The long-term conundrum with short-term investing

One of the most consistent questions that we get from investors now is whether the high volume of cash holdings of short-term government bonds is the best strategy to hit their financial targets.

We think the answer is a clear “no”.

Clients have adopted this strategy because of recent financial market performance. The negative returns across all asset classes have created a mentality of fear. As a result, they will not recover from the drawdowns experienced in the last 18 months anywhere near as quickly as they could.

Where investors normally look back over a long timeframe, this has now become compressed, and they are only considering their experience over an 18-month period. This is stopping them from allocating on a more normalised medium-term basis and is responsible for the 30%-50% allocation to cash and short-term government bonds.

So, instead of looking back 20 years to inform a three-year investment horizon, the window has narrowed significantly. And, obviously, that differs from what bond market specialists are doing at the moment.

This focus on the short term is really the problem. Investors need to think forward three years to how they will feel about the investment decisions they are making today.

Short-term problems

Investing on a short-term basis isn’t a good idea. That is because it doesn’t account for short-term volatility. Investing on a short-term basis gives a significantly lower stability of returns, as any volatility can heavily skew performance – it becomes a bet-on-market timing rather than more justifiable factors, such as yield.

Indeed, 50 years of market data, including through periods such as today’s, shows that investing on a long-term basis provides more predictable returns.

Fixed income should be a lower-volatility asset class, and the yield you invest at should be a great guide as to what expected returns should be.

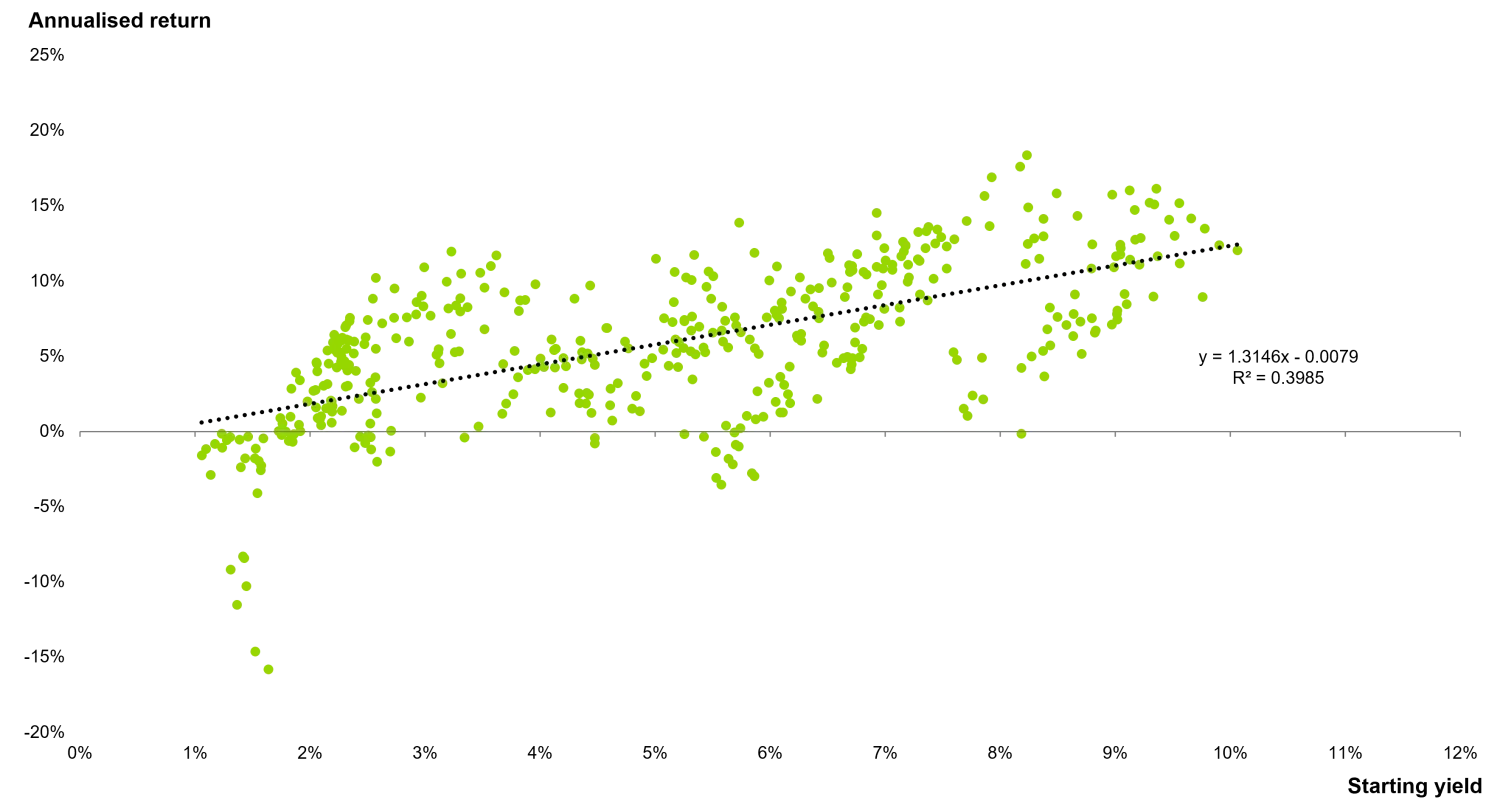

Chart 1: 1-year periods with starting dates Dec 1985 to Oct 2021

Past performance is not a reliable indicator of current or future performance.

