Squeezed: The upshot of the Fed’s quantitative tightening program

Following October’s encouraging US CPI report and the subsequent comments from Federal Reserve officials, financial markets now anticipate that the Fed has completed its rate hiking cycle having reached terminal rates. Current market implied rates suggest that there will be no further rate increases, with the first 25 basis point rate cut expected in May next year.

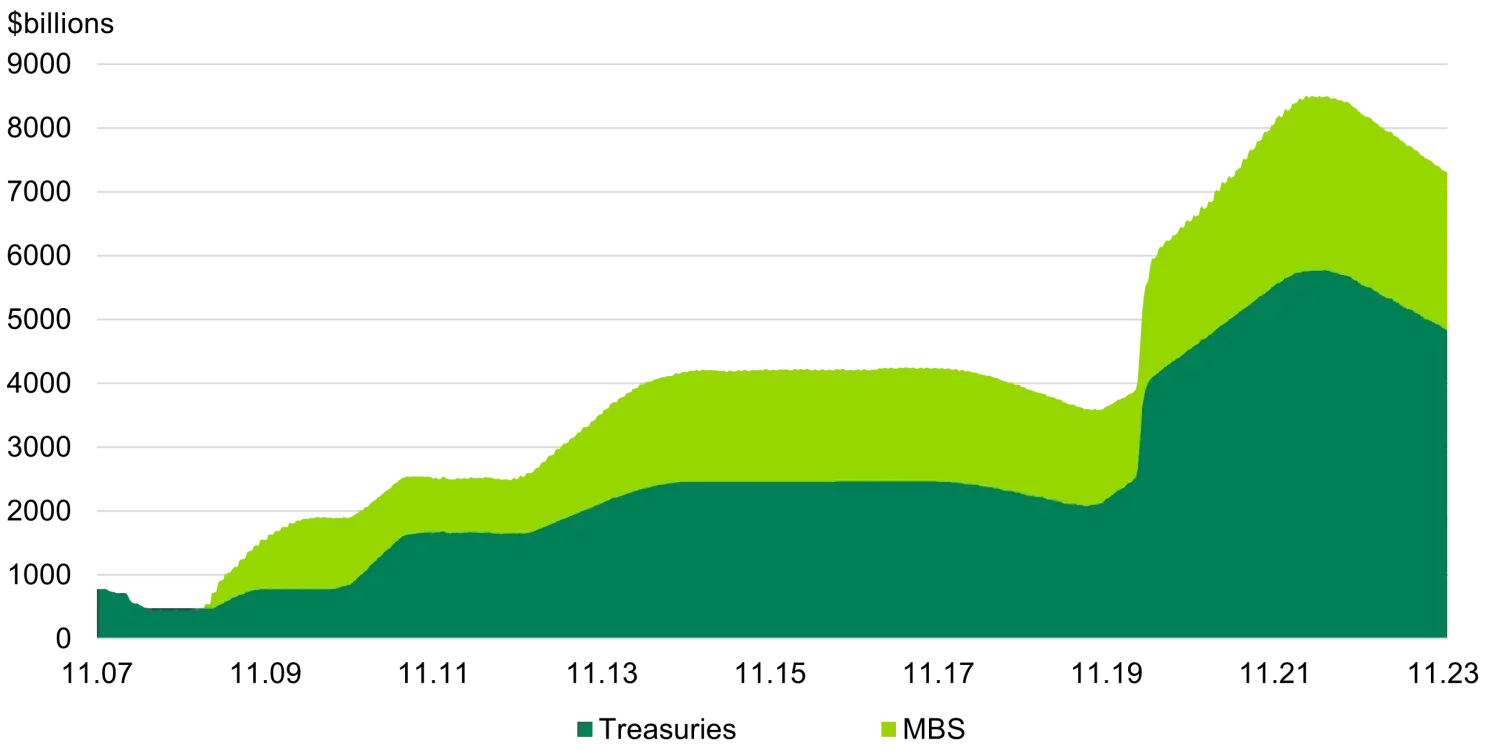

In the absence of further interest rate hikes, the Fed will remain in tightening mode through its quantitative tightening (QT) program, gradually reducing its balance sheet, which expanded significantly during the pandemic. Currently, the Fed is actively shrinking its balance sheet by $95bn per month, with $60bn of that coming from treasury securities and $35bn from mortgage-backed securities (MBS). The total size of the balance sheet (treasuries and MBS) currently stands at over $7.3tn, representing a decline of approximately 15% from its peak of $8.5tn in April last year.

