What Happened To Pari Passu?

We are not in the habit of writing when a lot of our readers are on holiday, however we know many of you still follow events closely even while off, and we felt this event was particularly newsworthy.

The event in question relates to the Portuguese bank Novo Banco, which was formed out of the good assets in the breakup of the country’s former largest bank, Banco Espirito Santo, back in August last year.

Novo Banco has since been up for sale and attracted many interested parties but the bids were not high enough for the state to complete the sale. It was known that Novo Banco was thinly capitalised, but this would be dealt with by bringing in a stronger owner. So far the plan sounds credible. However a spanner was thrown in the works when Novo Banco failed the ECB stress tests with a capital shortfall of Euro 1.4bn.This was largely expected and as is protocol, the Central Bank of Portugal ordered Novo Banco to present a capital plan to meet the shortfall. The plan included asset sales and also, given that a new sales process was imminent, it was assumed that the shortfall remained a special case and would be dealt with by the new buyer.

Here is where it becomes very muddy. Yesterday the Portuguese Central Bank announced the suspension of trading in Novo Banco’s senior debt as they were considering using senior debt for bailing in the capital shortfall (the junior debt had already been bailed in at the creation of Novo Banco back in August 2014). This is something we had contemplated but felt was unlikely given the state’s decision to sell the bank; however in any event, given the senior debt stack of c12bn versus a capital shortfall of Euro 1.4bn, it should only be a small haircut of around 12c in the Euro.

This morning further stories are appearing from the Central Bank that they have selected 5 of Novo Banco’s 52 senior bonds which they are going to use for bail in. To effect the bail in these bonds will be transferred to the “bad bank” where they will be subject to the recovery of those assets. In doing this, Novo Banco effectively loses this debt from its balance sheet and hey presto its capital position is enhanced by the notional value of the debt transferred, which is Euro 1.95 billion.

The other c10 billion of senior bonds in Novo Banco are unaffected despite ranking pari passu with the bonds being transferred.

We had assumed that at the point of non-viability or at the point of a capital shortfall, anything could happen - even events that we had never seen before. However we did also assume that certain protocols would be adhered to. The equal ranking language that sits in every prospectus is a core value that we never thought would be broken.

However, in the event of bail in the Central Bank claims the right to change all the rules, including this one. If this is indeed the case then we can expect a great deal of legal wrangling in the future, along with increased uncertainty. It will also hinder the recovery of the good banks in the future if bond investors cannot trust the basic rules in a prospectus or the hierarchy of losses.

For clarity, there has so far not been a statement from Novo Banco and what we are referring to are comments from the Central Bank that still need ratification in law. However what we write does appear to be what is being proposed.

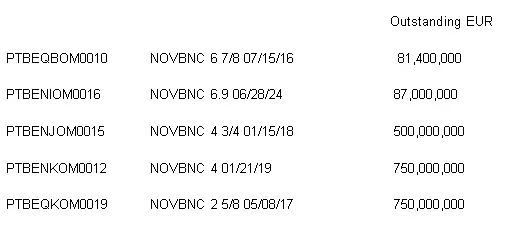

The bonds apparently being transferred are:

There are some consistencies in the bonds selected in that they are all domestic bonds. International bonds with ISINs starting XS have been left out, presumably because they do not have legal jurisdiction over these bonds. However the selection within the domestic choices is also somewhat random and in need of further explanation. Floaters for example have been omitted. Is this because the Central Bank is concerned that these are held by other Portuguese domestic banks? If so they are essentially choosing which creditors to inflict losses upon!

Unfortunately we do hold a small amount of the 2017s which we bought after the 2015s redeemed at 100 last month. Which is also strange given that the redemption was after the stress test. We shall of course be monitoring the situation very closely going into the New Year as there are many unanswered questions remaining.