For illustrative purposes only. Underlying data based on the BAML US Broad Market Index (US00). It is not possible to invest directly into an index and they will not be actively managed. Note: No client of the adviser has achieved the results provided herein nor should it be inferred that any portfolio will perform in a manner as outlined in this presentation. Source: TwentyFour, ICE indices

In the graph above you can see this isn’t the case if you invest on a short-term basis. If you invest for a one-year period at a 3% or 6% starting yield, you have roughly the same range of annualised return outcomes, and the total range from -16% to +19% is enormous.

So, the yield you invest at isn’t a great driver of expected returns over the short term – it only defines 40% of the annualised returns.

However, if you invest for three or five years the return is 80% to 90% driven by the yield you lock in at, and so your expected return is much more correlated and consistent as can be seen in the graph below.

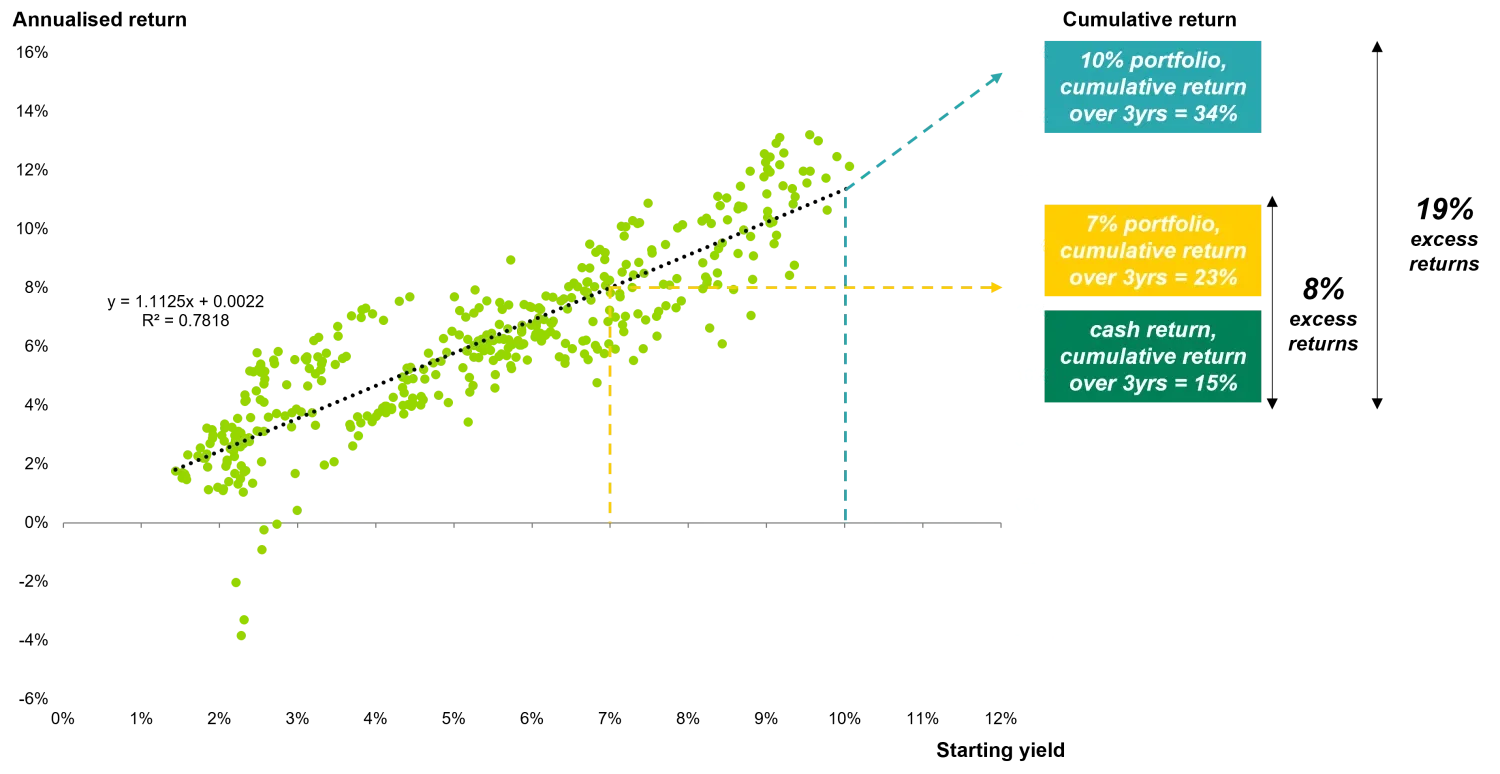

Chart 2: Investing long term give better outcomes in fixed income

Past performance is not a reliable indicator of current or future performance.

