Banking on change when it comes to Fossil Fuel Financing

The term ‘fossil fuel financing’ refers to the provision of capital (including loans, investments, and other forms of capital) to companies involved in the exploration, extraction and production of coal, oil and natural gas. This financing plays a significant role in the global economy, enabling fossil fuel companies to fund their operations, including the development of new projects, maintenance of existing infrastructure, and expansion of their businesses.

Banks have unsurprisingly played a significant role in fossil fuel financing, with the largest banks being some of the biggest lenders. While this capital is crucial for the fossil fuel sector and society (which is still very much reliant on fossil fuels) it raises concerns over the environmental and social impact of these activities, which ultimately are the drivers of climate change. As investors, measuring fossil fuel financing is not just about assessing financial risk, but also about understanding the broader impact of our investment decisions on climate change. As such, this is a consideration when investing in banks.

In this whitepaper, we will explore the role of banks in fossil fuel financing, looking at regional differences, how banks can influence positive change by encouraging environmentally responsible practices and how they can use ESG labelled bonds to support the transition.

The role of banks in financing the transition to a greener economy

On the surface, the carbon footprint of a bank may look relatively small in terms of its operations of offices and branches (scope 1 and 2 emissions). However, as financiers to various sectors, banks must also account for the downstream emissions generated by the companies, projects and households they fund, known as scope 3 emissions. While these emissions aren't directly produced by the bank, they result from the bank's funding activities and thus should not be overlooked.

Banks are the cornerstone to the economy and have an important role to play in society. They have the power to influence investment decisions and shape the direction of capital flows; thereby affecting economic expansion and where that growth does and does not occur. By aligning their financing activities with sustainability goals and supporting the transition towards sustainable energy sources, they can help accelerate the shift towards a low carbon economy and minimise the impacts of climate change. Consequently, they play a crucial role in steering the economy towards more sustainable practices and they are a vital part of the solution when it comes to the transition to a greener economy.

How can banks contribute to a more sustainable economy? Banks have authority over the sectors, companies and individuals to whom they finance. They retain the ability to halt, reduce or gradually withdraw lending to fossil fuel companies. Additionally, they can provide incentives to borrowers to organically transition their operations away from fossil fuels. It is important that banks do take action against these heavily polluting fossil fuel companies. However, what we don’t want to see is any rapid acceleration or deceleration of funding provided by banks to any sector because that can have catastrophic consequences for the economy; for instance, a sudden reduction in fossil fuel financing globally would lead to a significant energy crisis and impact society greatly. Banks must therefore develop comprehensive sustainable finance frameworks and robust policies which include exclusion and phase-out plans to help shape their lending going forward. Ultimately, what we want to see longer term is for the banks to pull back from fossil fuel financing, but at the same time, they need to offset this with an increase in renewable or sustainable funding.

One of the biggest hurdles is that not all banks will act in unison in the approach to fossil fuel lending. Purely from a financial standpoint, the fossil fuel sector is still very lucrative for banks, and it is much more profitable than the renewables sector. In addition, some of the strongest rated credits within investment grade are in the oil and gas sector, so from a credit perspective the fossil fuel sector remains very attractive. For that reason, if banks were to significantly reduce their involvement in the sector, it is highly likely that we would observe other market segments, such as private markets, stepping in to fill the void. Simply shifting financing to another part of the market isn't in the best interests of society as it fails to address the impacts of climate change. Additionally, the private markets are much less transparent and harder to influence, therefore hindering the progress society requires. Additionally, there are geographical differences in banks' appetite to continue fossil fuel financing; where some have retreated, others have stepped in to fill the gap. This lack of unity further reinforces the need for a gradual transition.

Despite banks being increasingly under pressure to align their financing activities with sustainability goals and support the transition towards renewable energy sources, the global economy remains heavily reliant on fossil fuels. There is no overnight solution and the transition to renewables needs to be gradual.

Fossil Fuel Financing – what are the risks for banks?

Continuing to lend to fossil fuel financing poses significant physical and transitional risks for banks, as well as reputational concerns.

Physical risks stem from banks facing exposure to an increased frequency of extreme weather events. This can potentially result in damage to the assets they finance, impairments on loans, and economic non-viability for the businesses they finance. Stranded assets present another risk, wherein investments in fossil fuel assets may become obsolete due to shifts towards renewables, risking defaults on loans.

Transition risks further compound these challenges, stemming from the move towards a greener economy. Regulatory risks and carbon taxes can weaken the credit quality of borrowers and rapid advances in sustainable technology can quickly change the fortunes of previously successful businesses. Market risks remain inherent, with commodity price fluctuations posing potential threats to banks portfolios. Finally, banks face reputational risks due to heightened scrutiny and activism surrounding fossil fuel financing, necessitating strategic adjustments to maintain public trust and safeguard their brand integrity.

These multifaceted risks show that banks need to consider their lending practices and transition towards sustainable investments to mitigate potential financial losses and reputational damage in the evolving energy landscape.

Net zero in the banking sector and how does it vary by geography?

Net zero within banks has gained momentum. Over the past few years, we have seen increased levels of commitment from the banking sector to reduce their financed emissions, in line with the objectives of the Paris Agreement. This commitment has been seen by a number of banks joining the Net Zero Banking Alliance (NZBA); a global initiative in which membership requires banks commit to transitioning the emissions from their lending and investment portfolios to align with the science based pathway to become net zero by 2050. Within 18 months of joining, banks must set targets for 2030 (or sooner) with intermediary targets to be set every 5 years thereafter. Signatories of the NZBA must publish their absolute emissions and emissions intensity on an annual basis, and must disclose their progress against a board level reviewed transition strategy, which sets out proposed actions and climate related sectoral policies within a year of setting targets. This is important because for banks to meet these targets they need to decarbonise not just their operational emissions but also scope 3, and to do that they need to pull back on fossil fuel financing.

However, one of the key issues lies in the absence of stringent regulatory frameworks, resulting in banks operating without clear mandates. Instead, lending practices are primarily influenced by government targets and investor pressure, which is evident in regions like Europe where aggressive goals to phase out coal-fired power generation have shaped bank policies. The variance in policy quality between regions underscores the challenges faced in harmonising regulatory approaches. Political pressures further complicate matters, particularly amidst uncertainties regarding future leadership, like we see in the US where the approach to sustainability varies greatly state by state.

