Outcome Driven Fund Update – 18th March 2020

These are clearly unprecedented times. We are seeing large gaps down in asset values, large liquidity preference and sometimes positive correlations between risk assets and risk-off hedges. Given the volatility across markets, we believe the best thing we can do is to keep you constantly up to date with our positioning, thinking and recent performance.

Positioning going into this:

We were at the lowest aggregate risk position in both funds’ histories (and lowest in my career for that matter).

ARC had its lowest ever duration, at 1.50 years, and lowest ever HY weighting of just 1%. Defensive rates exposure of 5% and almost one third of the fund maturing this year, in 2020, to help give the fund enhanced liquidity.

For CBF, it meant the lowest beta ever, at just 0.6, and the lowest ever HY exposure at 2%. It also had 18% rates exposure to try to offset the limited number of bonds maturing in 2020 (it is a longer duration fund after all), to also help give enhanced liquidity.

Since Q4 2019 we had been concerned that in our view the yield on offer from IG credit was not sufficient to compensate for any unexpected surprises. We did not know what the catalyst would be, just that reaching for risk we believed would be badly rewarded. In fact, this belief was the main point we made in the series of ‘Opportunities in Sterling Credit’ meetings and webinars we did in January.

Performance

ARC

The fund is now in drawdown by -2.16%, which is the largest in the fund’s history (just). The previous largest drawdown was -2.08% in Q1 2016, just after the Fed hiked for the first time in 10 years. Back then we had 12% in HY and a duration of 3.0, compared to 1% and 1.50 today.

Given the low level of risk in the portfolio, the fact that the drawdown is the largest in the fund’s history gives you the measure of just what the market has done in the last week. No one has been immune.

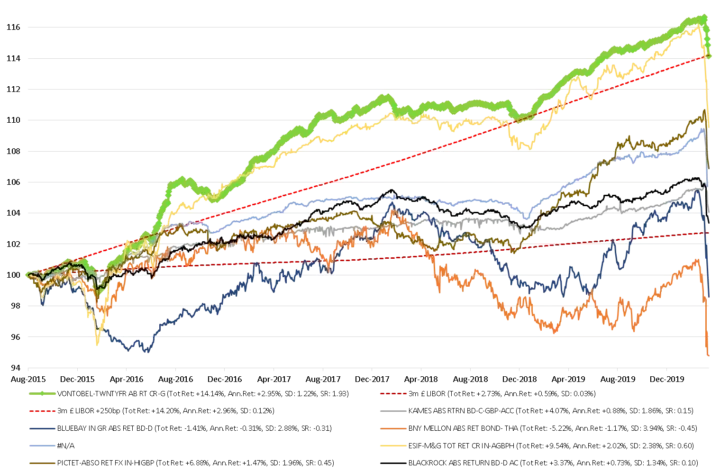

Chart 1: Since inception returns vs peers, to March 16 2020. Source: TwentyFour, underlying data Bloomberg

Compared to peers, we have significantly outperformed. Many of our absolute return peers here have had drawdowns in excess of -6%.

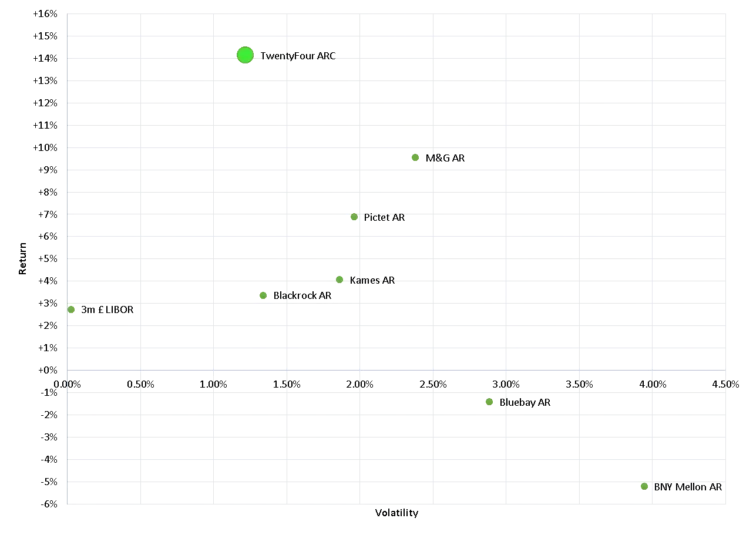

On the risk-adjusted returns chart, you can see what the huge shift in volatility over the last week has done to the distribution of the peer group:

Chart 2: Since inception risk-adjusted returns vs peers, to March 16 2020. Source: TwentyFour, underlying data Bloomberg.

