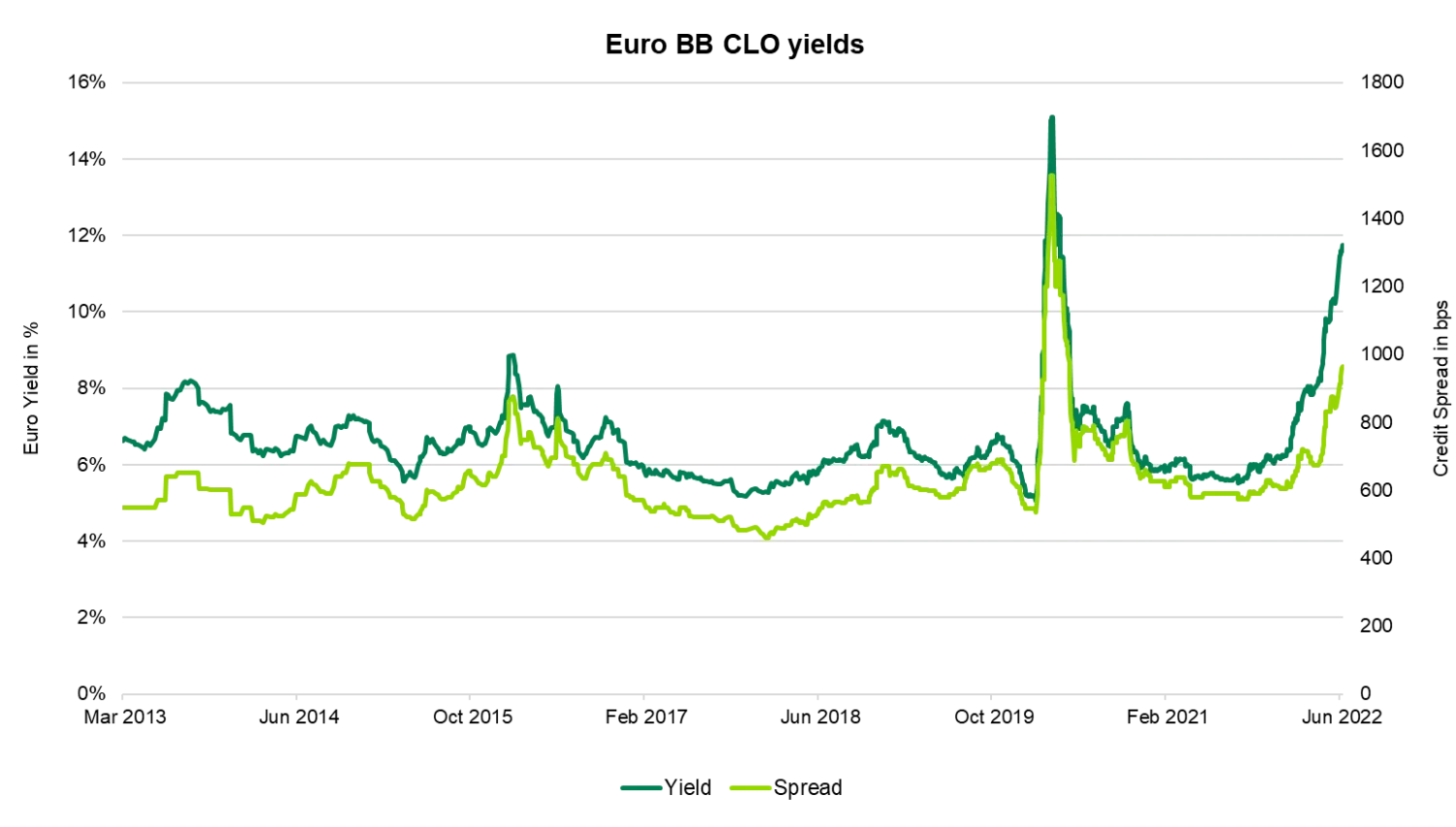

BB CLOs approaching 12% yield

So far 2022 has been a remarkable year and one that brings back memories from over a decade ago. Clearly we are in a totally different world now, and the reason for credit spread widening is not because of the collapse of the entire financial system, but if we look at June so far then it’s impossible not to think back to 2008/2009! ABS is not unique in that sense, with XOVER starting the month at 437 (already almost 200bps wider than on the first of January), and currently trading close to a post-COVID peak at 566, we can’t ignore the relentless sell off and very high volatility. In the European ABS market there is no place where this is as visible as in BB rated CLOs, one of the highest Beta products in the ABS market.

When I look back to the start of the year, which feels like a lifetime ago, coming out of the COVID pandemic, BB Euro CLOs were trading at an effective yield of 6.2%. But then Russia invaded Ukraine, inflation started running out of control and now a recession seems to be on the cards in the next 6 to 12 months. So, as risk sentiment turned, spreads started to widen in all markets and BB CLOs widened to 950-1000bps.

At the same time we have seen the Fed and BoE hike rates and the ECB signalling a hike in July and further hikes in September, so rate products have sold off as a consequence. CLOs are floating rate products, so “why are rate moves important” I hear you ask… It’s important as, although prices have not moved because of rate volatility, the all-in expected yield for holding a BB rated CLO has now materially increased. While current income is determined by where Euribor is today, one should not forget that these are roughly 7 year long bonds and that during the life of these bonds the coupon will increase as the ECB hikes to tackle high inflation. For a 7 year Euribor linked bond, the swap-rate vs Euribor is now worth 2.2% and that means that the effective yield on European BB-rated CLOs has now increased from 6.2% in January to 11.9% today, which, in our view, stacks up quite nicely to the Euro HY index at just south of 7% yield.

That is a yield number that we have not seen since the first weeks of the COVID-pandemic and in general a yield difficult to buy since the GFC and Peripheral crisis in 2011/2012. At the start of the first COVID lock-down, liquidity was virtually non-existent and CLO BBs were briefly trading at around 15% yield at a cash price in the 60s. But what we can see from the graph below is that yields don’t tend to be this high for very long, as we have experienced in 2016 and 2020. In those years it was difficult to buy bonds in bigger sizes, but today that’s a different story, there are still CLO Managers looking to price new deals before the summer (we can count at least 6), and there is a fairly active secondary market, albeit at wider bid-offers. This secondary market is mostly dominated by BWIC activity (public client to client auctions) as dealers are less willing to deploy balance sheets than they have done historically. Last week, according to JP Morgan data, there were more than €500m of CLOs up for the bid, which is high compared to the €285m weekly average for this year. As such, we are seeing bonds change hands in decent sizes.

BB CLOs are now trading at a cash price of 75 to 85 cents and from what we have heard the main sellers have been credit funds that are funding outflows. But if you realise that BBs can withstand GFC-like scenarios and cumulative loan defaults of 35-40% then it’s not hard to see why hedge funds are the main buyers at the moment, especially if you consider the uncertainty around CLO equity scenarios and yields. We often get the question if spreads can gap out further on bad news, and of course they can, especially if you also consider the pipeline of primary deals, it is impossible to pick the bottom. At these yields the 1 year forward break-even yield is at the previous peak of 15% yield, so that is starting to look compelling and at these levels I can see renewed interest growing over the summer.

Source: Citi Velocity, Bloomberg, TwentyFour - 28 June 2022