Fed balance sheet

Source: Bloomberg 27/11/2023

Market participants are aware that years of QE curtailed bond yields. As the Fed, European Central Bank and Bank of England now create an opposite dynamic through QT, we have to expect upward pressure on rates curves. Ten-year treasury yields are roughly 40bps higher since the start of the year, however, at the peak this was almost 120bps. Much of this has been due to higher-than-expected inflation and subsequent Fed hikes, however, in the second half of this year much of the rise at the long end has been attributed to both supply and QT.

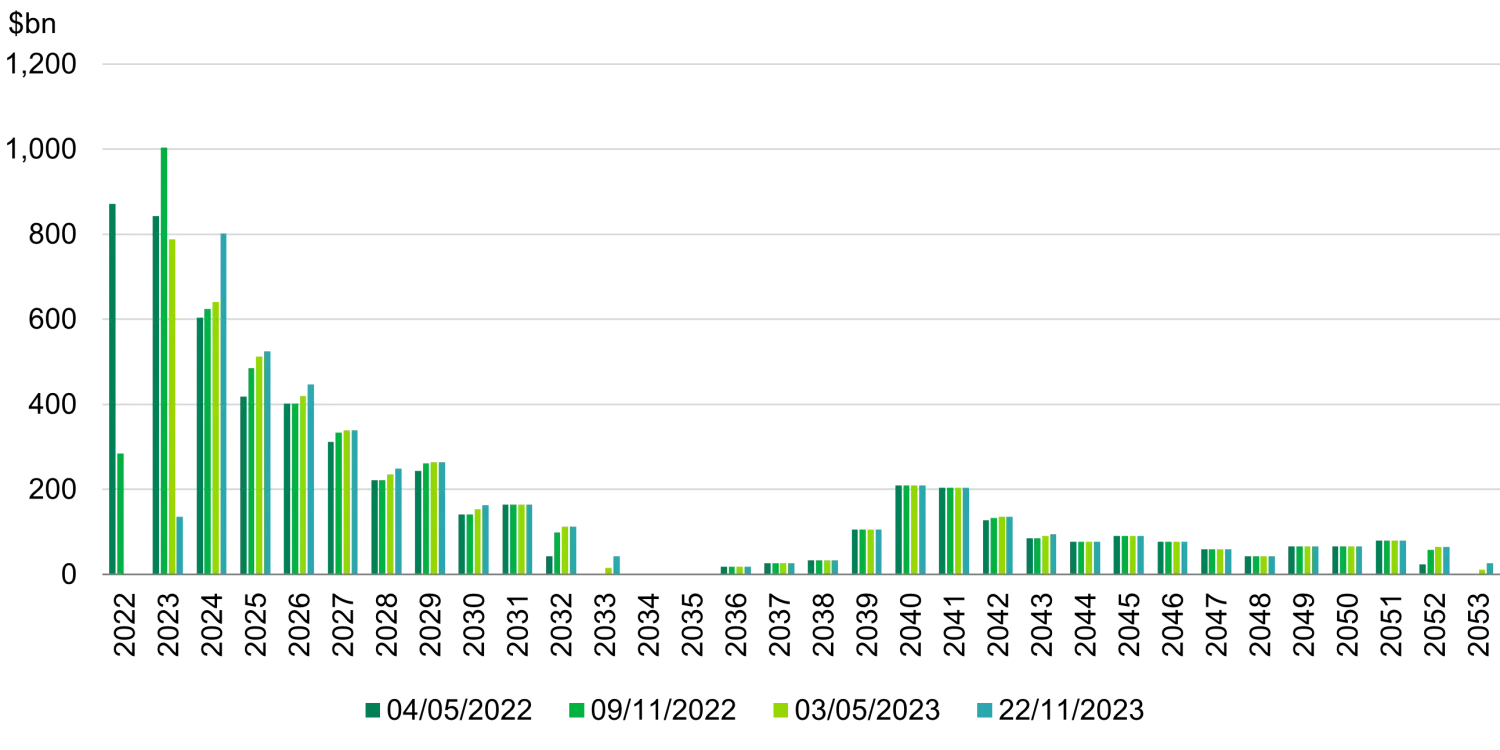

However, a closer examination of the Fed's QT activities reveals some interesting insights. The chart below illustrates four snapshots of the maturity distribution of the Fed's treasury portfolio over the last 18 months.