CBF

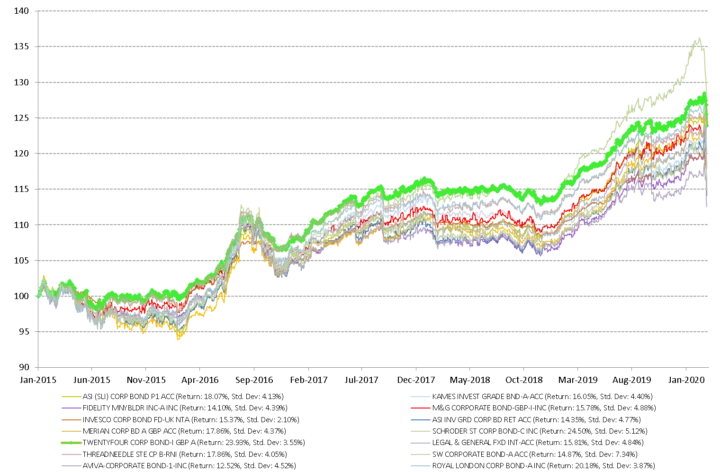

Given the higher duration benchmark of CBF, the fund and sector returns have dramatically shifted in the last week. CBF is now at a drawdown of -3.53%, which is a broadly similar magnitude to its all-time peak drawdown of -4.30% in Q4 2016. CBF has also outperformed versus peers, with some funds now down more than -16% in the last week.

Chart 3: Since inception returns vs peers, to March 13 2020. Source: TwentyFour, underlying data Bloomberg

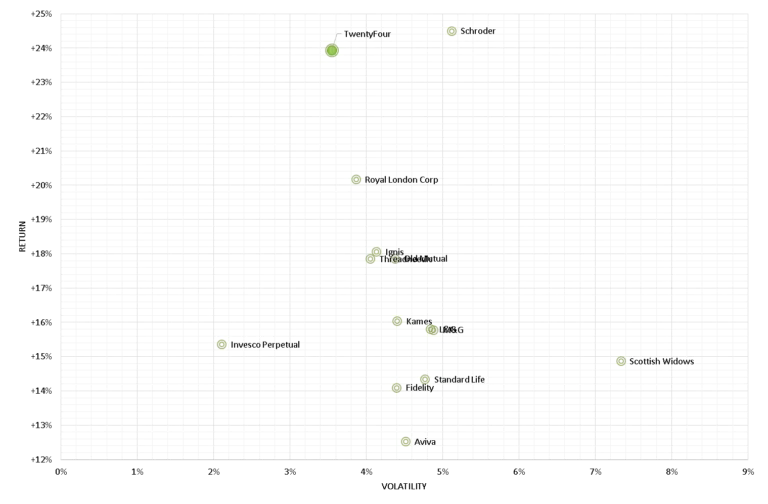

Last week’s price action has really shuffled the deck significantly in risk-adjusted terms, with the gap between CBF and peers dramatically changing. Every fund has moved down, clearly, but many have also moved rightwards in terms of volatility as well.

Chart 4: Since inception risk-adjusted returns vs peers, to March 13 2020. Source: TwentyFour, underlying data Bloomberg

With hindsight, what could we have done differently?

Although the funds are positioned to be very low risk, with hindsight having even less risk would have almost certainly helped, even if just a little – but the markdowns have been so indiscriminate that it would have been hard to escape any losses whatsoever. While US Treasuries were seen as the perfect risk-off hedge to begin with, in recent days the moves in USTs have also been quite wild and not always negatively correlated to risk, so having more in our risk-off bucket might not have materially altered returns. What about cash? Well, as well as negative cash rates in Europe, custodians in the UK are now charging some accounts for holding cash, so even cash can have a negative return.

In ARC, having 0% in HY instead of 1% would have helped.

For CBF, having nothing in RT1s would have helped, although that is a sector we materially de-risked in 2019 given strong performance back then, so we took risk off the table, but arguably not quite enough.

In the real stress sectors of high street retail and energy we have been conservatively positioned. Our only retail exposure as such is in supermarkets (where we hold short dated secured bonds), which have held up well and have actually done well during this crisis in terms of earnings. In energy the only direct oil exposure we have is in five-year Total bonds (only held in CBF, not ARC), which are AA rated and more upstream than downstream. The bulk of our energy exposure is either in network gas and electricity distributors, or hybrid distributors/clean energy suppliers – while their equity prices have been off up to 30%, their bond cash prices are closer to -1%. We have far more detail on the names and price moves in our recent webinar for anyone interested.

Any stock/sector concerns?

Our biggest stock concern is SAGA, given 50% of its earnings normally comes from cruise ship operations and 50% from insurance (mostly vehicle). This is only held in CBF (position size 0.30%) and clearly the cruise industry along with all travel/tourism looks to be in big trouble. The cash price on this bond is now at 45, which is suggesting hard default. We think this is significantly overdone – these sectors are expected to be receiving government aid and the senior bonds such as this one should ultimately be money good as a consequence. We are expecting there to continue to be significant volatility on this bond, however, and therefore in the short term the bond price could go even lower. Remember that the recovery value for most senior IG credit over the last 100 years has been close to 40%, so the price today is factoring in only a recovery value – we continue to hold and do not expect to sell. The earnings outlook for anything in this sector will almost certainly be terrible – but remember the other half of SAGA’s earnings comes from insurance, and with the bulk of that being vehicle insurance (fewer cars on the road should lead to fewer claims) we do not believe these bonds should trade this low.

