TwentyFour Income Fund - 10 facts to celebrate 10 years

March 6, 2023, marks the 10th anniversary of the TwentyFour Income Fund (TFIF) being listed on the London Stock Exchange with a £150m capital raise. At the time, the Fund’s launch represented a new foray into European asset-backed securities (ABS) for the Investment Trust sector, granting access to an asset class that was recovering but remained largely misunderstood in the wake of the financial crisis. For TwentyFour, TFIF was a first closed-ended fund and a dedicated vehicle to focus on less liquid opportunities for our clients.

10 facts on 10 years of TFIF

1. 92.2% – total NAV return since IPO

2. 6.71p – average annual dividend (minimum dividend target recently raised to 8p)

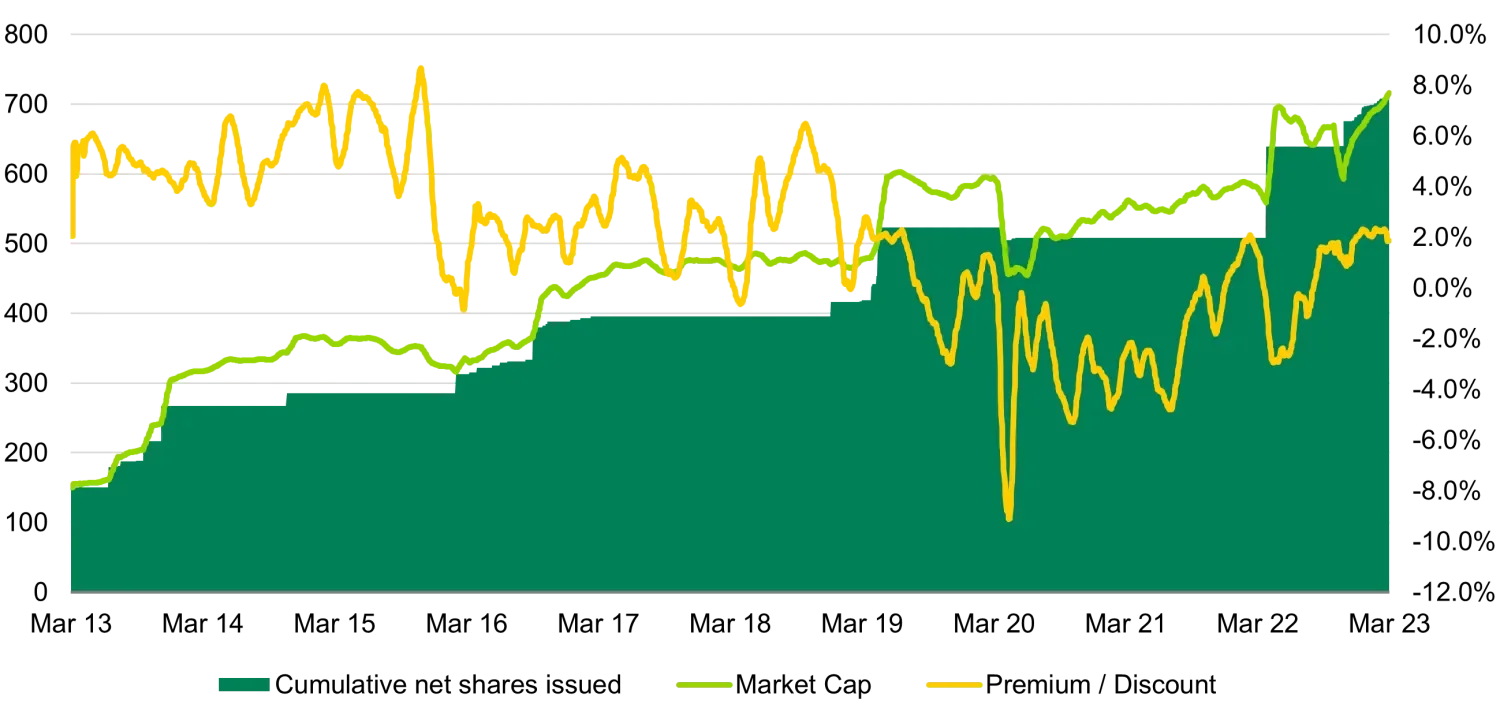

3. £789m – total funds raised since £150m IPO

4. 1.7bn – shares traded

5. 1.9% – average share price premium

6. 0 – defaults

7. 40% – average investment grade assets held since inception

8. £4.2bn – total gross bond trades made

9. 14.46% – current mark-to-market yield

10. FTSE 250 – admitted September 2022

Objective at launch in 2013

TFIF set out with a 6-9% long term annual total return target. The core objective was to deliver a minimum 6p annual dividend through the strong credit risk and income we saw available in European ABS markets. At that time, deleveraging by the banks meant traditional owners of assets (including ABS) were retreating and external capital was required. Very much part of this structural move, the ABS market offered a large floating rate universe of bonds, backed by diverse and granular pools of high quality assets spanning mortgages, consumer credit, commercial real estate and leveraged loans. The bond structures are notionally complex, but the potential rewards available for specialist knowledge was (and remains) higher expected performance and returns compared to more standard corporates. What also remains is the need for external capital, with a now healthy banking system well capitalised but focused on a narrower range of core activities. This shift of course has led to the development of private markets, another reason we believe TFIF’s investment proposition remains as relevant as ever.

TFIF has comfortably delivered high levels of long term floating rate income, but with zero defaults and an average of 40% investment grade rated assets held. The closed-ended nature of the Fund structure has provided welcome flexibility, allowing opportunistic capital deployment against the tide.

TFIF has spent 73.4% of its life trading at a premium and the shareholder register has grown from 57 at IPO to 170 currently.

TFIF 10 year anniversary

Past performance is not a reliable indicator of current or future performance. The value of an investment and the income from it can fall as well as rise as a result of market and currency fluctuations and you may not get back the amount originally invested.

Source: Numis, 1 March 2023

Flexible investment thesis