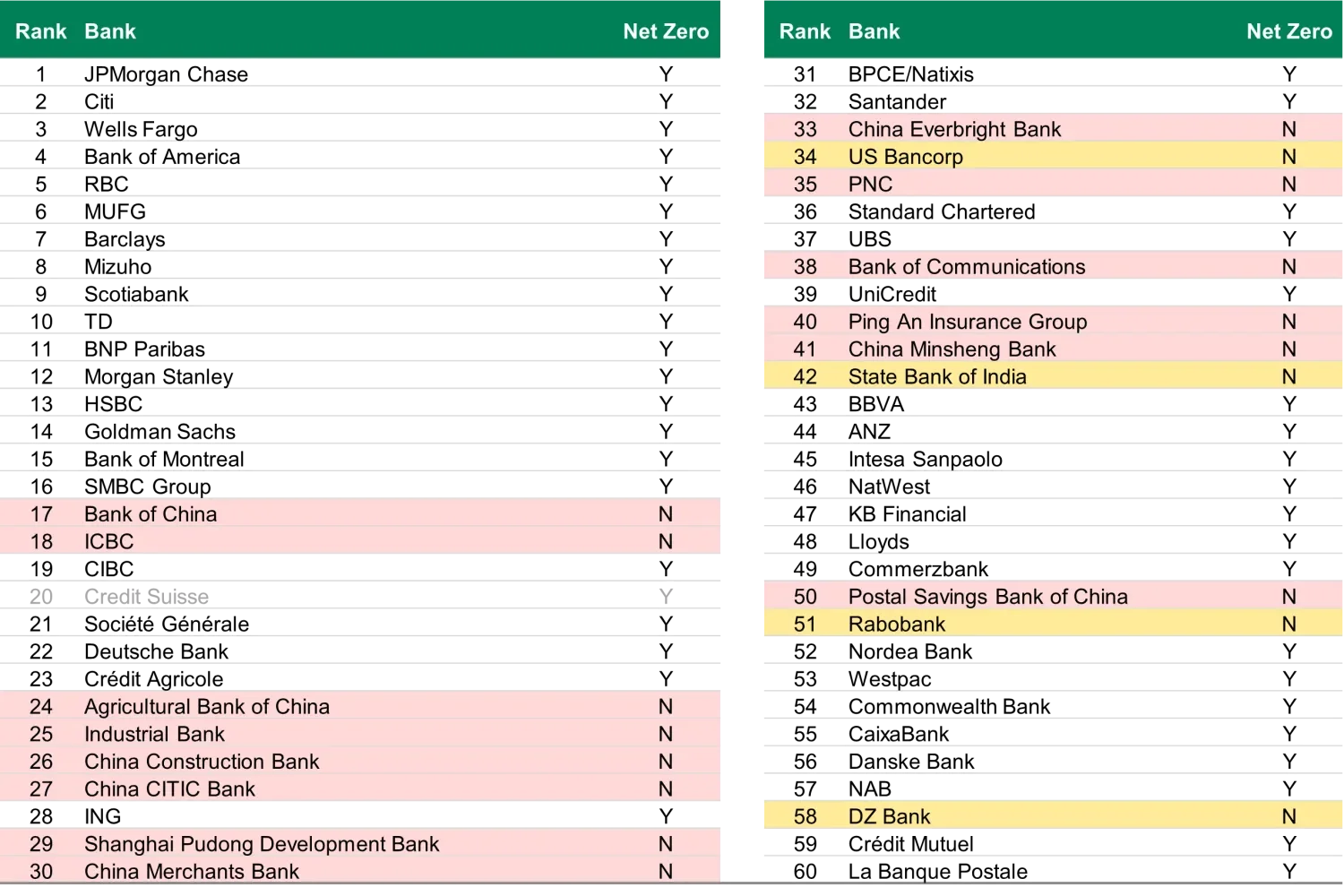

Looking at the top 60 financiers of fossil fuels globally, as reported in the ‘Banking on Climate Chaos 2023’ report, reveals a noteworthy trend. Whilst the majority have signed up to a credible net zero initiative, 18 banks had yet to commit to the NZBA or the Science Based Targets Initiative (SBTi). Notably, 14 of these are Chinese banks. Rabobank and DZ Bank are perhaps the most surprising as they have not committed to either initiative despite publishing their own science-based targets. The remaining two banks (one Indian and the other a US regional bank) are less surprising in their lack of commitment.

Source: Banking on Climate Chaos Report 2023, Net Zero Banking Alliance

We believe net zero is an important input to evaluate the ESG profile and commitments of banks. Importantly, these commitments will shape bank lending activities going forward and such policies can often add more valuable insights than emissions history or ESG scores, which are largely backward looking.

