European ABS: Five things to expect in 2022

If 2021 was a bad year for global bond returns, it follows there were few natural shelters to be found within fixed income from the brunt of inflation and rates-driven volatility. To put some numbers to that story, the Barclays Global Aggregate Index (a widely used broad measure of bond performance) returned -4.7% in USD terms, while European investment grade credit returned -1.1% despite credit spreads tightening over the course of the year1.

In our annual outlook we said that in 2022 we expected to see a convergence between the state of the economic cycle, monetary policy and market expectations; central bank policy was lagging the economic recovery and this had not gone unnoticed by markets, in our view a recipe for correction. We thought growth in key economies would remain comfortably above long-term trends and inflation, despite containing a transitory element and peaking, would prove persistent.

In the weeks since that piece was published, the Bank of England did indeed embark on its tightening cycle with a 15bp rate hike reversing its emergency COVID rate cut, US labour market data has gone from strength to strength, and Fed commentary has brought forward guidance on quantitative tightening and pointed to a lift-off as soon as March. Convergence seems well underway and despite being early in the year, the volatility we expected has already been evident, with the 10-year US Treasury yield moving up a remarkable 26bp to 1.77% in the first week of January. Fundamentally then, we think the drivers of underperformance in broader fixed income that we saw in 2021 look set to continue in 2022.

With all that in mind, we think European ABS should prove a valuable allocation for fixed income investors faced with this convergence in 2022, and there are a number of key themes that we think back up this view.

Floating into a safe harbour

So, the name of the game is steering clear of unwanted yield curve related volatility which traditionally requires low interest rate duration. Floating rate bonds can give investors upside in a rising rate environment as their coupons are reset higher in line with base rate rises. This can make them rather effective tools and a very popular choice during a tightening cycle, and they often see significant inflows during these periods.

Potential floating rate investments can actually be found in many sectors of fixed income - investment grade corporates, financials, covered bonds, leveraged loans and European ABS for example – but history shows the spreads on offer to investors in these markets can vary considerably.

European ABS currently offers the highest spreads of the lot for comparable ratings. There are a range of AAA opportunities from Prime RMBS at 27bp through to non-bank RMBS at around 75bp and CLOs at 95bp, while at the BBB level we see non-bank RMBS at 180bp or more, CLOs at 330bp and CMBS at around 300bp.

Dipping below investment grade we would look specifically at CLOs (portfolios of leveraged loans), where we currently see BB CLOs at around 650bp and B CLOs at 950bp (CLOs also benefit from the same Euribor floor as their underlying leveraged loans).

Turning to ABS then does not have to mean sacrificing spread despite its defensive characteristics through this part of the cycle. In our view, returns driven by carry alone in European ABS are likely to outpace almost every other part of fixed income through 2022.

A broadening opportunity set

In stark contrast to the aftermath of the global financial crisis, we have seen a resurgence in ABS activity on both sides of the Atlantic post-COVID, with both issuers and investors contributing to a record 2021 for primary markets. High demand for borrowing across consumers and corporates, ample systemic liquidity and a healthy financial system all contributed to issuers’ need to access securitised capital markets. In Europe the total issuance was €105bn2 with CLOs having a record year while auto ABS even surprised to the upside despite car sales being impacted by supply chain shortages (UK auto lending was 14.4% lower in November against the previous five-year average3).

We see further growth for European ABS in 2022; a 20% rise in primary issuance looks feasible with mostly the same drivers in place. However, we think one important shift will be the re-emergence of traditional bank sponsored issuance, mainly RMBS, with treasurers finally starting to look beyond the cheap funding programmes of the ECB and the BoE (the TLTRO and TFSME respectively). For example, UK and Dutch RMBS, traditionally two of the most active primary markets in European ABS, accounted for just €5.4bn of supply in 2021 according to Barclays analysts, a fraction of the total we were seeing before those central bank programmes were launched.

Now though Barclays is forecasting €9.7bn for 2022 and material growth in years thereafter.

