Time to extract Europe’s elevated bond spreads

The wider global investor community rightly treated Europe with caution in 2022, driven by energy supply fears and widening periphery spreads. However, sentiment around these issues has improved over recent weeks, and with spread levels elevated it looks as though there is additional value to be extracted from Europe.

Reliance on Russian energy resulted in European assets selling off last year as the region’s primary gas supply was cut off and market participants feared this would push the continent into severe recession. However, a huge investment in liquified natural gas (LNG) storage facilities and a successful push to find immediate alternative sources of energy, as well as a good portion of luck from a mild winter, has led to a belief that Europe not only has enough energy security to carry it through 2023, but through the winter of 2024 too. Indeed, European Union gas storage levels are higher today than when the Nord Stream pipeline was cut off back in September. This has resulted in some hasty revisions to European growth forecasts, with predictions of a sharp 5% GDP contraction from some commentators replaced by the economic ministers of Germany and the EU saying that both may avoid even a technical recession.

The normalisation across energy markets has also quickly fed into inflation data. European gas prices are a fifth of where they were around the time of the Nord Stream cut-off, and inflation as a result has fallen significantly in the last two monthly readings. Along with other lead indicators, this suggests that rather than a double peak in inflation that many investors had feared for Europe, the region has in fact seen the worst of price pressures and is following a similar path to that of the US. The rates market has begun to price this in, with the ECB deposit rate now implied to normalise lower in the latter part of 2023 and 2024, similar to the expected path for the Fed Funds rate in the US. The other benefit of energy prices coming down is that the extraordinary aid cheques that Germany (an estimated €200bn) and other countries committed to in September will now be nowhere near these figures, which will help the supply technical across euro government bonds.

The other area of concern for Europe as 2022 wore on was fragmentation between the core and periphery. This issue was addressed by the ECB at its July meeting with the introduction of the Transmission Protection Instrument, or TPI, even if the tool remains something of an enigma in terms of its potential and conditions for use. Nevertheless, optimism surrounding the periphery has been buoyed by renewed talk of joint issuance from the bloc, and, though this is not going to be a straight line, the persistent idea of a fiscal union will only strengthen Europe’s image abroad. The closely followed spread between Italian BTPs and German Bunds is subsequently now at 180bp, down from recent highs of around 250bp. The wider confidence has helped the euro bounce by around 14% from its lows against the dollar, another element of Europe’s positive feedback loop since the ECB president, Christine Lagarde, has previously been vocal about the impact of importing inflation.

This tailwind of good news, along with the fact that the Eurozone is enjoying the lowest unemployment rate in its history, has resulted in confidence for both suppliers and consumers bouncing over recent weeks, evidenced by a big beat from the German ZEW survey on Tuesday.

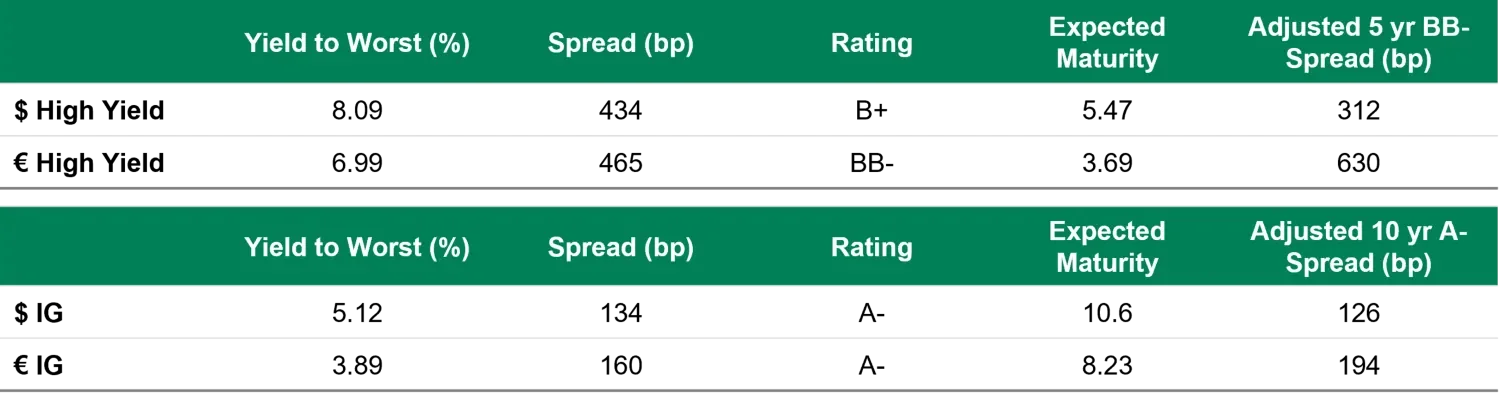

While it must be said that uncertainty remains elevated globally across all markets, the European story is one that has meaningfully improved. Meanwhile, spreads are still paying investors a premium to invest in Europe, as the chart below demonstrates. With confidence on the continent increasing, it may not be long before this begins to erode.

Source: TwentyFour, BofA ICE Indices, 17 January 2023