Fed treasury portfolio

Source: Federal Reserve Bank of New York, 27/11/2023

Counterintuitively, the Fed has been purchasing treasury securities even while engaging in quantitative tightening (QT). This seemingly contradictory behaviour stems from the Fed's aggressive roll off of its treasury holdings at the shorter end of the yield curve. This means the Fed's maturing treasury holdings exceed their $60bn monthly QT limit, necessitating reinvestments in longer-dated treasury securities. While QT has been cited as a significant contributor to rising long-term yields this year, a closer examination of the data reveals that this has not been from direct selling.

Looking at December alone, the Fed faces over $74bn of maturing treasuries, $14bn more than their limit, meaning they will be forced to reinvest. In terms of where these reinvestments occur it is clear they have a preference for the very short end (one to three years) and out to the 10-year point, however, interestingly there has been some reinvestments specifically at the 20-year point but more so at the 30-year maturity point.

Despite this, the sharp roll off it does have its benefits. The Fed can substantially reduce its balance sheet without engaging in active selling, as the natural maturity profile of its portfolio is doing most of the work. If the Fed maintains its current pace of $60bn per month, or $720bn per year, it will not need to actively sell any treasuries in 2024. Instead, it will be able to reinvest $80bn, thanks to the $800bn in rollovers expected over the year.

However, the Fed remains a significant net seller of front-end treasuries, which, combined with high issuance volumes, has undoubtedly put pressure on yield curves. Prior to this, the Fed was one of, if not the largest, holders and buyers of treasuries. Therefore, the question arises: where has the capital come from to replace the Fed's buying power?