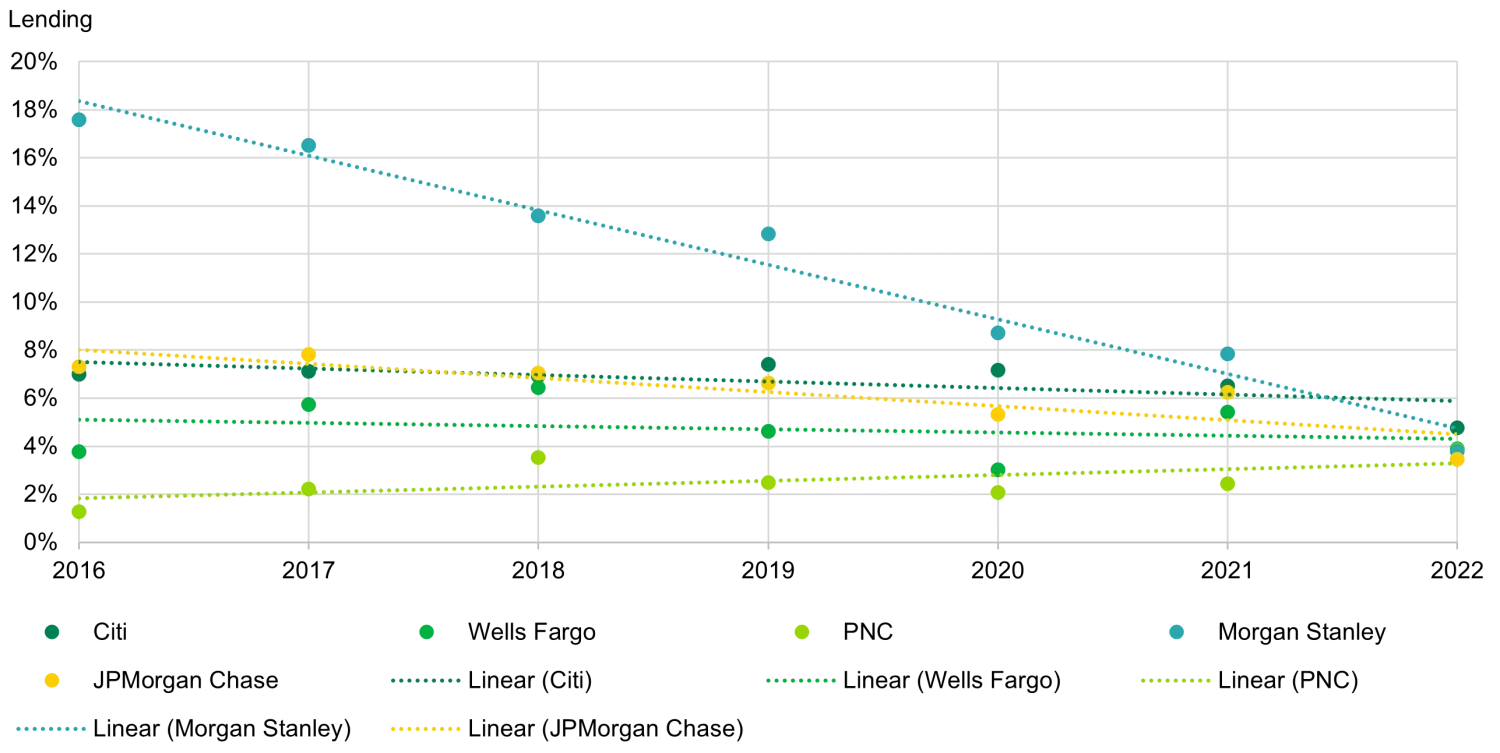

Referring to the Banking on Climate Chaos Report 2023, the data presented is in absolute terms, which we believe is not overly informative, as the largest banks in the world naturally finance the most fossil fuel lending. In our view, a more meaningful approach is to normalise these absolute figures by the size of the loan book. This allows us to determine the percentage of overall lending activities represented by fossil fuel financing for each bank, which materially changes how some banks rank against peers. For example, JP Morgan dropped from first place in absolute terms to twelfth, and a similar trend is observed for other large banks, such as Bank of America, Barclays, and HSBC.

Source: Bloomberg, Banking on Climate Chaos Fossil Fuel Finance Report 2023

Despite much of the negative press which surrounds some of the largest banks, many have made significant strides over the past 7 years in materially reducing the proportion of fossil fuel lending within their lending book.

Whilst the overall trend indicates a decrease in fossil fuel financing by banks, there are significant geographical disparities.

The US presents an encouraging picture and demonstrates huge progress from the largest US banks. Banks such as Morgan Stanley and Goldman Sachs have demonstrated substantial declines in fossil fuel financing (a reduction of 78.5% or 84.9% respectively over the last 7 years*). These trends are very encouraging, however, there is room for improvement from other US banks. It is important to note that the significant political pressures in the US may limit the extent to which US banks can enact changes in this regard.

*Bloomberg, Banking on Climate Chaos Fossil Fuel Finance Report 2023

US % Lending Top 5

Source: TwentyFour, Bloomberg, Banking on Climate Chaos Fossil Fuel Finance Report 2023

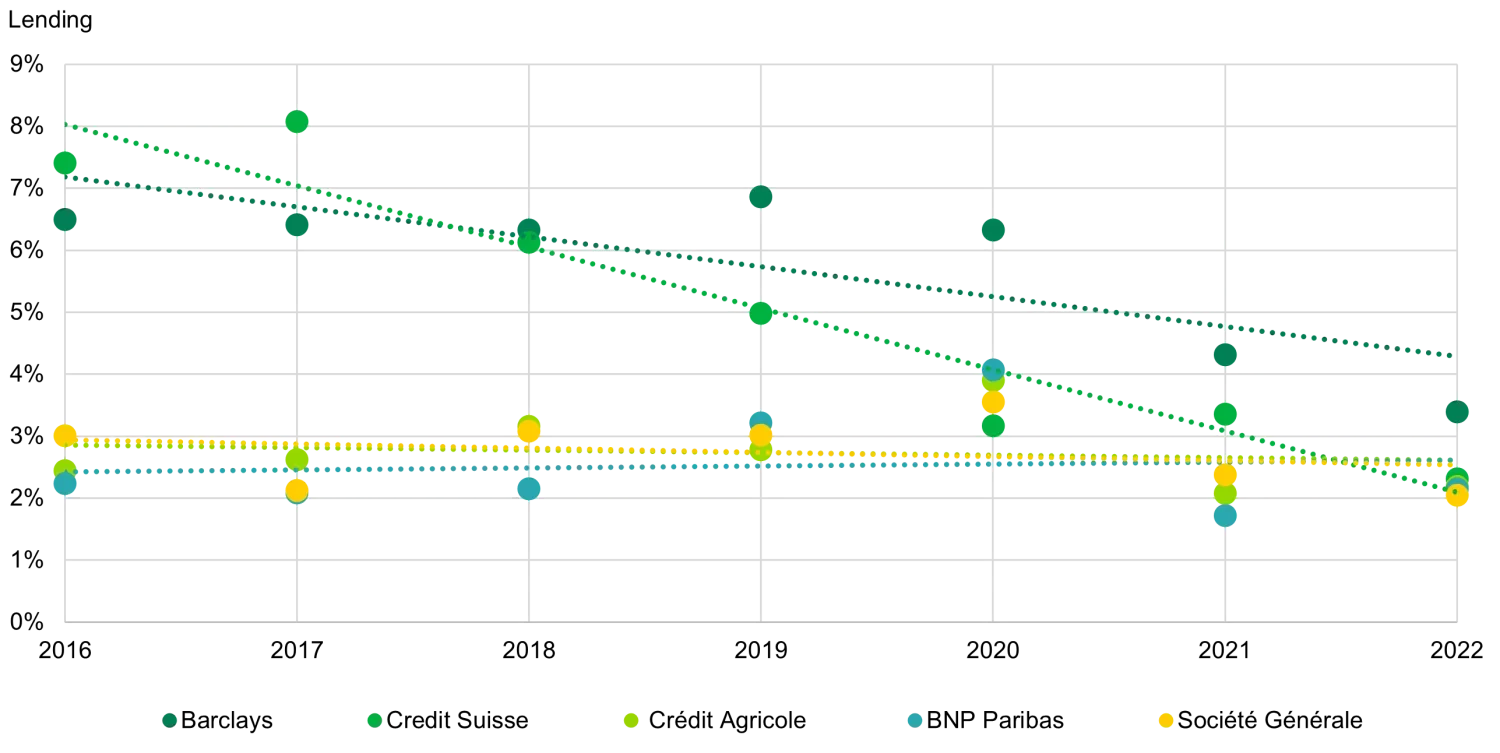

According to the Banking on Climate Chaos Fossil Fuel Finance Report 2023, in Europe, Barclays and Credit Suisse (now part of UBS) have made significant strides in reducing lending to the fossil fuel sector, whilst some French banks such as SocGen, BNP and Credit Agricole have failed to make any material progress.