In the formative years, TFIF hunted out a predominant set of ABS deals issued before the global financial crisis (the so-called 1.0 era of ABS). In 2013, the 2.0 era of ABS had not yet begun in earnest and primary issuance was heavily geared towards lower yielding AAA funding transactions from banks. Non-banks or specialist lenders, which typically required more leverage from ABS deals, had yet to recover or re-launch their lending businesses. This set TFIF up to capitalise on two opportunities: a positive supply technical and economic recovery in Europe. These ABS opportunities featured lower bond coupons but were available at deep discounts to par. It was common for 1.0 deals to have poor data, making credit work and due diligence intensive, but the reward opportunities proved healthy and were realised over multiple years; TFIF held 19% in peripheral Europe assets in August 2013 compared with 2% currently.

Over time, and with the onset of quantitative easing (QE), the recovery of the 1.0 market started to play out, capital gains were reaped and with it we saw the emergence of the 2.0 ABS market, bringing varied transactions and new issuers. Importantly, this created new public mezzanine and private opportunities for TFIF to build on. This also brought a different profile of investment, richer in coupon and income, backed by new tightly regulated lending in Europe, with the crisis-era excesses washed away. TFIF was able to be an early adopter of such opportunity with new issue premiums and generous bond structures a regular feature of the market.

Alongside this renaissance came a 2.0 market for Collateralised Loan Obligations (CLOs). While issuance resumed modestly in 2013, the overall size of the market continued to shrink until February 2016 (bottoming at $69.3bn), but it has since grown into arguably the most active part of the European ABS market, now totalling $237.2bn; CLOs are likely to remain a dynamic and core part of TFIF’s long term strategy.

Our favourite trades (humour us)

Over those 10 years, TFIF has been able to use its flexible format to seek income and attractive risk-adjusted premiums. It has sought these both in conventional ABS securities and private alternatives, targeting high coupons, tactical discounts and value in complex and typically under-researched names. Among over 1,700 trades, for the portfolio managers two stand out as best illustrating the kind of opportunity the Fund was (and we believe still is) set up to take advantage of.

1) BBVAL 07-1 B: Spanish lease ABS deal from BBVA (Ca/CCC)

o Bought 27 September 2013 at 56, a yield of 3m€+1741bp

o Sold 14 September 2016 at 94.31, a yield of 3m€+570bp

o Total return of 72.37%

Early in the Fund’s life we sought out opportunities in areas we considered to be less researched pockets of the universe, often with limited competition. Such opportunities epitomised what we regarded as mispriced risk (along with ratings) but also necessitated detailed data and underwriting through engagement with lenders and servicers. In the case of BBVAL, a proportion of the pool was in default and data was poorly reported, but as we discovered, it was available if you asked. Our modelling indicated the credit risk was modest once performing assets repaid to plan, and only a very conservative proportion of defaulted leases made small recoveries. In other words, there was much more protection available for the bond that we thought was not being given credit. The ratings also put many investors off (Fitch downgraded the CCC to CC after we purchased).

