Time to extract value from Europe’s bargain bonds

When Wall Street’s army of analysts were publishing their outlooks for 2023 back in November, there was very little love for Europe.

“The euro area and the UK are probably in recession, mainly because of the real income hit from surging energy bills,” said Goldman Sachs, reflecting a broad consensus among the world’s big investment banks that European growth would be non-existent at best in 2023.

However, the first few weeks of this year have seen a marked shift in sentiment towards Europe as more robust economic data and a cooling of the energy crisis have improved the region’s prospects.

Goldman’s own -0.1% forecast for Eurozone GDP in 2023 lasted until January 10, when it was upgraded to +0.6% on the back of “more resilient growth momentum at the end of last year, sharply lower natural gas prices and earlier China reopening,” with the bank also softening its projected UK recession from -1% to -0.7%. The following week, Morgan Stanley and JP Morgan joined the ever growing list of firms reversing bearish calls on the euro, with the end-2023 consensus having abruptly risen from dollar parity to around $1.10.

Despite this rapid macro reappraisal, European credit spreads remain at what we consider attractive levels, particularly when you consider it continues to offer a rare premium over its US equivalent. In our view, European credit now represents a strong medium term value opportunity that investors cannot afford to ignore.

New value in Europe vs. US trade

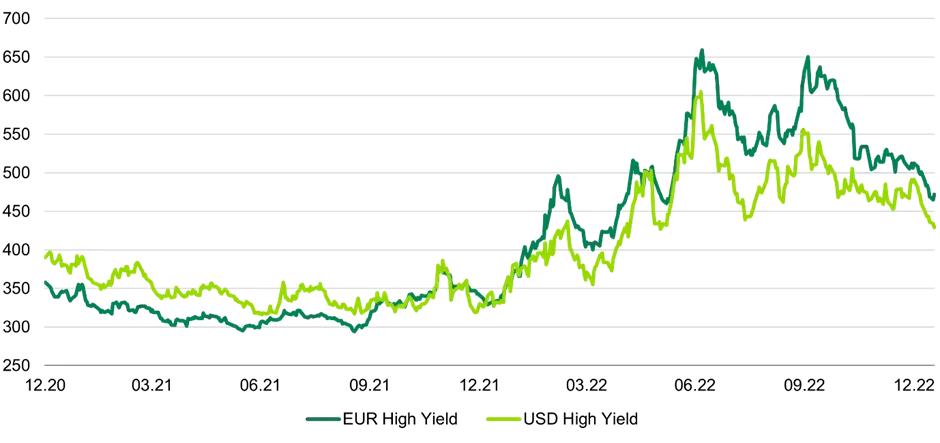

US credit has traditionally offered investors a premium over European, but that dynamic has been gradually turned on its head in the last two years.

Source: TwentyFour, ICE BofA Indices, 18 January 2023. Past performance is not a reliable indicator or current or future performance. It is not possible to invest directly into an index and they will not be actively managed.

As the chart above shows, the US premium in high yield was gradually eroded over the course of 2021, partly driven by the perception that the US recovery from COVID-19 would emerge sooner and be stronger than Europe’s. The relationship then completely reversed in early 2022 in the wake of Russia’s invasion of Ukraine, and the European premium would then grow as wide as 100bp later in the year after Russia halted gas supplies and a winter of energy rationing in Europe became a real possibility. The current European premium is most pronounced in high yield, but it is replicated to a lesser extent across investment grade and financials indices too.

With 2022 being one of the worst years for fixed income in living memory, yields on both sides of the Atlantic have skyrocketed, and looking at headline yields the US would appear to be better value. However, when considered in dollar terms the yield on the Euro HY index becomes 9.51% vs. 8.09% for US HY (it is worth noting neither get close to the yield on the UK HY index, which is now around 10.5% in dollar terms).

Source: TwentyFour, BofA ICE Indices, 17 January 2023. It is not possible to invest directly into an index and they will not be actively managed.

In our view the previous US premium was justified by the fact that on average, US credit tends to be longer dated and lower quality than its European counterpart, and as the table above shows, that fact remains unchanged for both HY and IG. Adjusting for the difference in duration and credit quality between the indices, we see far more potential in European credit spreads today. It is also worth noting that US buyers of euro denominated credit gain an additional benefit, since the spread pick-up in swapping the euros back to dollars is currently around 250bp.

If US credit remains longer dated and lower quality, then the question is whether Europe’s growth and inflation outlook is bad enough, relative to the US, to justify European credit trading wider.

Is Europe out of the woods?

