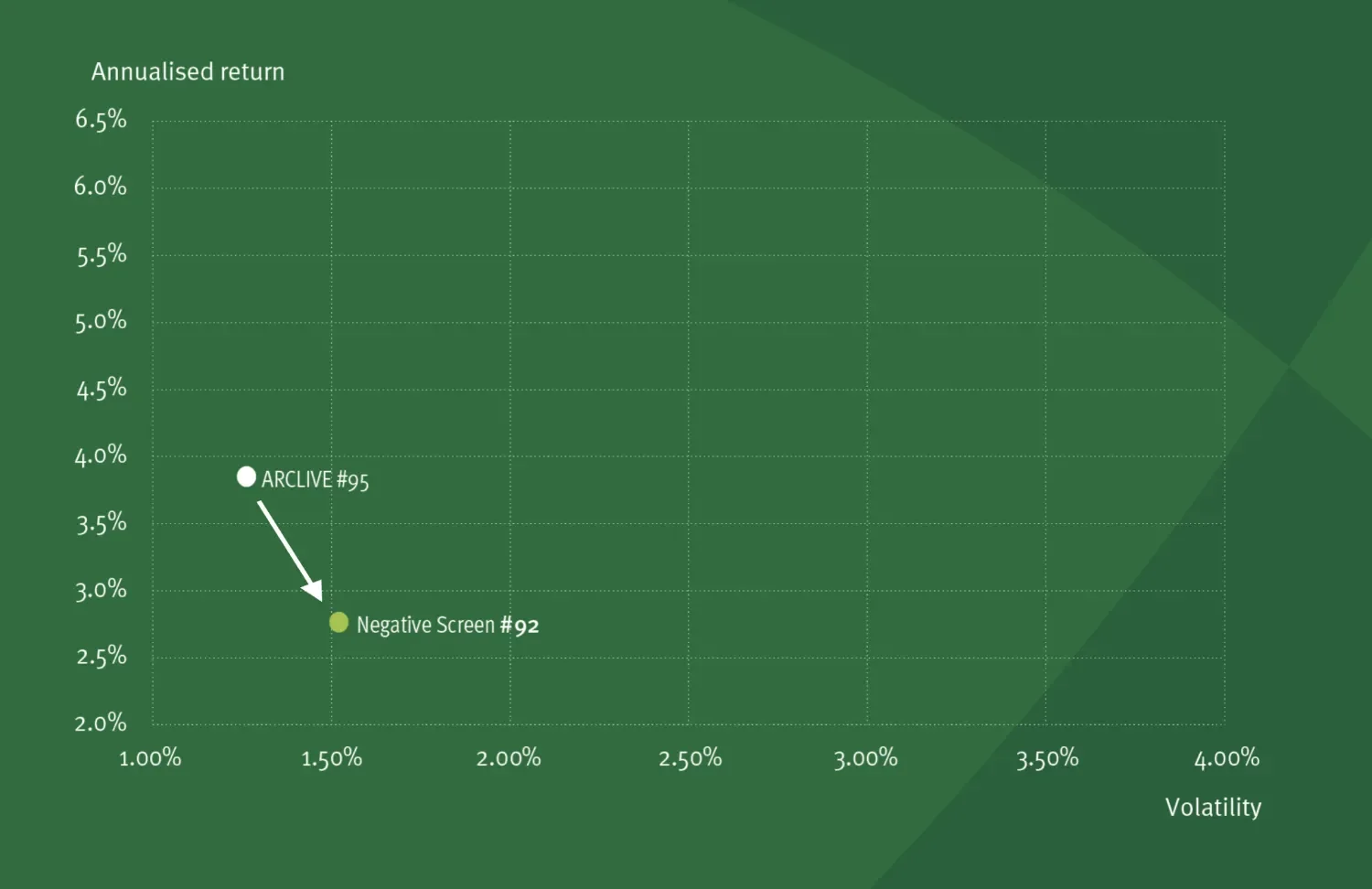

At first, Bowie applied a negative screen to the portfolio, meaning certain sectors such as tobacco and alcohol were excluded. The results of this were not encouraging: the fund would have lost around 1% a year in terms of performance, which is substantial for a bond fund, while volatility would have increased.

