Financial conditions are tightening – what comes next?

One of the ways central banks determine if financial conditions are tightening or loosening, and to what extent, is by asking commercial banks about their lending activities.

Through quarterly surveys such as the Senior Loan Officer Survey in the US or the Credit Conditions Survey in the UK, bank managers are directly asked a series of questions regarding their lending standards in different sectors of the economy. The idea is that if the people deciding whether or not different kinds of loans get approved are making those loans more difficult to get, then refinancing conditions will be more difficult for both consumers and corporates.

This tightening is typically accompanied at some point by an economic slowdown. In this scenario demand for credit is also affected; there is less need for credit if growth opportunities are more limited, and consumers and corporates that do not urgently need a loan might choose to wait until banks relax their conditions. That might mean lower collateral requirements, less stringent affordability tests or lower spreads, among others. In other words, both the supply and demand for credit decline in a slowdown, but it is the lack of credit availability that eventually causes defaults and an increase in what banks call non-performing loans (NPLs). This should be reflected at some stage in lower or flat levels of outstanding debt, as the supply of credit recedes and some demand is postponed.

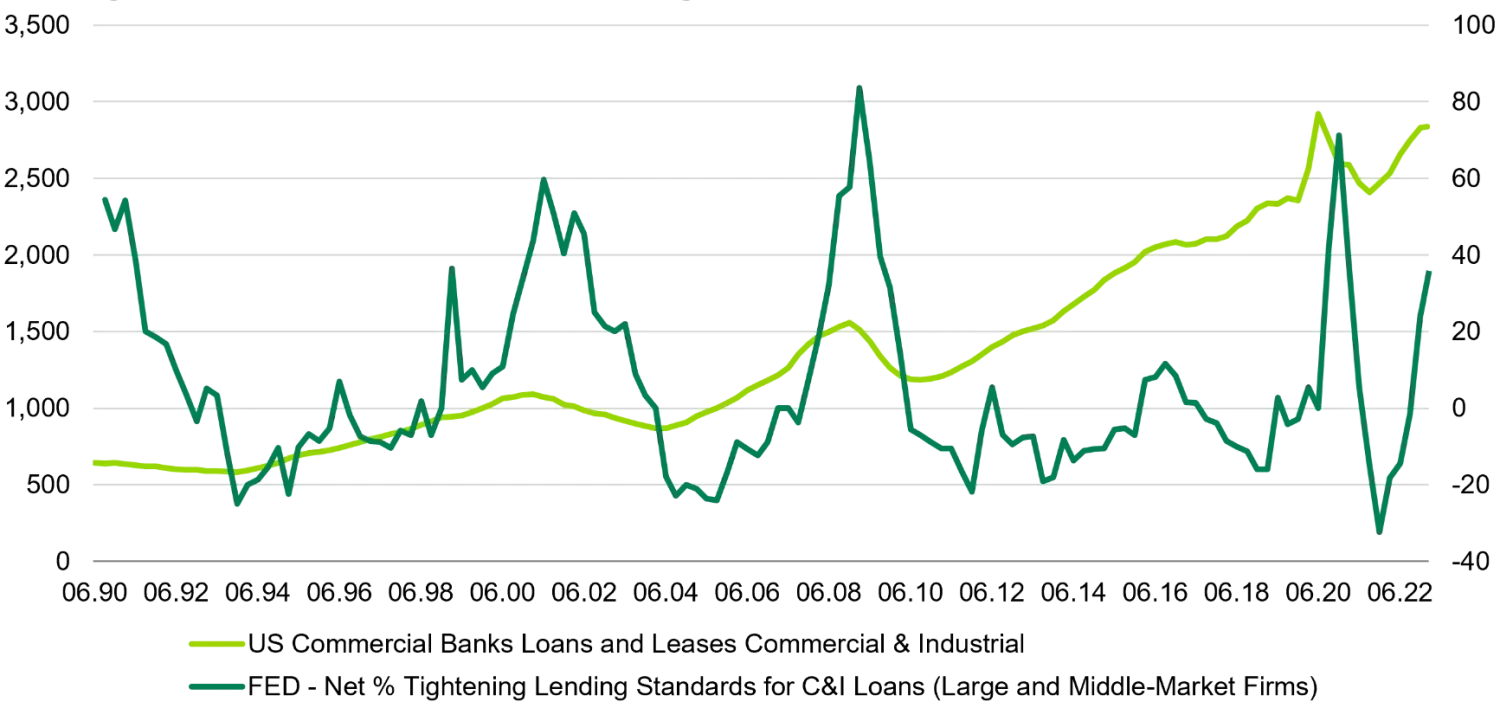

This dynamic has borne out historically at times when banks have indicated they are hardening credit conditions. As the graph below shows, since the Senior Loan Officer Survey started in the US we have seen four episodes of tightening by the banking sector, and we are currently experiencing another. The graph below shows total commercial and industrial (C&I) loans and leases outstanding in the US, plotted against net tightening of lending standards for those loans. The survey actually happened to start in the early 1990s at a time when nearly 60% of the banking sector said it was tightening financial conditions; from December 1990 until December 1993 the stock of C&I loans declined by 9.4%. Next we have the dot-com bubble close to the year 2000, where again at the peak approximately 60% of banks reported harder lending standards; this time the stock of C&I loans declined by 21.5% from February 2001 to May 2004. Some five years after this came the big one, the collapse of Lehman Brothers. At the worst point in the survey during the global financial crisis over 80% of US banks were in tightening mode, resulting in the stock of C&I loans falling by a whopping 26% between October 2008 and October 2010.

Lending standards and C&I loans outstanding

Source: US Federal Reserve