Although not formally mandated, Europe has ambitious goals to phase out fossil fuels by 2040, prompting European banks to adopt more stringent and robust policies. That said, the ongoing conflict in Ukraine has forced governments to extend the lifespan of coal-fired power plants, disrupting utility companies’ previous planned decommissioning efforts. This will somewhat affect banks' phase-out progress.

Europe % Lending Top 5

Source: TwentyFour, Bloomberg, Banking on Climate Chaos Fossil Fuel Finance Report 2023

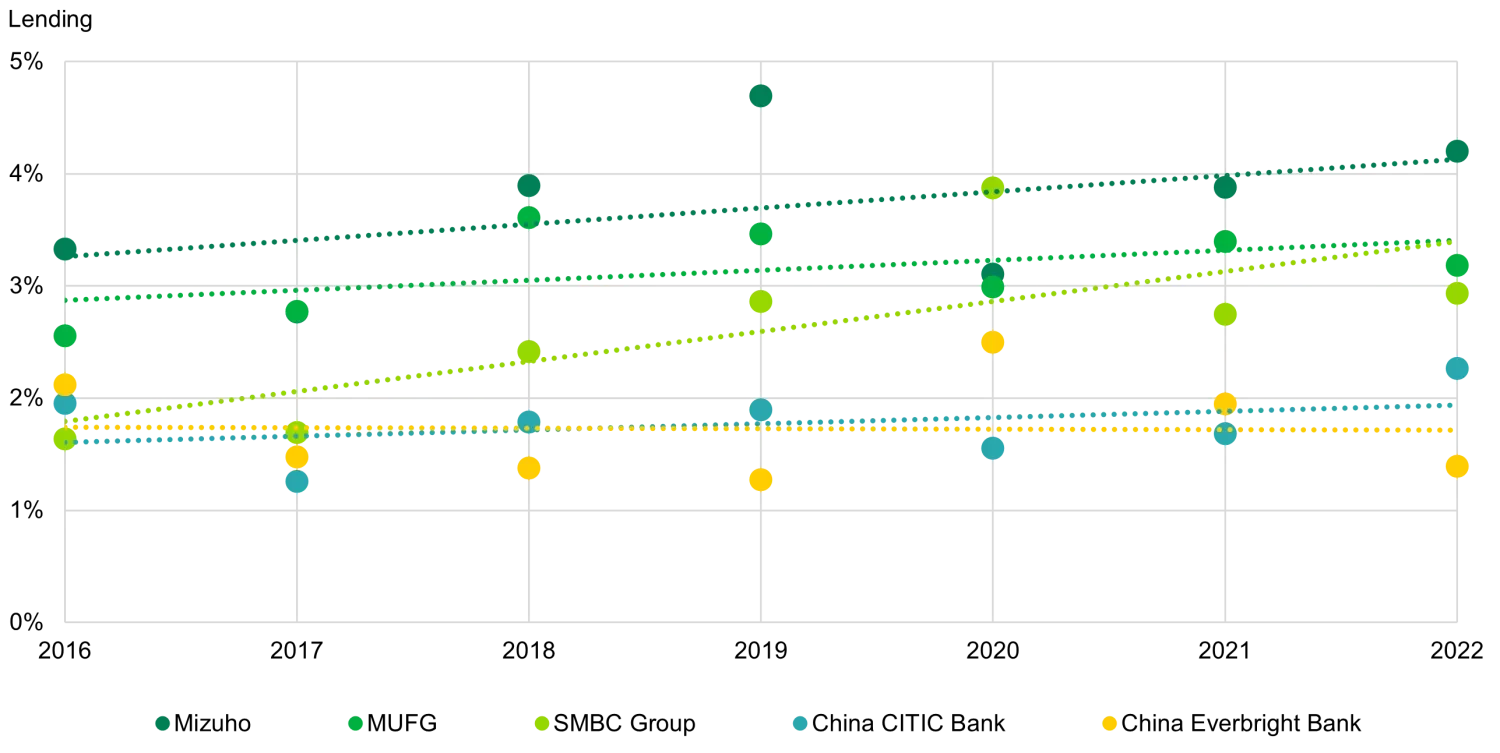

The most significant geographical outlier is Asia, particularly the Japanese banks, which are evidently filling the void left by other banks, and are in fact increasing their fossil fuel financing activities. The chart below underscores that there has been no progress from the top five (normalised) financiers in Asia, with alarming increases evident in the trends of Mizuho, SMBC, and MUFG. Taking a closer look at these banks, it is clear that they also have very weak policies when it comes to decarbonisation plans.

Asia % Lending Top 5

Source: TwentyFour, Bloomberg, Banking on Climate Chaos Fossil Fuel Finance Report 2023

Finally, when it comes to Australian and Canadian banks, there is little to highlight. In Australia, financing volumes remain largely stable both in absolute terms and when normalised. However, due to their relatively low percentage of fossil fuel financing compared to other regions, significant changes are not anticipated. Similarly, Canadian banks do not exhibit significant downward trends in absolute fossil fuel financing. However, when adjusted for the size of the loan books, more positive trends emerge, with the top 5 financiers all showing a decline.

Bank fossil fuel policies and what they tell us

Evaluating a bank’s approach to fossil fuel financing is a manual and time consuming process, mainly due to the complex nature of these policies and intricate caveats that they contain. There are a two very useful publicly available sources: the Oil & Gas Policy Tracker, and the Coal Policy Tracker, which aid in the assessment of bank policies and highlight where the gaps lie. Both policy trackers rank bank policies numerically and provide standardised information on the strength of bank policies.

Despite many polluting sectors being contained within bank balance sheets, the primary focus for investors currently is within two key sectors; coal and oil & gas.

