Flash Fixed Income: Three big themes for 2025

Key takeaways

- We expect government bond markets to be volatile as investors scrutinise deficits and sticky inflation in developed markets.

- Despite banks and investment firms seeking to publicly align themselves with the incoming Trump administration’s policy on fossil fuels, we believe this will prove a temporary setback to the broader ESG trend both in the US and globally.

- In what appears a late cycle economy with asset prices high we see more limited potential for capital gains, but we think fixed income investors can still expect healthy returns given high starting yields.

For fixed income investors thinking about their asset allocations for 2025, we have identified three major trends worth considering.

1. Volatility in rates markets

We think volatility in rates markets will remain high throughout 2025. We finished 2024 with a significant rise in government bond yields, and this move has continued in earnest into 2025 (see Exhibit 1).

Exhibit 1: 10-year US Treasury and UK Gilt yields remain volatile

Past performance is not a reliable indicator of current or future performance. It is not possible to invest directly into an index and they will not be actively managed. Source: Bloomberg, TwentyFour, 14 January 2025.

We see two primary drivers of selling pressure in government bonds, and we don’t think either is likely to abate anytime soon.

First, core inflation remains sticky, particularly in the US and UK. While headline inflation has fallen, wage growth remains at levels inconsistent with inflation being held sustainably below target. Service sector inflation and rents are also not displaying the disinflation central bankers want to see. This creates the potential for higher inflation prints to spook investors who fear its resurgence this year. It has also radically pared back investor expectations for rate cuts from both the Federal Reserve (Fed) and Bank of England (BoE), limiting their ability to intervene to dampen rates volatility. In the Eurozone, disinflation looks more broad-based and this is allowing the market to hold onto forecasts of four rate cuts from the European Central Bank (ECB) – however, tariff-driven global trade wars would be expected to quickly change that outlook.

Second, investors are increasingly concerned about precarious fiscal deficits. Developed market governments’ spending and borrowing continues at levels the markets see as unsustainable, which is attracting the attention of so-called “bond vigilantes” once more. However, the major drivers of spending, so-called entitlements (pensions, healthcare and so on) are considered sacrosanct by both incumbents and oppositions. Political willingness to meaningfully lower spending looks to be non-existent, and investors will become more reluctant to extend goodwill to multi-year plans. We expect the bond market will increasingly price in a relative ranking between governments on this basis, which means government bonds could suffer more frequent bouts of volatility as crises of confidence emerge.

2. Has fixed income seen peak ESG?

Flows into green and sustainable funds have been significant over the last decade. With investors having come to recognise the impact of sustainable investment practices, not just for the planet but also in identifying red flags for avoiding unwanted financial risks, they have increasingly demanded the integration of ESG credentials into asset managers’ processes.

Bond issuers, in turn, have made changes to appear more attractive in this light. Beyond the fundamental differences they have made to how they do business, firms have moved to improve transparency and disclosures around their ESG efforts and have also looked to signal third-party verification of their plans by signing up to industry-level initiatives.

It is therefore interesting to note that following the re-election of Donald Trump as US president, several high profile institutions have publicly dropped their membership of such initiatives. The Net-Zero Banking Alliance (NZBA) has been the flagship climate initiative for banks to advertise their commitment to aligning investment and lending portfolios with net-zero targets by 2050 or sooner, with Wall Street giants Bank of America and Morgan Stanley among its founder members in 2021. However, starting with Goldman Sachs in December and ending with JP Morgan on January 7, all the major Wall Street banks have withdrawn from the NZBA. At the same time, major investment firms such as BlackRock have withdrawn from the Net-Zero Asset Managers initiative, resulting in a suspension of its activities.