Insurance Sector

This has been our favourite sector for some time – but clearly some insurers will potentially have a big hit to earnings. This is why our preference for the Life Insurance subsector of insurance should play well. We have no exposure to direct Property & Casualty (P&C) insurers, and although we have exposure to general insurers, the bulk of their book is likely to be in Life or Vehicle – sub-sectors we believe will hold up well. As such we continue to see Life/Vehicle insurance names as some of the best risk-adjusted return opportunities available for low risk funds.

Positioning now

Little has changed, we have certainly not added risk, and if anything we have looked to trim risk a little in CBF by trimming RT1 exposure in one of our holdings and then buying it back 8 points lower.

For ARC, we have sold some of our bonds maturing in the next six weeks to help keep a large cash buffer.

When would we add risk?

There are many fantastic opportunities now, which in normal circumstances we would expect to jump at and look to add risk. However, these are not normal circumstances.

A good example is one of our favoured banks, Coventry Building Society, which has a Tier 1 capital ratio of more than 30%. Yesterday we could have picked up its recently issued Coco bond at a cash price in the mid-80s, for a yield of 11%. This bond was issued exactly a year ago at 100. This morning as I type it is offered at a cash price of 79, a yield of more than 13%. For context, we last bought Coventry Cocos in Q4 2018 when they were yielding 8%. They matured in Q2 2019, being one of the best opportunities to add risk we’ve seen in recent years – 13% is the yield today for virtually the same risk. The colour we have from traders at banks is that Asian investors particularly have been selling these bonds to meet margin calls on the leverage they have in their portfolios. We believe this leverage unwind dynamic will come to an end soon.

Clearly the market is trading at distressed levels, giving rise to incredible yields that were last seen in 2008 (or possibly not even then). What is different this time of course is the credit quality of financials, banks especially. UK and US banks have seen a big improvement in capital ratios and emergency liquidity facilities from central banks in the last 10 years, meaning the likelihood of a major UK or US bank failing in the near term is very low. The cleaning up of balance sheets from TARP (or equivalent) in the US and UK are what have led to this quality improvement – but this has not always been the case in other parts of the world where we have continued to see bank failures.

What holds us back from adding to risk is the uncertainty over client flows. In open-ended funds, as last year’s focus on some equity and property funds painfully highlighted (repeated this week with property fund closures), is that liquidity is precious. While we have high levels of liquidity in both funds, we just cannot predict what client flows will do, so we believe it is best to be prudent and stay ultra-liquid.

The broader credit, rates, equity and even FX markets have seen liquidity dry up on some days – in some ways it has even felt worse than 2008 on certain days for certain periods of the day – but you cannot apply blanket statements here. Liquidity has been tough at times, patchy at others, and not bad at still other points in the last week.

If government policy actions can put a base under risk assets, allowing clients to tolerate risk in the short term, then that could be a catalyst for us to add risk.

The buying opportunities are there for investors that can tolerate short term mark-to-market volatility. The opportunity to own one of the world’s highest quality banks, with the lowest risk balance sheet we can think of, at a 13% yield, is not one that comes round very often.

At the fund level, ARC has gone from a yield of 1.8% to almost 3%. In a week. In January and February I was telling clients that the yield on the portfolio was below the target return, but we were positioned that way to try to protect capital. Now the yield is above the target return once again, without us adding any risk whatsoever.

CBF has gone above 3% in yield. In terms of the average spread, we have widened by more than 100bp in both funds. At the point when we are confident to add risk, we should be able to materially move the dial in terms of portfolio yield – in such circumstances we anticipate the yields on both funds could be raised by more than 1% each when we do decide to add risk.

As ever, we are here for you whenever you need us. By phone, email, video conference etc. until we can meet face-to-face – please do not be shy in sending in any requests for information in the meantime.

Regards, Chris and the Outcome Driven Team

Performance

Vontobel Fund – TwentyFour Absolute Return Credit Fund Performance

| Rolling performance | 02.19-02.20 | 02.18-02.19 | 02.17-02.18 | 02.16-02.17 | 02.15-02.16 |

| Class G Acc | 4.11% | 0.97% | 3.02% | 8.10% | N/A |

TwentyFour Corporate Bond Fund Performance

| Rolling performance | 02.19-02.20 | 02.18-02.19 | 02.17-02.18 | 02.16-02.17 | 02.15-02.16 |

| GBP I Acc Class | 9.81% | 1.00% | 3.48% | 10.37% | -0.15% |

Past performance is not a reliable indicator of future performance. Performance figures are shown in GBP on a mid-to-mid basis inclusive of net reinvested income and net of all fund expenses. Performance data does not take into account any commissions and costs charged when shares of the fund are issued and redeemed. The value of an investment and the income from it can fall as well as rise as a result of market and currency fluctuations and you may not get back the amount originally invested. Source: TwentyFour; 28 February, 2020