Coal Policies

When looking at the coal policies, which covers mining and coal fired power generation, there are two main components to consider; the net new financing that a bank will provide and the phase out component (i.e. how banks will transition the current financing off their balance sheets). There are many credible alternatives to coal and the full move away from coal is already underway. Therefore at a minimum we’re looking for banks to commit to no new coal financing and align to the International Energy Agency (IEA) targets of a global phase out by 2040 (2030 for Europe / OECD) in order to transition coal off their balance sheet in a timely manner.

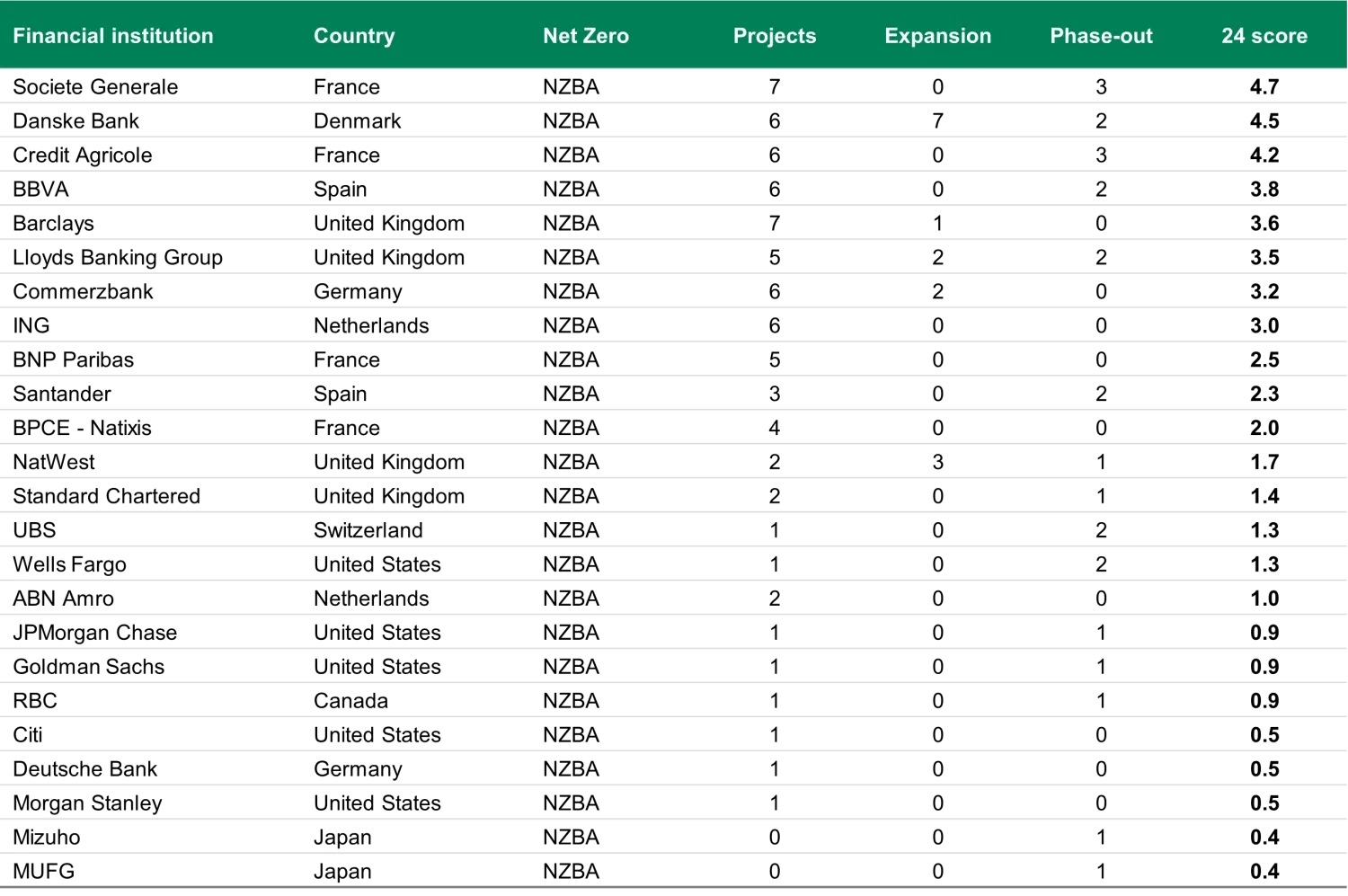

The publicly available Coal Policy Tracker assesses bank policies across three main components; projects, phase-out and general lending to companies with expansion plans, rated on a scale from 0 to 10. TwentyFour’s internal scoring uses this information and weights these scores to quickly enable our Portfolio Managers to get an overall feel for the bank’s direction when it comes to coal. Importantly, it doesn’t yet determine whether a bank can be included or excluded in portfolios, but it is a key component that is now considered in the overall ESG analysis conducted. Our priorities are to see strong policies around new project financing and a credible plan to phase out coal off their balance sheet. The TwentyFour combined score is weighted as follows:

- Projects: 50% (arguably the most important as it focuses on new financing to coal mining and coal fired power plants, which we do not want to see)

- Phase-out: 40% (important for banks to remove this financing off their balance sheet to meet net zero targets)

- General lending Expansion: 10% (a tricky area, not the most important and not a key consideration for banks)

Generally, all banks score favourably on the ‘projects’ or new financing category. French banks in particular demonstrate robust scores, driven by the government’s plan around coal. Unsurprisingly, it is the US and Japanese banks that exhibit the worst scores