Bowie attributes this to the defensive characteristics of bonds in many of these ‘sin’ sectors, despite the companies’ exposure to ESG risks down the line.

However, applying a positive screen in combination with a negative screen yielded much better results. In fact, it showed that the best performing part of the portfolio would have been securities with the highest ESG scores.

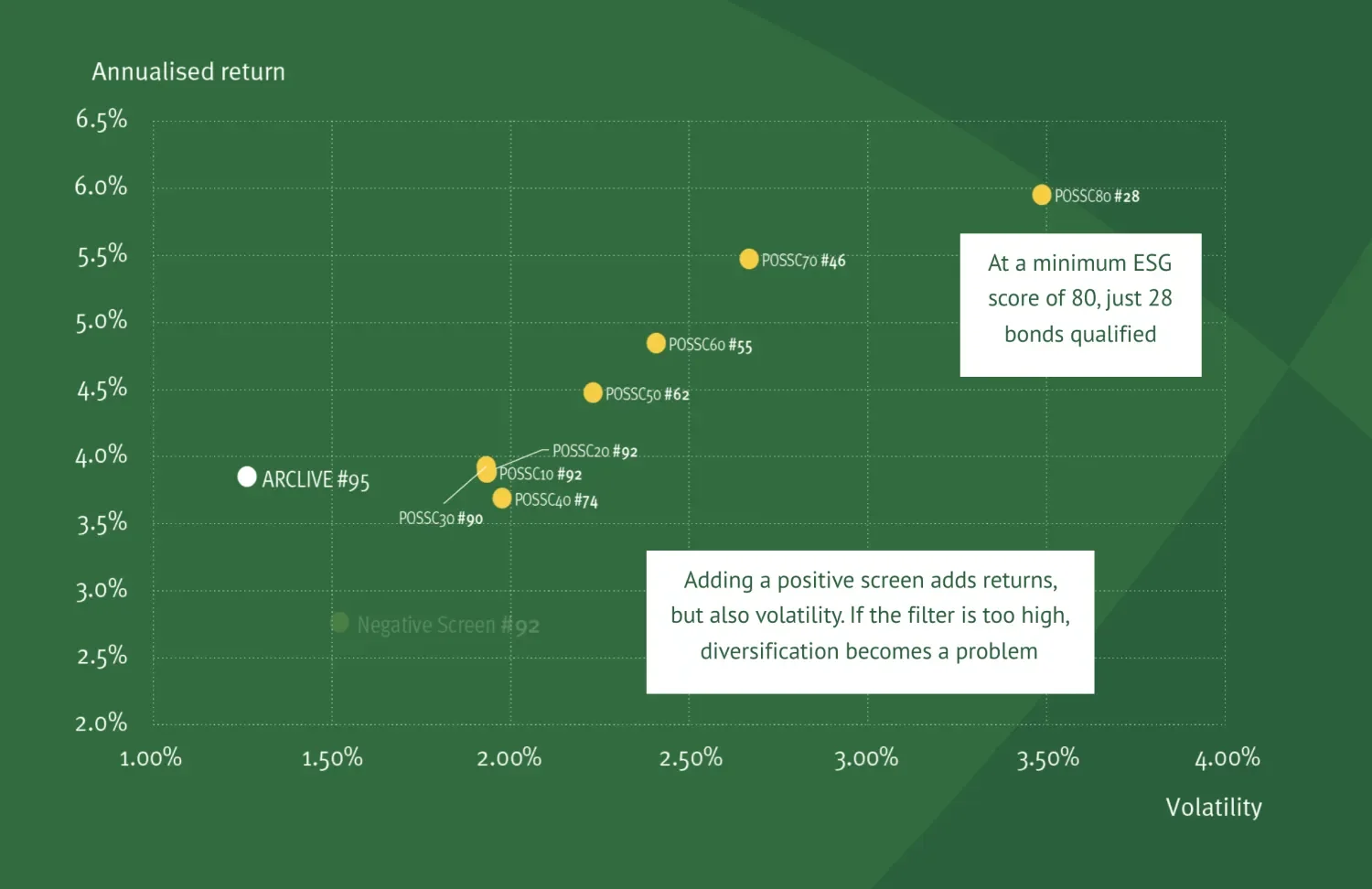

The only problem? Just 28 bonds qualified for the highest scoring category, while the volatility of this model portfolio was off the acceptable scale.