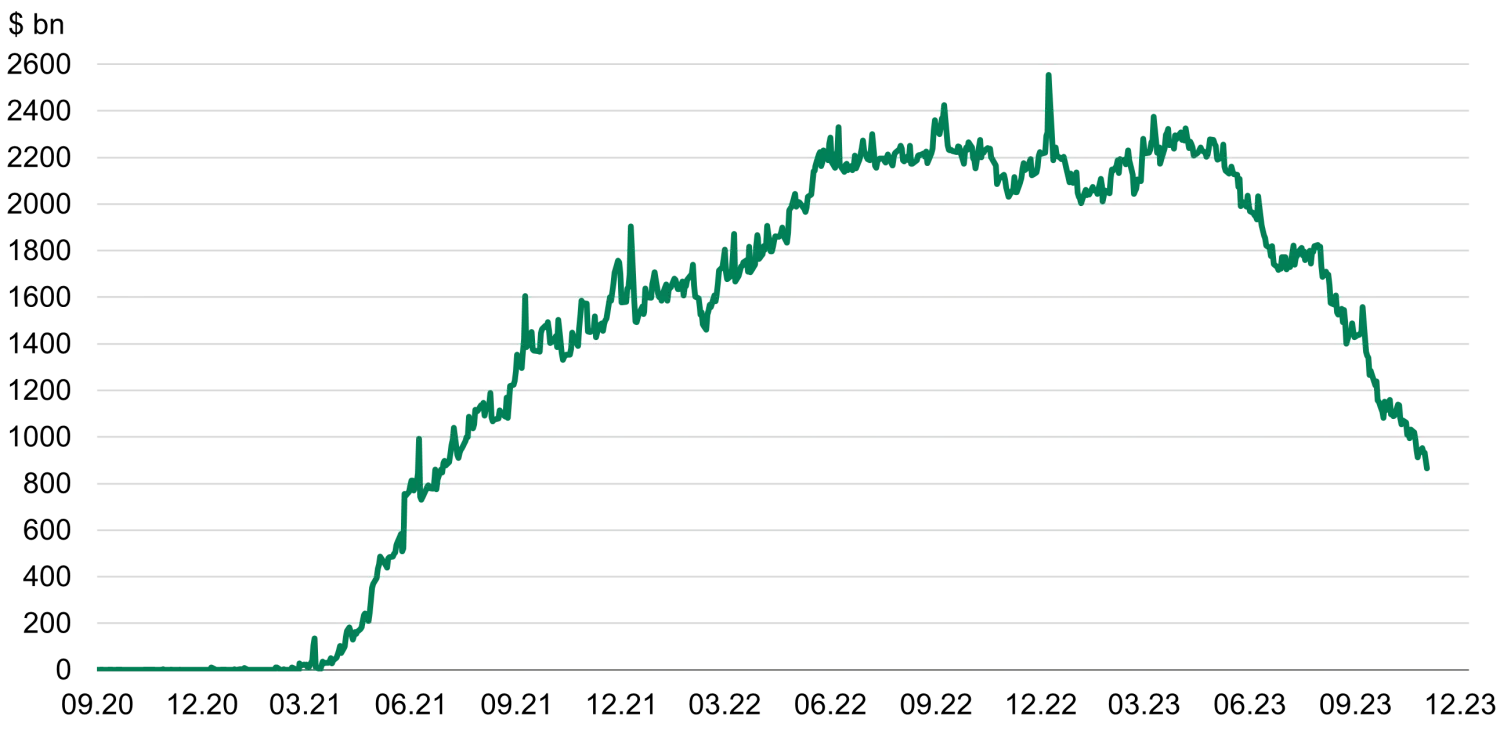

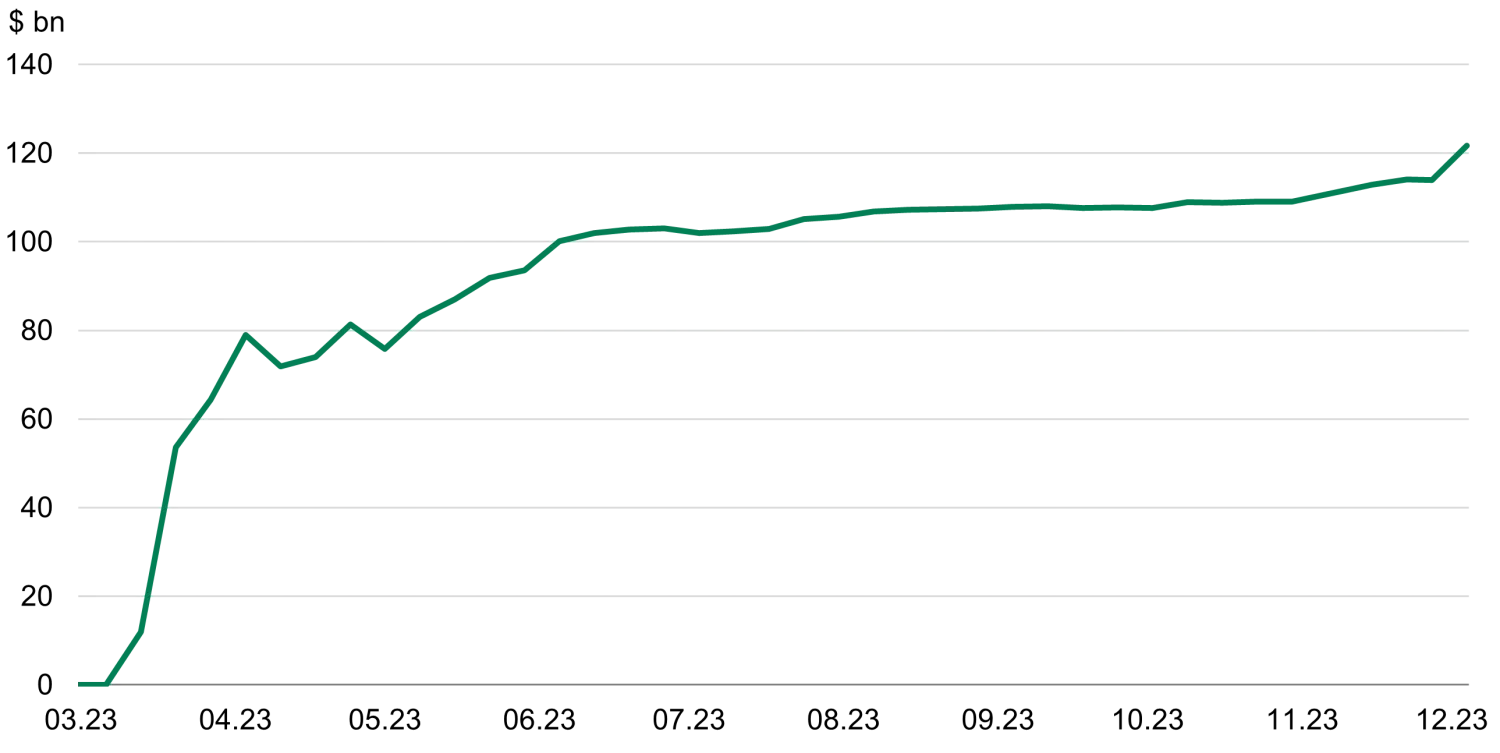

Fed overnight reverse repo facility

Source: Bloomberg 30/11/2023

The overnight reverse repo (RRP) facility allows banks and money market funds to park excess cash overnight to earn a rate very close to the federal funds rate (currently 5.50%). With the recent surge in interest rates, the RRP facility has become a lucrative haven for money market funds and excess liquidity within the banking system, both of which have experienced substantial inflows due to the pandemic-induced expansion of the money supply.

However, since May 2023, the usage of the RRP facility has plummeted sharply. If this trend continues, the facility is expected to be depleted in the first quarter of 2024. This pool of capital has played an important role in absorbing the large volume of new treasury issuance, acting as a valuable source of liquidity for the Fed. Moreover, it has partially offset the impact of quantitative tightening (QT) by filling the void left by the Fed as a net buyer of short-dated treasuries. In absence of the RRP backstop it is not unrealistic to expect upward pressure on short-dated rates driven by supply volumes and QT should the Fed continue.

While these factors have undoubtedly contributed to the decline in RRP usage, it is not the sole explanation. The contraction of liquidity (deposits and lending) within the banking sector, triggered by tighter monetary policy, which has led to a sharp decline in money supply, has also played a significant role.