For illustrative purposes only. Underlying data based on the BAML US Broad Market Index (US00). It is not possible to invest directly into an index and they will not be actively managed. Note: No client of the adviser has achieved the results provided herein nor should it be inferred that any portfolio will perform in a manner as outlined in this presentation. Source: TwentyFour, ICE indices, Bloomberg

Investing for three years gives a much better idea of expected returns than investing for one year.

What else do we know that is relevant?

Well, we know that if investors are in cash or short-dated instruments, then all the good news is behind them as market pricing clearly shows cash rates going down over the next couple of years. While they might look attractive in comparison to the last 15 years, your returns are going to deteriorate and ultimately disappoint, making it very difficult to achieve your financial goals going forward.

If we look at cash rates at the moment, and we compound those over the next three years, we only get a return of around 15%. The main driver here is the need to reinvest all your principal and the interest earned at continuously lower yields – i.e. reinvestment risk.

But a bond portfolio that yields 7% provides compound returns over the same three-year period of around 23%. A bond portfolio that has a 10% yield returns 34% over that same three-year period. Investor returns are better because of the higher yield but also due to not needing to reinvest the principal.

The excess returns between cash and a 7% portfolio is 8 percentage points over three years or 19 percentage points for a 10% portfolio.

And so, again, how are investors going to feel in three years if they could have had a 23% or 34% return, but only got 15%.

Timing

Investors may decide that they are not going to sit in six-month T-bills or cash for the entire three-year period, but this creates different problems.

The Federal Reserve has been consistently clear, as have other central banks, that monetary policy now is restrictive. That means interest rates are above what is appropriate for a balanced economy. So, yields are high and will fall.

Allocations to cash and cash substitutes are also very high right now, in some cases 30% to 50%.

When yields are high, fixed income is cheap, and when fixed income is cheap, prices can rally a long way. And if there is a lot of cash sitting on the sidelines, as there is now, then that rally can be very hard and very fast.

High cash balances make the asset reallocation more important, but harder, given the size of the move investors need to make. Investors need to think about when they want to be invested in a more normalised investment profile, and then work back from there to when they need to start doing something about it. Sitting on cash balances of 30% to 50%, means that money won’t move in one step.

So, if an investor has 30% excess cash that they want to invest, and they want to do it over a six-month period, then they need to be making a 5% reallocation every month from today for them to be invested in six months’ time.

And how might a rally impact that? Well, let’s look at an example of a safe investment grade portfolio that has a 7% yield. If we saw a 3% rally in bond prices, then their yield would drop to 6.5%, with three-year returns dropping by over five percentage points from 23% to 17%. That’s a very material impact on investors’ financial ambitions over not a very long timeframe.

What if rates move?

We have already mentioned that thinking short term doesn’t result in the most reliable returns. The short-term impact of rate movements is that bond prices adjust, but more important is what happens to your returns over a longer period. As mentioned above, cash has significantly more reinvestment risk, so if rates move, cash returns are a lot more sensitive - your returns don’t match your expected returns at the outset.

However, a movement in rates for bond portfolios impacts short-term price volatility, but for medium-term investors the return impact is negligible as can be seen in the table below.

Table 1: What happens if rates move?

- Rate moves impact cash investment more than bonds if bonds are held to maturity

- Cash needs to be continually reinvested and so is more sensitve

Cumulative 3yr returns as rates move up or down immediately after investment

Modelled performance is not a reliable indicator of actual current or future performance. For illustrative purposes only and underlying data based on the BAML US Broad Market Index (US00). It is not possible to invest directly into an index and they will not be actively managed. Source: TwentyFour

Over a more normalised timeframe, bonds get you a higher and much more stable return than you would do if you’re invested in cash.

Why is 2023 different from 2021?

The current environment is very different to 2021. What we’ve seen over the last couple of years is a negative performance within financial markets. The change in monetary policy we’ve seen, as central banks have hiked rates, has created uncertainty in markets and price volatility.

The main protection you have as a bond holder against market volatility is the yield at which you buy your bonds, and this was very low in 2021. So, we had an environment where there was less protection, and a bigger change in the main driver of performance: monetary policy.

Today, bond markets have materially higher starting yields that provide significantly more protection. At the same time, central banks have already done a lot of the heavy lifting, so the risk of a similar round of rate hikes is much lower given expectations that central bank policy is at the peak already.

Conclusion

In summary, investors’ expectations, and the way they are investing has changed materially in a way that is less likely to help them achieve their financial goals.

We know investing short term gives less certainty of performance. We know the Fed is saying yields will ultimately come down. We know reinvestment risk is materially greater in cash, and total return is more volatile as yields change. We know you get a better compounded return in bonds than in cash. And we know that from here a rally can happen quickly and materially impact investors’ returns.

And that is why I think we must continue to ask how investors are going to be thinking in three years’ time about what they’ve achieved, based on decisions they’re making today.