The answer, according to Bowie, lay in finding the sweet spot where risk, return and ESG credentials meet. To find this, the team compared the performance and volatility metrics of a range of portfolios applying increasingly stringent positive screens with combined ESG scores from 10 to 80 (the latter meaning only companies with a combined ESG score of 80/100 and higher would be included).

“We found the magic number for us is 34 for the minimum ESG score,” says Bowie. “This is where the research determined you get the best balance of ESG impacting your returns without dramatically increasing your volatility.”

It was also illustrative of the fact, notes Bowie, that a sustainable fixed income fund is not a “free lunch”. 34 as a minimum figure may seem like it is too low to include in an ESG fund to some. It also excludes almost half of the group’s credit universe from the positive screen. But Bowie argues it is important to recognise ESG strategies will not work for every type of fund.

“With an ESG process as detailed and as engaged as ours, you cannot access traditionally defensive sectors, so you can’t realistically have a lower level of volatility that many investors might be used to,” he explains. “This is why we are adamant that we need to offer choice. For some investors, it is all about the sustainable focus. But others need risk-adjusted returns, and for them ESG integration in our traditional funds is enough.”

Integration means the group considers ESG factors as part of its relative value decision alongside traditional methods of credit analysis. Every portfolio manager has to integrate ESG factors into their decisions and it helps form assessments of relative value. From there the managers determine the yield they require from the potential investment to accept those additional ESG risks. If the company looks risky in terms of ESG factors, the yield needs to be higher.

According to Bowie, the main difference between the group’s core sustainable funds and integration is that ESG integration “doesn't stop [the managers] buying companies that might have relatively poor ESG scores”, though when investing in riskier companies from an ESG standpoint “you need to be compensated by being paid a much higher yield for these investments”.

This is why he thinks the sustainable portfolios TwentyFour creates are unique in the fixed income fund market. By finding a similar risk-return combination to its other products, the firm can offer its clients the choice between ESG integration, which underpins all of its funds, and the more rigorous screening approach applied to its sustainable range.

The final element of the firm’s ESG policy is ongoing engagement with issuers to try to help the businesses improve their ESG credentials. The results of these engagements are published on TwentyFour’s website on a quarterly basis, ensuring transparency and accountability for the portfolio management team.

The concept of engagement is built into the group’s Observatory platform. All of the data is supplemented with a momentum score which is an assessment of how well a company is improving its ESG credentials. The managers are looking for companies on a positive trend and Bowie refers to this score as the ‘delta’.

“A company that scores relatively poorly today but has a board committed to change means that its momentum score would reflect the fact the future for this business should be better,” he says.

“We find it helps to get comfortable with a company that's moving in the right direction, then you can look to invest in all of their bonds and enjoy the benefit of that company becoming cleaner and greener.”

This assessment helps focus engagement as well. “We do not get to vote but we can influence behaviour through our engagement. We share this with our clients and publish reports about our engagement meetings on our website quarterly, because we understand transparency is key to inciting change.”

The group has also written about company practices through its blog in order to challenge decisions that reflect badly in ESG terms. For example, in 2018, Aviva announced it was going to cancel its preference notes at par, with large losses for mainly retail holders.

“We saw this as an example of treating stakeholders poorly, and differently. It gave us concerns about their willingness to call subordinated debt at future call dates,” says Bowie, who at the time reached out to the issuer’s finance and investor relations teams. “But we also realised we have the power of our blog; and within one week of publishing our concerns we were pleased to see Aviva had reversed its position.”

Stay up to date with our latest blogs and market insights delivered direct to your inbox.