Source: Coal Policy Tracker; 31 March 2024

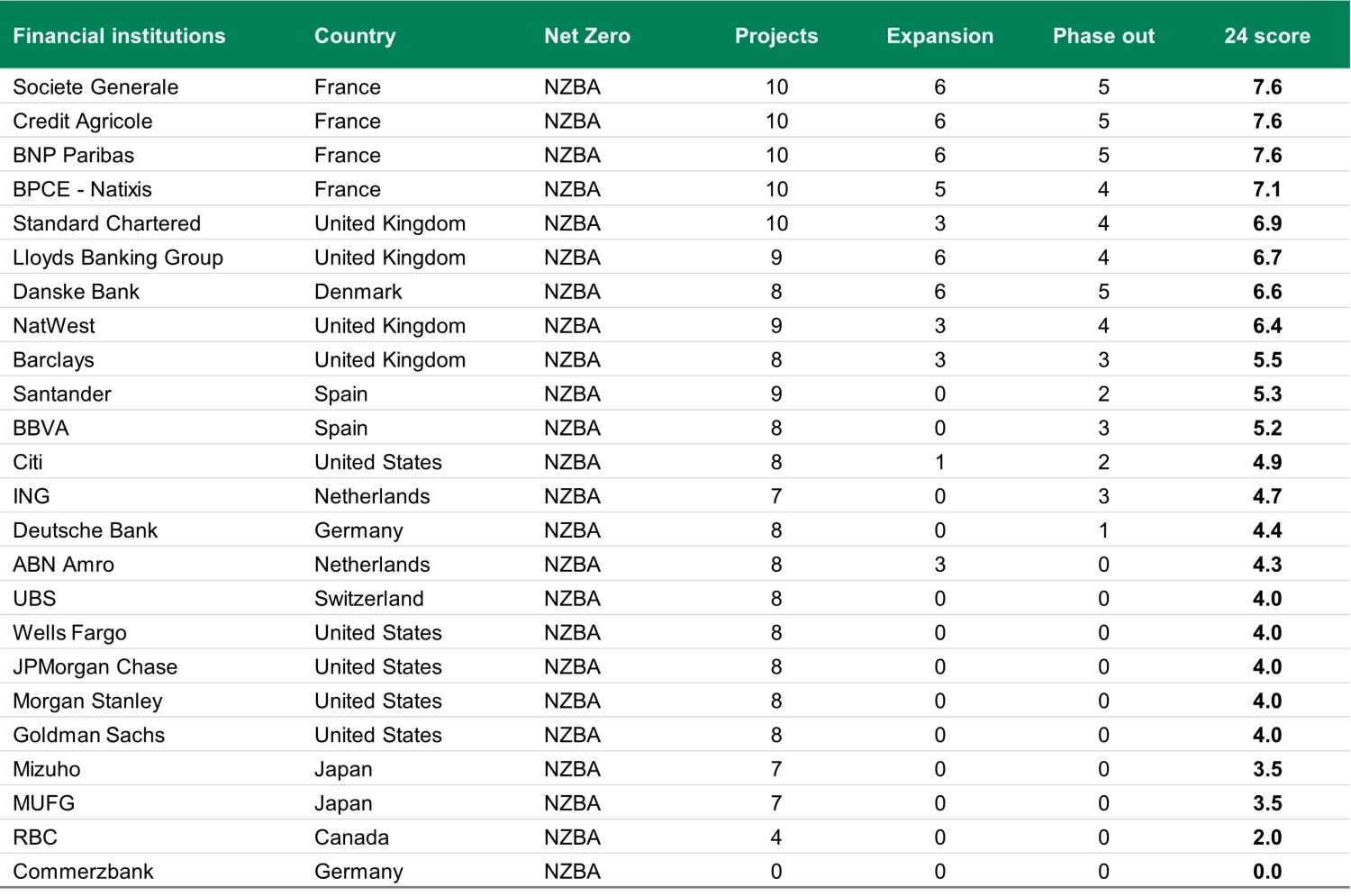

Oil & Gas Policies

Oil and gas policies are trickier to analyse as the global economy is still heavily reliant on this sector and a full exclusion (or aggressive phase out) is not currently feasible for many banks. Phase out plans for oil and gas vary between banks and regions, but it is encouraging to see banks demanding more from the companies they lend to, such as greenhouse gas emissions disclosures, fossil fuel phase-out plans by 2050, and commitments to reduce fossil fuel output in line with the goals of the Paris Agreement. At a minimum, we want to see full exclusion of new unconventional oil and gas financing.

Like the Coal Policy Tracker, the Oil & Gas Policy Tracker also assesses banks against projects, phase-out and general lending to companies with expansion plans, rated on a scale of 0-10. Most European banks show that they are excluding financial services dedicated to unconventional oil and gas, and some are more ambitious stating they have a full exclusion of new financing dedicated to oil and gas fields, be it conventional or unconventional. The phase-out category and expansion are much weaker, based on the fact that banks and society cannot fully commit to a transition away from oil and gas currently.

The data reveals unsurprising similarities between the strength of Coal and Oil & Gas policies, with the biggest laggards in coal also being the biggest laggards in oil and gas; primarily the Japanese and US banks.

Source: Coal Policy Tracker; 31 March 2024

Bank policies serve as crucial indicators of future financing intentions. Therefore integrating their policy data into our ESG analysis allows us to complement our ESG scores with forward-looking policy data, alongside traditional credit fundamentals.