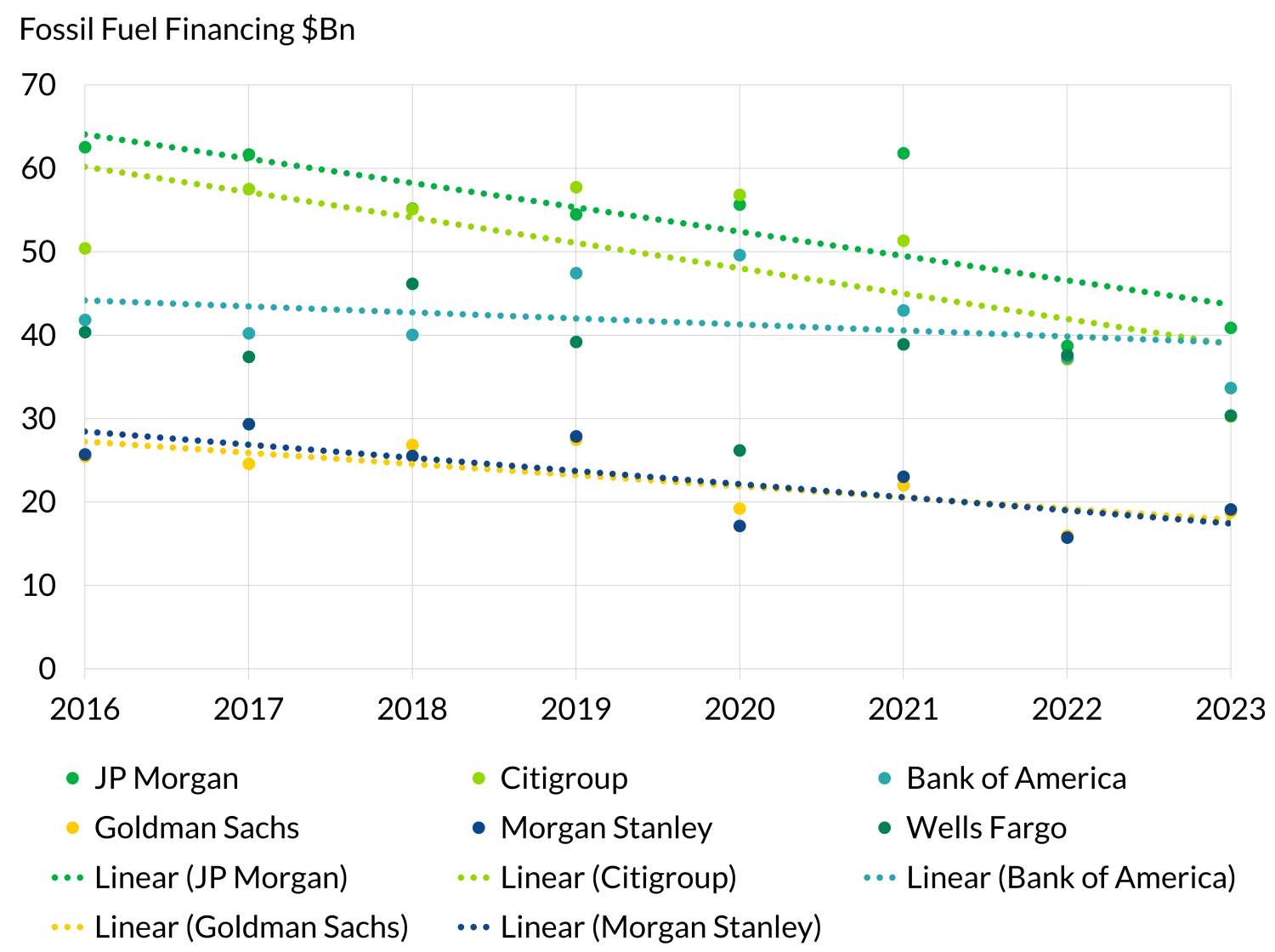

Do these moves suggest 2024 will come to be seen as peak ESG for fixed income? We don’t think so. While these firms clearly feel it is important to make a public gesture aligned with Trump’s desire to increase fossil fuel production in the US, the sustainability commitments these banks have made are inherently long-term. As Exhibit 2 shows, the impact of these commitments on fossil fuel financing among the exiting banks has been material (a 30% drop in absolute volume since 2016), and we don’t see this being unwound by a presidential term that at four years is relatively short compared to the banks’ targets.

Exhibit 2: Wall Street fossil fuel financing

Source: Banking on Climate Chaos report, May 2024.

All the Wall Street banks have retained their previously set climate targets and suggested no change in policy. BlackRock has said its departure will not change how it manages client portfolios and that it will continue to assess material climate-related risks. Meanwhile European banks, operating within a very different political environment, will not feel the same pressure to exit the NZBA and in our view will likely continue to see the value of membership of such initiatives.

So while the optics for sustainability initiatives may be suffering a temporary setback within the US, we expect the broader ESG trend both in the US and globally to continue.

3. Carry will be king

High starting yields combined with capital gains from spread tightening delivered healthy returns for fixed income investors in 2024. With those high starting yields largely still in place, but the potential for capital gains more limited, we think carry (simply the return derived from holding bonds and collecting their yield) will be the primary driver of returns in 2025.

As an example, the performance of the GBP 1-5 year BBB corporate bond index over 2024 was +6.0%. That index began the year with a spread of 188 basis points (bp) and a yield of 5.9%. As of January 14, the spread available on those BBB bonds has fallen to 126bp but the yield has ticked up to 6.0%.

The key to collecting carry in our view is ensuring portfolios are robust to downside volatility that may materialise, with a focus on high quality earnings from underlying investments in companies more resilient to shocks.

Capital gains will be harder to come by because we appear to be late cycle, asset prices are high, and while economic growth is robust in the US, it is getting harder for firms to surprise with additional profitability. History shows the economy can, however, stay in late cycle for an extended period – so the more consistent return derived from yield becomes desirable.

We do think corporate balance sheets are healthy and the default rate will remain low, which is a benign environment for corporate bonds and broader credit. So while credit spreads are tight here, we don’t think the lower potential for capital gains should preclude fixed income investors from expecting decent returns once again in 2025.

Important Information: The views expressed represent the opinions of TwentyFour as at 14 January 2025, they may change, and may also not be shared by other members of the Vontobel Group. The analysis is based on publicly available information as of the date above and is for informational purposes only and should not be construed as investment advice or a personal recommendation.

Any projections, forecasts or estimates contained herein are based on a variety of estimates and assumptions. Market expectations and forward-looking statements are opinion, they are not guaranteed and are subject to change. There can be no assurance that estimates or assumptions regarding future financial performance of countries, markets and/or investments will prove accurate, and actual results may differ materially. The inclusion of projections or forecasts should not be regarded as an indication that TwentyFour or Vontobel considers the projections or forecasts to be reliable predictors of future events, and they should not be relied upon as such. We reserve the right to make changes and corrections to the information and opinions expressed herein at any time, without notice.

Past performance is not a guarantee of future results. Investing involves risk, including possible loss of principal. Value and income received are not guaranteed and one may get back less than originally invested. TwentyFour, its affiliates and the individuals associated therewith may (in various capacities) have positions or deal in securities (or related derivatives) identical or similar to those described herein.