The Comeback of Corporate Hybrids

With September now behind us, colder mornings and darker nights approaching it seems an opportune time to take stock of how the primary market reopened this year after its traditional summer lull.

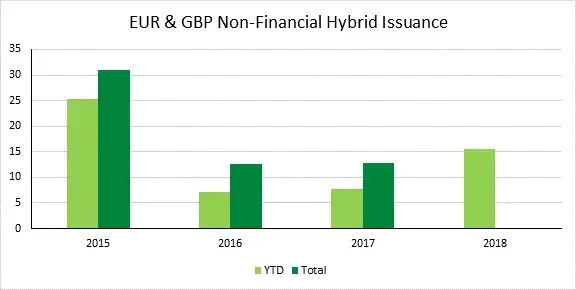

For us, one of the standout developments has been the re-emergence of corporate hybrid bond issuance. We have seen little new supply in this part of the market since 2015, when several utilities companies came to the market, but as the chart below shows, we have already seen more issuance year-to-date in Europe than the totals issued in both 2016 and 2017. One theory for this change is issuers are beginning to care more about their credit ratings. Because hybrids act as a partial equity injection from an accounting point of view (they have just enough flexibility in repayment terms and sit at a subordinate level in the capital structure, offering higher yields to investors) they help to improve rating agency metrics, which make the difference when avoiding a downgrade.

Source: TwentyFour, Bloomberg as at 3rd October 2018

Why would issuers care more about their credit ratings in 2018 than in the last two years? The approaching end of the ECB’s corporate sector purchase program (CSPP) could be the explanation. The CSPP has compressed spreads to the degree that the difference in interest expense between servicing A/BBB or even BB rated debt has become minimal for many companies. When the CSPP ends, we expect to see a reversal of this phenomenon (which is why we are heavily underweight CSPP eligible paper). CFOs that hold the same view are thus willing to issue some more expensive debt now to avoid being on the wrong side of a ratings boundary later, which might reprice their entire debt stack. Based on this theory, we should see hybrid supply continue to pick up this year and more still in 2019.

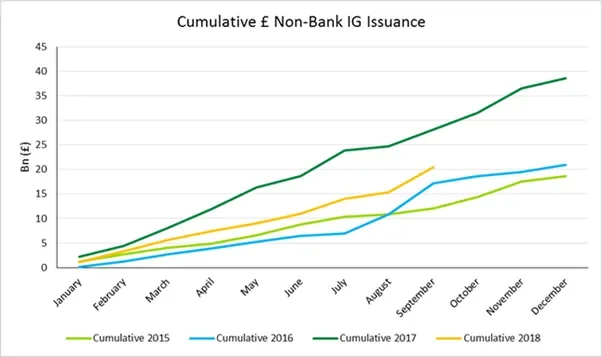

Another market we have been watching closely is sterling corporate bonds, given the uncertain outlook around the UK’s Brexit negotiations with European Union. Here too, the picture is healthier than some may have expected given the slew of recent headlines. Last month the primary market in sterling saw £5.2bn of investment grade non-bank supply, compared to £3.4bn over the same period last year. Although many of these credits did come with decent new issue premiums to entice investors and repriced secondary curves for those names, overall spreads held stable over the month, only 3bp wider at the index level. In addition, not all of the supply came from simpler structures, with investors clearly having enough confidence to buy more novel and more junior instruments. So as well as more traditional issues from the likes of PIC, Prudential, AT&T and BMW, Rothesay Life brought an RT1 and Vodafone issued a sterling hybrid as part of its €2bn multi-currency raise.

Sterling primary issuance in 2018 is healthy, already ahead of 2015 and 2016 totals and showing no sign of slowing down, though we are clearly not seeing the plethora of issuance that 2017 brought. While investors are being selective and demanding concessions in some places, the sterling market’s continued ability to absorb paper shows investors are not paralysed with nervousness. Cash is being deployed when opportunities present themselves. Thus we continue to feel comfortable buying sterling bonds that offer value. Brexit worries have not closed the sterling market.

Source: TwentyFour, Bloomberg as at 3rd October 2018

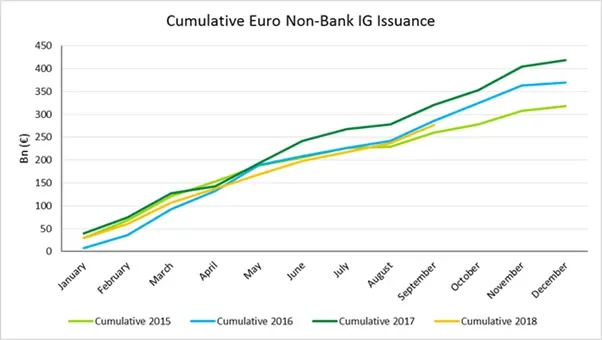

Non-bank issuance in euros has been similarly strong, with €40bn issued versus €42bn during September in 2017 and a 4bp tightening at the index level. Arguably companies are also bringing down leverage by issuing a little less senior debt. Looking back on monthly issuance through 2018, we can see euro denominated issuance is holding pace with previous years but is below 2017. It could also be argued, however, that the higher volumes in 2017 came as a result of companies taking advantage of all-time lows in absolute yields with a lot of opportunistic issuance.

Source: TwentyFour, Bloomberg as at 3rd October 2018

We believe the health of the primary market and how well the market has been able to digest new issuance is a useful indicator of investor sentiment and the underlying technical strength of the European corporate bond market. Following the volatile and often negative headlines on the progression of Brexit negotiations and Italy’s woes, readers might have expected a lacklustre ‘Back to School’ report for corporate bonds, but we are seeing a more positive picture.