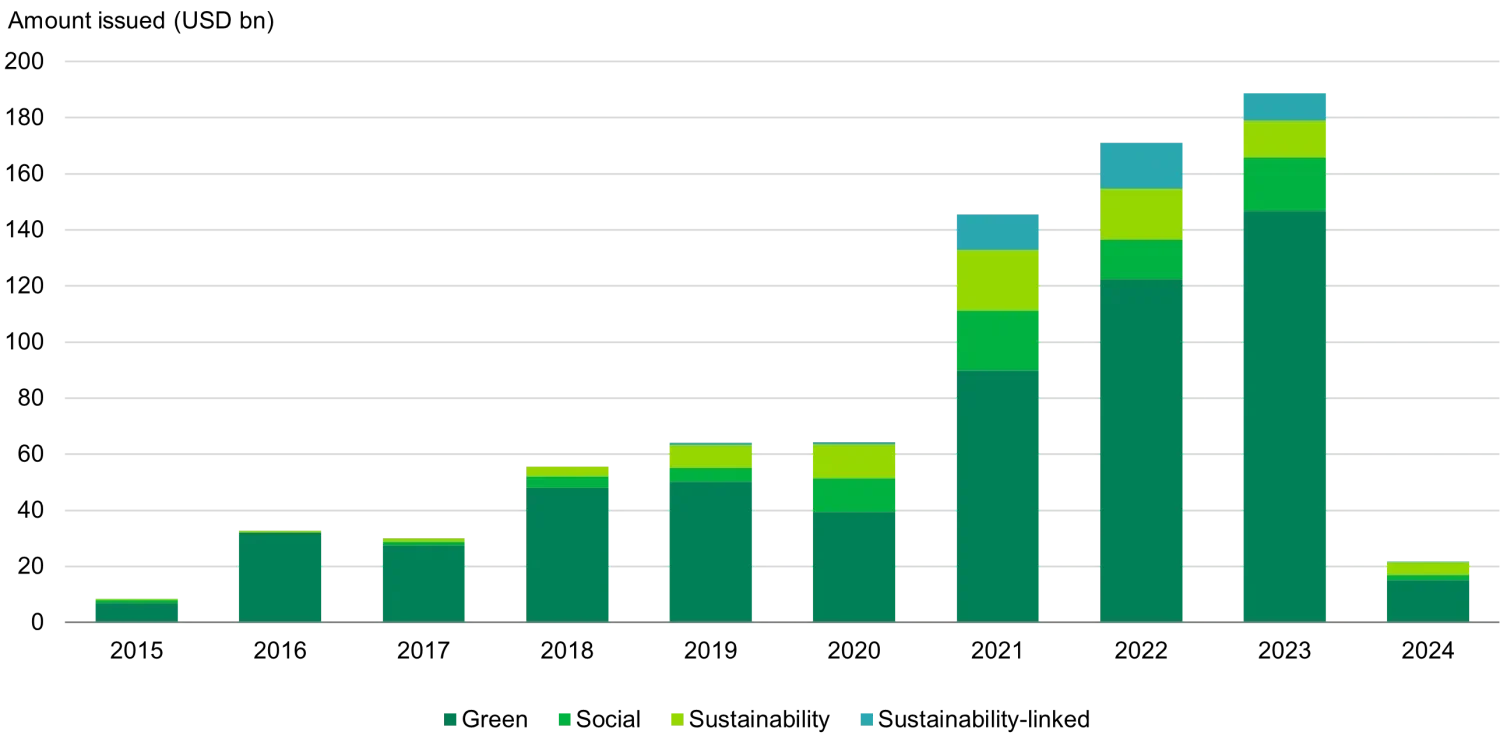

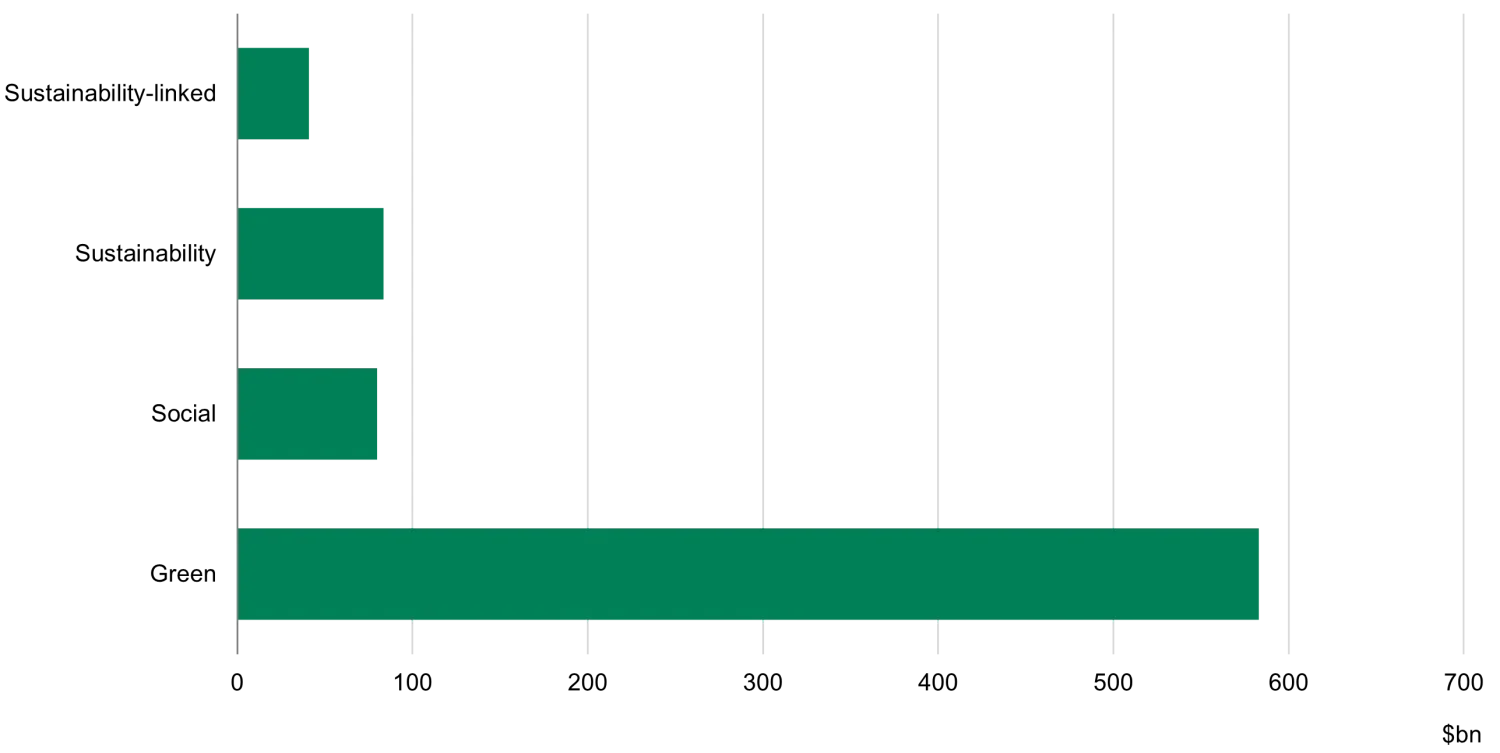

Labelled bond issuance

Investors have shown notable enthusiasm for endorsing and financing sustainable lending practices, as shown through labelled bond issuance volumes. There has been a significant increase in the last few years, due to increased attention on sustainability and the very strong macroeconomic backdrop following the COVID pandemic. Year to date 2024 issuance has been fairly weak, but this is a result of a more challenging macro backdrop, rather than specific ESG drivers or concerns about the bond structure.

Bank ESG bond issuance

Total issuance ($bn)

Source: TwentyFour, Bloomberg; 31 March 2024

Green bonds have dominated the labelled bond market, with most having pre and post issuance verification (from the likes of the Climate Bonds Initiative and Sustainalytics) which ensures that the capital investors are providing is used for credible green projects. We have seen heightened demand from investors for green issuance versus conventional bond deals, granting banks access to cheaper funding sources (on average green deals are 5bps cheaper to issue). However, a significant limitation of green bonds lies in the absence of control over the broader activities of issuing banks. Despite the potential environmental benefits associated with green bond financing initiatives, banks may concurrently engage in conventional corporate debt issuance to fund less sustainable projects.