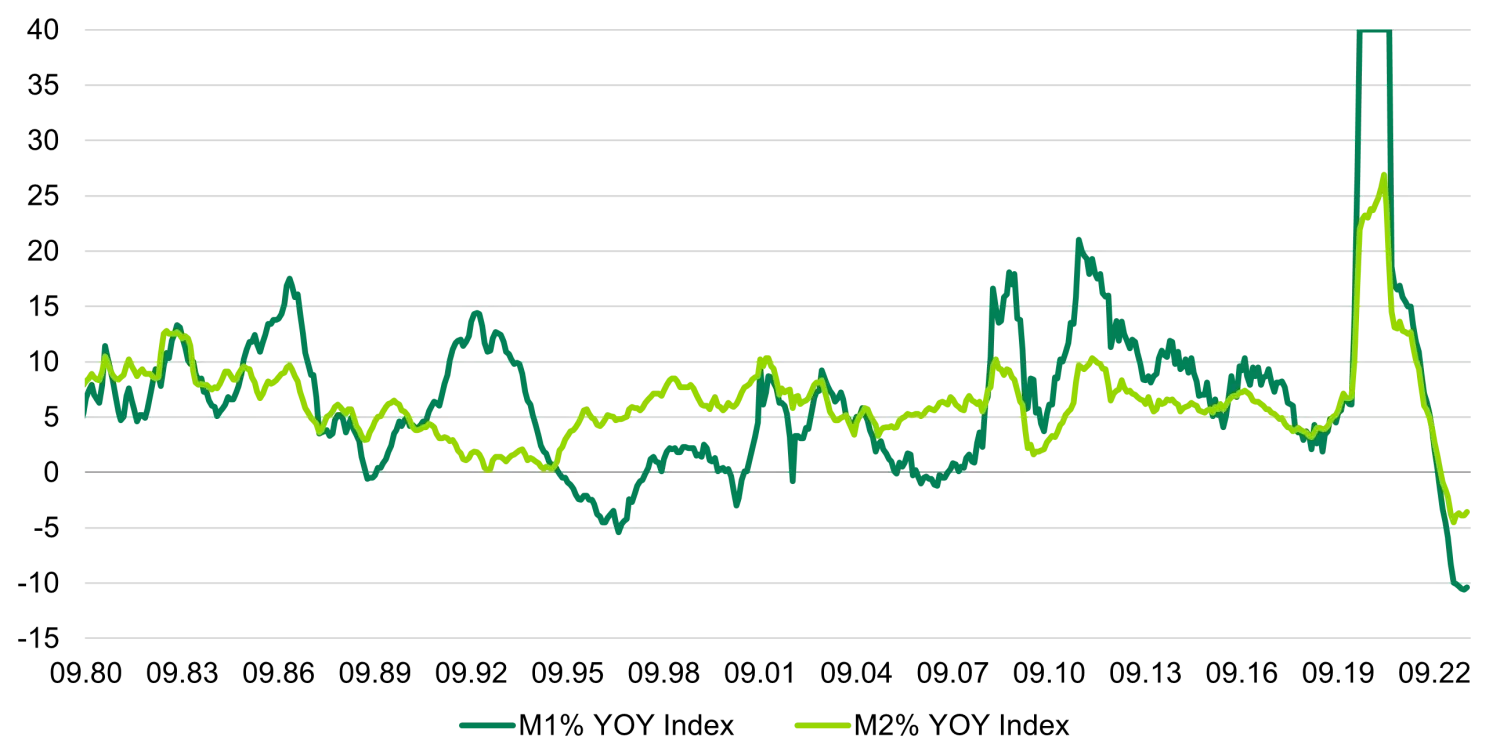

US money supply

Source: Bloomberg 27/11/2023

The decline in money supply is more than likely a key driver of the persisting problems that continue to face the US regional banking sector.

Bank term funding program

Source: Bloomberg 06/12/2023

The continued increase in utilisation of the bank term funding program (BTFP) suggests that the liquidity challenges faced by the regional banking sector following the collapse of SVB in March 2023 have not abated. As a refresher, under this program, banks can borrow from the Fed by pledging underwater treasuries and MBS as collateral and in return receiving par. These one-year loans are priced at the one-year overnight index swap rate plus 10 basis points, which currently translates to an interest cost of 5.25%.

For context, banks typically pay much less on deposits, making this a very expensive form of liquidity, further highlighting the difficulties of raising deposits in a market with rapidly declining money supply. Additionally, while banks have the option to prepay these costly loans, banks are expanding rather than contracting their use of the program.

Currently, the BTFP is scheduled to end in March 2024, at which point BTFP loans will begin to mature. However, given the rise in yields since March 2023, the majority of the collateral pledged will be even further underwater. For instance, the 2.875% 2043 treasury was priced around 85 in March but is now priced around 78. In light of these factors and to avoid a panicked selling of underwater assets to raise liquidity, it is highly probable that the Fed will simply extend this program - ultimately, they have no choice. While this support is necessary to prevent further issues in the banking sector, it does underscore the ongoing pressure on the banking sector due to tight financial conditions that are expected to persist.

Furthermore, the impending depletion of the RRP facility, which has served as a crucial tool in offsetting the impact of QT, could complicate the Fed's efforts to continue to run down its balance sheet in 2024. While Fed chair Jerome Powell has indicated the possibility of continuing QT even as the Fed transitions to an easing stance, navigating this may prove more challenging than anticipated.

In conclusion, the ongoing contraction in the money supply continues to pressure the US regional banking sector, particularly amid escalating deposit competition and a simultaneous broad-based decline in deposits. The sustained tight financial conditions create a precarious situation, prompting the crucial question of what may break and whether the Fed can swiftly cut rates to avert a crisis.