Olive Oil, What’s Not To Like?

Deoleo is a Spanish olive oil company that people will know from its brands like Bertolli. It’s long been considered to be one of the “idiosyncratic” stories in the European leverage loan market. The deal has an 85m revolver, a 55m second lien tranche and widely traded 460m senior secured tranche. This cov lite loan was priced in June 2014 with a Euribor +3.5% at 99.50, with Euribor floored at 1% and rated B/B2 by S&P and Moody’s, it was an interesting loan to buy for many CLOs. With an ok spread, solid rating and at a price of 99.50 it did well optically for CLOs.

Almost 5 years on a lot has changed, and not for the better. The loans were downgraded to CCC+/Caa1 in 2016 and 2017. Interestingly S&P recently confirmed the CCC+ rating with a stable outlook but said that they didn’t believe the capital structure is sustainable, and could be strained by unfavourable business and economic conditions (as reported by Debtwire in February this year)…. that doesn’t sound like a CCC+ to me. Unfavourable weather and operational headwinds have squeezed liquidity in the business, even CVCs 25m capital injection in October 2018 doesn’t seem to be enough. The CEO has also resigned after 3 weeks on the job due to health reason, more bad news for CVC as losses are racking up.

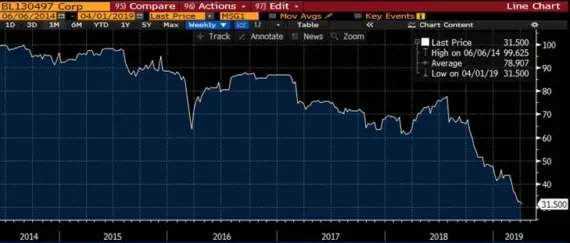

A restructuring or a sale at these levels will be painful for the equity investors in the CLOs that own this loan. As a debtholder we’re pretty well insulated (as BBs for example have over 10% subordination and significant interest coverage) but it’s an interesting example for us, as we can see which managers were involved in the deal and whether they still own it. Loan defaults have been very low across the market, but there are a few of these names out there that have traded in the 70/80s for a while now, so a problem name like Deoleo gives us a good data point in evaluating CLO managers. As the graph below shows the price decreased relatively gradually until there was no way back for the company, leaving CLO managers with plenty of time to come up with an exit (or entry?) strategy.

According to data from Reuters LPC, Barings (Babson Capital), Alcentra and ICG are the 3 managers that currently still hold Deoleo in their portfolios; however, from what we can see another 6 managers bought this in 2014, but those 6 have all sold it over time. Carlyle was the first one to bite the bullet and sold a fair part of their holdings in 2014 in the high-90s, and the remainder in 2017 when it traded down to 74. Other managers like Apollo managed to buy it in the 93 context and initially sold some at 98, which would have been impressive if they didn’t keep the rest down to 75. Interestingly some managers added in the 70s and 80s to “build par”, but unfortunately they got it wrong this time.

Clearly this is just one example, and we don’t expect CLO managers to get it right all the time, as this would be impossible. A manager that has avoided 1 default doesn’t necessarily avoid the next one and, in mitigation , we can see that overall most CLO managers have significantly lower default rates than the rest of the loan market. However, it does show that there are managers with different styles and as a debt investor we prefer to see managers avoid these kind of names in the first place; and, if they did buy it, cut their losses early. The lack of covenants, in our opinion, will result in significantly higher loss severities, and it shows that on the way down there is no bid from distressed buyers until the price is below 50.