In the US, Fed tapering will likely remove some $200bn of Agency MBS demand from the market, which we believe has the potential to disrupt spreads and returns. To a lesser extent continental European ABS may face select pressure on spreads if the ECB slows its own purchases. To illustrate this, the ECB’s ABS Purchase Programme (ABSPP) may only be small in size (€27.7bn as of the end of October 2021) but unlike its sister corporate and covered bond programmes around two thirds of ABSPP activity is executed through the primary market, creating a more pivotal technical dynamic. Additionally, the ECB is overweight Dutch RMBS and German auto ABS, which in our view leaves these specific sectors more exposed to underperformance compared to the wider European ABS market.

European market growth should mean greater diversification potential for investors, as well as deeper liquidity. We have seen a growing number of sponsors and issuers enter the market, as well as new niche assets like equipment leasing and inaugural commercial real estate (CRE) CLOs.

Europe has not seen many new investors enter the market in recent years – prohibitive capital weightings still lock out potential insurance investors – despite the obvious attraction. Bank treasuries and institutional investors have however had strong appetite for floating rate products, something we expect to continue into 2022.

Deteriorating fundamentals – but from a high base

Huge fiscal stimulus and direct support of corporates and consumers played a pivotal role in maintaining fundamental performance and default rates within European ABS pools in the wake of COVID-19. Equally powerful has been the speed of the economic recovery, with GDP in most countries at or approaching pre-pandemic size. UK unemployment for example is at 4.2%, just 0.2% above pre-pandemic levels4 and with overall employment 1.5% higher. This is a good illustration of the support households have experienced with labour support schemes enabling a smooth transition back to the workplace, a trend seen across many European countries. In addition, many others have found themselves large net savers over the same period.

We anticipate the main challenge to ABS fundamentals in 2022 will be the bite of persistent inflation eating away at disposable incomes and creating pressure on borrowers’ ability to pay. We also expect to see some further modest increases in the cost of borrowing, though in many cases this will still be low when compared with 2019. A strong banking system with ample liquidity, strong job availability and wage growth on the other hand should result in a benign landscape for arrears and defaults within ABS deals.

While this is not a perfect ‘goldilocks’ scenario, we are confident fundamentals will not be a concern for European ABS investors in 2022.

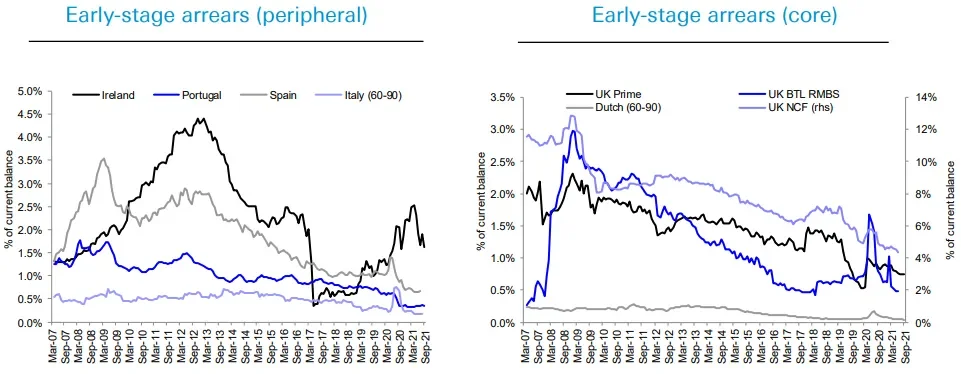

That said, we think some degree of normalisation in arrears is likely as the economy moves to a more normal footing, and the same goes for pool performance. The context here though is that as the charts below demonstrate, 2021 saw early-stage arrears in RMBS deals fall5, so while we expect some deterioration going forward it will be from a strong starting position. A similar theme exists if we were to look at CRE or leveraged loan defaults.

If we take stock of lending standards, we see them back to pre-COVID quality across almost all parts of European lending, with a risk that lenders compete on credit standards as well as margin in 2022. Reassuringly, the leverage within European ABS bond structures has remained largely unchanged though. A typical BBB CLO for example had 14-17% subordination through 2021, very similar to pre-COVID levels.

