Roll Down explained

Several times this year we have discussed the benefits of “roll down” in an environment that for fixed income investing is particularly unfriendly. We believe roll down gains will be one of the best ways to protect portfolios in 2018 from the rising rate curves that we have been experiencing so far. So what exactly are “roll down gains”? For seasoned fixed income investors you need read no further, but for anyone else that is looking to impress dinner party guests this weekend, we hope this is useful! Let’s start with a couple of definitions and some considerations.

A normal sloping yield curve has longer dated bonds at higher yields than shorter dated bonds; an inverted yield curve has shorter dated bonds with higher yields than longer dated bonds. With a normal sloping curve roll down gains are there to be had, with an inverted curve these roll down gains become roll up losses which are not so nice. The shape of yield curves are driven by many factors, including short term interest rate expectations, which are the primary driver of the first few years of the yield curve, and inflation expectations which are the major driver of longer term rates.

Typically as short term interest rates go up, the yield curve flattens, which is exactly what we have been experiencing in the US. In fact to be precise we have been experiencing a bear flattening; where yields rise but more aggressively at the front end than the rear of the yield curve. This all sounds pretty straight forward, and the conclusion might be “does a flattening yield curve remove the opportunity of roll down gains?”

The answer for rates markets is, yes it does. Especially as it’s a bear flattener.

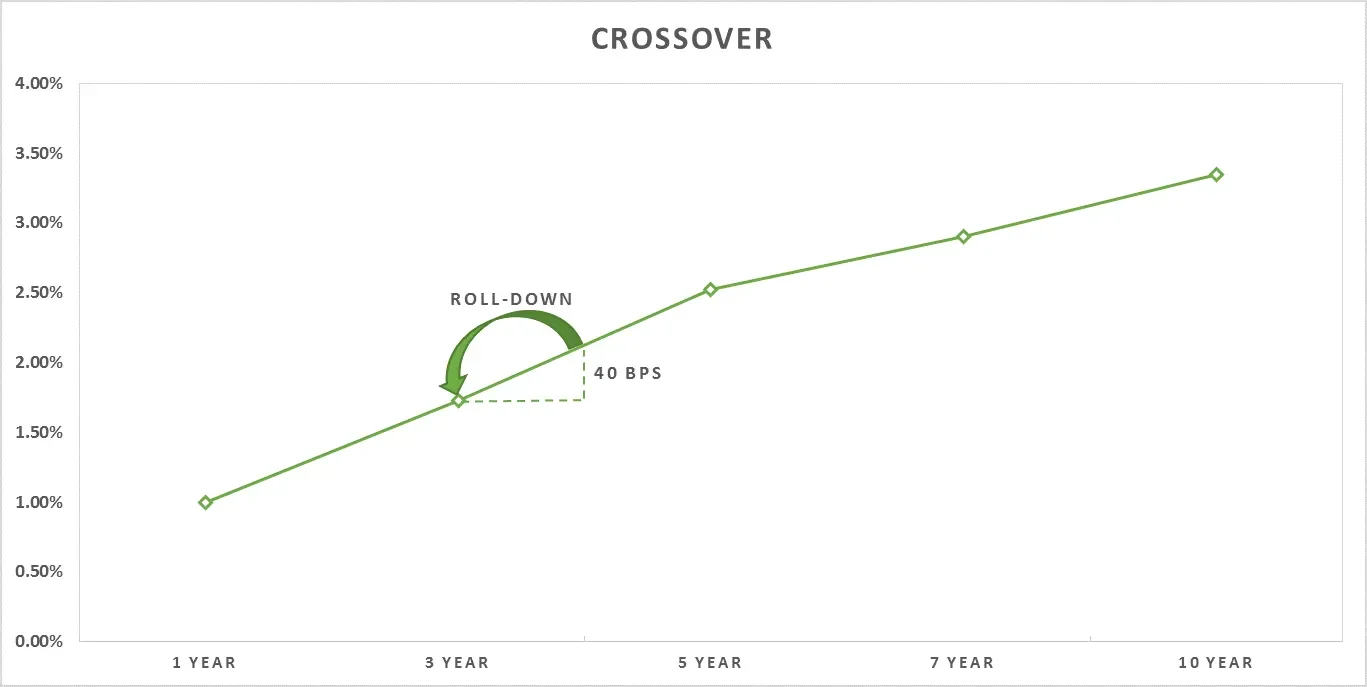

The roll down gains that are still there, and in fact are nearly always available, are in the credit markets. The credit curve of a given borrower is almost always a normal one, or a positive sloping one; where the longer that you lend to someone (i.e. the maturity of a bond), the greater the compensation that you expect to be paid. Below is the example of the Crossover Index which is representative of the pure credit spread of the most frequently traded high yield borrowers in Europe.

Source: Bloomberg, TwentyFour Asset Management

As you can see the steepest part of the yield curve is the front end, so it is here that the best roll down gains are to be had. We also know that the shorter the bond the lower the price sensitivity to changes in yield, this is duration. So if we position ourselves too short in the yield curve, the lack of credit duration means our roll down gains are very small. However, if we position ourselves too long we miss the steep part of yield curve.

Consequently, we see the sweet spot for roll down gains at around the 3 to 4 year part of the yield curve. Using the example above, where there are no other influences apart from credit risk, and credit spreads remain constant, we could buy bonds at the 4 year part of the yield curve and earn a spread of 213bps, hold it for 1 year, after which we still hold a bond with a spread of 213bps, but really should only have a spread of 173bps. The gap between 213bps and 173bps is the roll down, and the gain is that gap multiplied by the residual duration.

So in this example we earn the credit spread for 1 year holding of 213bps, plus we book the roll down gain of 40bps, which with a 3 year duration, equates to 120bps. This gives us a total return of 333bps for holding that bond for 1year, meaning that 36% of the credit return therefore comes from roll down.

What is missing here is the additional yield, and also risk, that we have from the risk free curve on top of which this credit curve sits. This risk free yield in £ is currently 124bps, in $ its 272bps, and in euros it’s just 23bps. Risk free curves are also currently positive, so again if there are no changes to market expectations for this risk, there are also some roll down gains to be had here; however, these are a lot less reliable than those that we earn from credit.

All in all though, it is very clear that roll down gains do offer significant protection, which is why they are a fixed income manager’s minister of defence in a rising rate environment.