Two related – and considerable – challenges were at the heart of the broadly bearish view on Europe that dominated the market outlooks for 2023. One was the energy crisis, and the other was the impact of the energy crisis on inflation expectations, which added to fears that the European Central Bank was behind the curve with its more ponderous approach to rate rises than that deployed by the US Federal Reserve. Both risked sparking their predictions for a severe recession in 2023.

However, a huge investment in liquified natural gas (LNG) storage facilities and a successful push to find immediate alternative sources of energy, as well as a good portion of luck from a relatively mild winter so far for much of Europe, has led to a belief that it not only has enough energy security to carry it through 2023, but through the winter of 2024 too. Indeed, European Union gas storage levels are higher today than when the Nord Stream pipeline was cut off back in September.

The normalisation across energy markets has also quickly fed into inflation data. European gas prices are a fifth of where they were around the time of the Nord Stream cut-off, and inflation as a result has fallen significantly in the last two monthly readings. Along with other lead indicators, this suggests that rather than a double peak in inflation that many investors had feared for Europe, the region has in fact seen the worst of price pressures and is following a similar path to that of the US. The rates market has begun to price this in, with the ECB deposit rate now implied to normalise lower in the latter part of 2023 and 2024, similar to the expected path for the Fed Funds rate in the US. The other benefit of energy prices coming down is the extraordinary aid cheques that Germany (an estimated €200bn) and other countries committed to in September should now be nowhere near these figures, which should itself help the supply technical across euro government bonds.

Another area of concern for Europe as 2022 wore on was fragmentation between the core and periphery. This issue was addressed by the ECB at its July meeting with the introduction of the Transmission Protection Instrument, or TPI, even if the tool remains something of an enigma in terms of its potential and conditions for use. Nevertheless, optimism surrounding the periphery has been buoyed by renewed talk of joint issuance from the bloc, and, though this is not going to be a straight line, the persistent idea of a fiscal union should only strengthen Europe’s image abroad. The closely followed spread between Italian BTPs and German Bunds is subsequently now at around 180bp, down from recent highs of around 250bp. The wider confidence has also helped the euro bounce by around 14% from its lows against the dollar, another element of Europe’s positive feedback loop since the ECB president, Christine Lagarde, has previously been vocal about the impact of importing inflation.

This tailwind of good news, along with the fact that the Eurozone is enjoying the lowest unemployment rate in its history, has resulted in confidence for both suppliers and consumers bouncing over recent weeks, evidenced by a big beat from the bellwether German ZEW survey on January 17.

Where do we see most value?

While we see numerous relative value opportunities in European credit, two sectors in particular stick out to us at the moment given the higher rates environment and the lingering threat of a hard landing for the global economy.

One is the European banking sector, where we expect to see net interest margins continue to increase as they benefit from central bank rate hikes in 2022 and continuing into 2023. Non-performing loans are not expected to rise materially even if the Eurozone dips into recession, and with banks still holding elevated capital levels, fundamentals look strong in our view. Despite this, subordinated bank debt is still paying investors attractive yields, such as an Additional Tier 1 (AT1) bond from ING which is rated BBB (A+ at issuer level) and currently yielding around 9.75% in dollars (8.71% in sterling) to its 2027 call1. Indeed, even senior unsecured bank debt is trading at elevated spreads with all-in yields that look attractive considering the quality of the paper, giving us bonds which in our view investors can be comfortable holding through any period of the economic cycle. Société Générale, for example, issued an A- rated senior deal in January with a spread of 295bp and an all-in yield of around 6.70% in dollars (5.66% in sterling)2.

Another is European collateralised loan obligations (CLOs), a sector which took a lot of pain in 2022 as recessionary fears caused leveraged loan spreads to widen. CLOs have a strong (and floating rate) income component, though with average bond life of up to 7-9 years they can see more volatile price action. However, we have consistently outlined how this volatility belies the credit risk afforded through the structural protection in securitised bond structures in Europe, which we see as being particularly valuable to bond investors in late-cycle conditions. With spreads of around 550bp available for BBB rated European CLO notes and 900bp for BB rated tranches, as well as their markedly higher yields compared to the start of 2022, we think any potential volatility here is well compensated. With the added potential for capital gain as we expect spreads to tighten in the next several months, we think European CLOs could be one of the top performers across global fixed income in 2023.

The global investor community rightly treated Europe with caution in 2022, driven by energy supply fears and widening periphery spreads.

While it must be said that uncertainty remains elevated globally, across all markets, we think the sentiment around these issues has justifiably improved over recent weeks, and with spread levels elevated across fixed income, we regard European credit as one of the areas where investors can look to extract additional value.

_______________________

1 Highest yielding European bank AT1 of that rating

2 Highest yielding European bank senior unsecured bond of that rating