ESG progress, regulatory stability

European ABS issuers have made steady progress in making data available for our ESG assessments, and we expect 2022 to see the continued harmonisation of ESG reporting and loan level data. The granularity of ABS data makes the task more onerous when compared with a standard corporate disclosure but will be worth the wait we think. The resumption of more meaningful bank sponsored issuance will also likely herald more green and social focused deals, given the greater focus from those businesses and deeper asset pools from which to draw suitable collateral. We saw €4.6bn of such deals in 2021, according to Barclays, and while there is no standard definition, we see three types of ESG-related ABS transaction:

- Green securitisation - where the underlying assets are regarded as green

- Green bonds - where the proceeds are used to finance green activity

- Social bonds - where lending is regarded as having a positive social use

We certainly expect at least as much issuance this year; Barclays sees up to €12bn with a likelihood for Social labelled deals to grow the most given the seemingly low threshold and no observable change in issuer lending standards when obtaining one; we will make our own assessment of each deal as part of our due diligence process as always.

On the regulatory side, the UK government has also ruled out significant near-term changes in the securitisation framework post-Brexit, reducing the risk of an unhelpful divergence from the EU regime. There is still no momentum building to facilitate a change in capital weightings for ABS securities, however, which keeps most insurance buyers out of the market. This is helpful in preserving value but naturally acts as an anchor on more material market growth.

Abundant relative value with rates a friend not a foe

We enter 2022 with spreads having pulled back from the tights of September last year, partly as a result of ABS supply gradually fulfilling investor demand and affording greater credit selection, and partly in sympathy with a growing risk aversion across global markets due to heightened uncertainty around the pace of monetary policy tightening.

We see plenty of relative value across European ABS, especially versus more mainstream fixed rate markets given rates weakness tends to be a tailwind for floating rate assets during tightening cycles.

You won’t be surprised to learn CLOs are at the top of our list. The market accounts for around a third of the European ABS market these days, is normally incredibly active in both primary and secondary domains and has seen liquidity develop along with its growth. With bank warehouse lines open in large numbers and strong M&A activity, we fully expect supply to run hot which should help in maintaining a favourable investor technical. We see CLOs as not only the best standout value within European ABS but probably within fixed income ; BBB, BB and B rated CLO notes are currently yielding around 3.5%, 6.5% and 9.0%, respectively, compared with the BAML Euro HY Index at 2.8%6.

We also see good value in CMBS and the more granular CRE backed deals, which on a credit selective basis can offer a spread premium and yields approaching those available on CLOs. Currently we are seeing low levels of leverage and high structural protections, with a diversification benefit to other sectors and a supportive backdrop to fundamentals and valuations. This sector has also historically carried a liquidity premium owing to the more bespoke nature of each deal, which needs to be considered when allocating.

Finally, a fairly obvious one, maybe to the extent it is overlooked. The BoE has hiked rates, GBP denominated ABS coupons have thus increased, and we expect more of this in 2022, a clear positive for investors since it means more income. The UK ABS market is the largest and generally most liquid within Europe, so we feel being overweight here continues to make sense. The ability to further add value through active trading exists in the greatest size here as well, in our opinion. With fundamentals normalising, we are likely to see a greater degree of tiering between deals as well as opportunities through the year to trade around credit duration if broader markets are volatile. The UK market is also considered to be less prone to a tapering-driven correction as the BoE has no ABS purchase program.

In short, we see several reasons to be positive on European ABS in 2022, and we won’t apologise for being more bullish on monetary tightening than most fixed income investors.

___________________________________

1 Morgan Stanley, Jan 2022, 2 Morgan Stanley, Dec 2021, 3 Pantheon Macroeconomics, December 6th 2021, 4 ONS, Oct 2021, 5 Deutsche Bank, Moody’s, December 2021, 6 Bloomberg, January 6th 2022