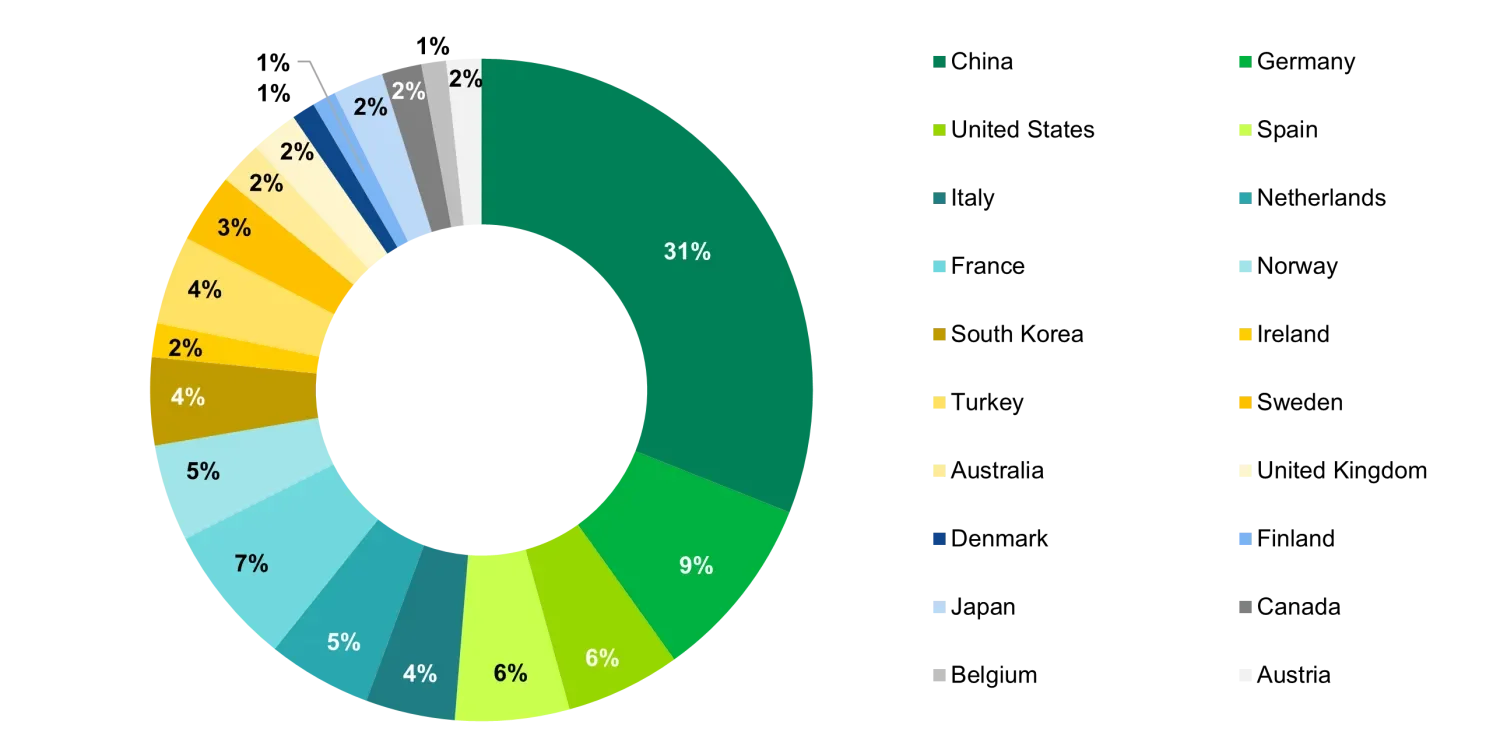

Looking at where this issuance comes from, China has emerged as a surprising leader in this space, representing nearly one-third of global issuance despite being the world largest polluter and their ongoing investment in coal-fired power generation. German issuers follow at 9%, with the United States lagging behind at a mere 6%* - a disparity underscored by the size of their respective economies.

*TwentyFour, Bloomberg; 31st March 2024

Top 20 ESG bank bond issuers by country

Source: TwentyFour, Bloomberg; 31 March 2024

TwentyFour’s approach

We acknowledge that we are still in the early stages of our journey when it comes to looking at fossil fuel financing within the banking sector. As highlighted above, our current focus involves integrating bank policy data into Observatory, our proprietary ESG database, which ensures this information is considered along with other forms of ESG analysis across our entire fund range.

We have recently added fossil fuel financing as a second pillar to our existing set of carbon emissions engagement principles. Phase one was focused on collecting emissions data and engaging with issuers we believed we could influence to both lower their carbon emissions and improve their overall environment disclosures. Fossil fuel financing is part of phase two. We have started to identify the biggest financiers of fossil fuels within our bank holdings and those with the weakest policies. The aim is to have regular engagement with these banks and ensure that they tighten their policies over time leading to a reduction in financed emissions.

Carbon Emissions Engagement Principles

For our sustainable range of funds specifically, we will use the policy data on fossil fuel financing from the banks to engage, escalate concerns and divest if needed. Notably, we have already taken action by divesting from banks like Mizuho, while also recognising positive momentum in banks such as BNP (who have previously been a laggard in relation to fossil fuel financing). Ultimately what we want to see is a tightening of bank policies and subsequent reduction in lending volumes. Importantly however, we believe we need to allow banks time to adapt their policies, change their lending practices and see this action evident in the scope 3 or financed emissions figures. Given there is no overnight solution to the challenges banks currently face, we recognise that momentum is important and a critical aspect of our ESG analysis.

We have five main criteria we look at when evaluating the banks;

- Credible net zero commitment

- Robust coal & oil and gas policies

- Transparent financing data which demonstrates progress and improvement

- Credible green product offerings for consumers and corporates

- Utilisation of green and labelled bond issuance

Additionally, we maintain an engagement priority list targeting the banks that we invest in where policy improvements are warranted, aligning with our carbon emissions engagement policy.

Our strategy reflects our commitment to our evolving ESG framework to address the complexities of fossil fuel financing. By integrating bank policy data and emphasising engagement, escalation, and divestment where necessary, we aim to drive positive change within the banking sector. Our focus on momentum underscores the importance of allowing for policy evolution while holding banks accountable for progress towards sustainable financing practices. Through clear criteria and engagement priorities, we seek to incentivise banks to adopt stronger environmental policies and contribute to the transition to a greener economy.