Which brings us to COVID-19. When banks began what was the steepest tightening of financial conditions in the history of the survey, the stock of loans actually increased. At the time we attributed this to the fact that Basel III had made banks a lot more robust (so they were both able and willing to keep lending to the economy), along with the fact that companies ran to their bank executives and drew down their committed credit lines as a precautionary measure. Both of the series in the graph above reversed relatively quickly once fiscal and monetary stimulus (coupled with vaccination programmes) meant that the virus was eventually brought under control. So back then, standards tightened enormously, but lending volumes were up significantly, and both reversed at almost the same time. Very strange from a statistical point of view, but there is a reasonable explanation.

The current tightening episode is still developing, but it is fair to say that the latest data is showing signs of a plateau in the stock of C&I loans (this data is as of February 15 so is quite recent). This is to be expected since banks are reporting they are making it more difficult to obtain a loan, which in part is resulting in lower growth expectations, which in turn depresses an already weaker demand for loans as a result of higher rates. Looking at previous tightening episodes, it is C&I loans that tend to take a hit first, then residential real estate loans, commercial real estate loans and consumer loans tend to follow.

In our view, macroeconomic trends such as this are more important for the Fed than one month’s data being stronger than expected, which could be why the Fed chair, Jerome Powell, pushed back on fears that financial conditions had loosened too much at his press conference earlier this month. Ultimately, if banks have less willingness to lend and demand for credit takes notice of lower growth projections and higher rates, then it is very difficult for growth not to slip below trend. It is therefore no surprise to us that Fed officials have for the most part acknowledged the current stronger-than-expected data, but do not seem to be changing their course of action dramatically. Of course, if data continues to be significantly stronger than expected then we would expect the Fed to change its policy actions, but the current macro trends still point towards a slowdown which, while perhaps not ending in recession, will likely get pretty close.

What does all this mean for fixed income portfolios? Given the economy narrowly avoiding a recession would be viewed as a positive outcome, and considering where spreads and all-in yields are currently, we would think investors will look to move up in credit quality and begin closing duration underweights. The way in which a portfolio manager does this will depend on their mandate and limits, but if we compare the current juncture to recent history we think there are now attractive yields to be had while taking less credit risk.