For TFIF, long term high conviction investments were what this vehicle was designed for. The bond was sold shortly after receiving its first principal payment (and deferred interest), by which point risk had reduced materially and S&P and Moody’s had upgraded to A-/Baa2.

2) VOYE 1X D: BBB rated CLO from tier one manager Voya Investments

o Bought 17 March 2020 at 76.1, a yield of 3m€+995bp

o Sold 16 July 2020 at 93.8, a yield of 3m€+424bp

o Total return of 25.03%

This was the first buy we made moving against the tide of COVID-19. The stability that a closed-end fund provided in those most uncertain of times was powerful, and again we believed provided an ideal home for early high conviction trades. Only four BBB CLOs have ever defaulted in Europe, all from the 1.0 era, and we stress our CLO positions using adverse scenarios based on multiples of what the 2008 crisis threw at the leveraged loan market. The CLO market has frequently provided such opportunities in periods of volatility. COVID-19 was one of them, and the UK’s LDI crisis in late 2022 was another, allowing the portfolio managers to buy BB rated CLOs at yields in excess of 15% as other investors were scrambling for cash.

The next 10 years

The return of higher interest rates and inflation (within reason) is something shareholders have craved, but 2023 is the first year we believe TFIF is offering shareholders the full tangible benefits of these. The average Bank of England rate since IPO has been 0.66% – we celebrate TFIF’s 10-year anniversary with the rate at 4.0% and further hikes priced into futures markets. TFIF has twice increased its target dividend in recent months, first to 7p and now to 8p, and as TFIF pays out all residual income annually (balancing payments in April) we think this number could potentially be higher in the future.

Central banks look to be faced with stubbornly strong labour markets, which should play into the strengths of ABS performance. ‘Good data’ is not necessarily ‘bad data’ for TFIF. With sticky inflation, we think ‘higher for longer’ rates are a serious possibility, which for TFIF (as an investor in floating rate bonds) is a positive starting point and we think could potentially elevate shareholder dividends for the coming years.

TFIF has built scale that helps bring flexibility and the opportunity to reach into all parts of the European ABS market. The growth in the team over 10 years, achieved with experienced and diverse hires, allows us the flexibility to shift our focus between public and private investments as market conditions and opportunities evolve over time.

The current mark-to-market yield of the Fund is 14.46%, its highest since inception, but in our view this is simply thanks to higher risk-free rates rather than increased credit risk.

TFIF finds itself at an interesting juncture as markets adapt to a post-QE reality. Against this backdrop we are confident that this fund and its opportunity set are more relevant today than at any point in its history, and we believe it remains uniquely placed to take advantage

We would like to extend our kindest regards to all shareholders.

Aza, Ben and Doug

_______________________

1 Based on full financial years, excluding current financial year which is not complete.

2 Comprises total conventional bond transactions, excluding private investment.

Annual past Performance to 31 January 2023:

|

Discrete Performance |

YTD |

2022 |

2021 |

2020 |

2019 |

2018 |

2017 |

2016 |

2015 |

2014 |

2013 |

|

NAV per share inc. dividends |

2.78% |

-8.84% |

7.85% |

5.97% |

5.04% |

2.39% |

13.51% |

4.28% |

-0.12% |

13.39% |

N/A |

Past performance is not a reliable indicator of current or future performance. The performance figures shown are in GBP on a mid-to-mid basis inclusive of net reinvested income and net of all fund expenses. Performance data does not take into account any commissions and costs charged when shares of the fund are issued and redeemed.

Source: TwentyFour

Key Risks:

-

All financial investment involves risk. The value of your investment isn't guaranteed, and its value and income will rise and fall. Investors may not get back the full amount invested.

-

Past performance is not a reliable indicator of future performance, and the Fund may not achieve its investment objective.

-

The Fund invests in structured credit products or asset-backed securities (ABS). The issuer of such products may not receive the full amounts owed to them by underlying borrowers, which would affect the value of the Fund. Credit and prepayment risks also vary by tranche which may affect the Fund's performance.

-

The Fund has the ability to use derivatives, including but not limited to FX forwards, for hedging and EPM purposes only. This may magnify gains or losses.

-

Typically, sub-investment grade securities will have a higher risk of issuer default, and are generally considered to be more illiquid than investment grade securities.

-

Information on how environmental and social objectives are achieved and how sustainability risks are managed in this Fund may be obtained from twentyfouram.com/sustainability