Three strategies for beating inflation with bonds

Inflation was the dominant theme across financial markets in 2021, and we think it is likely to be a big driver of returns again in 2022.

In its annual analysis of investment outlooks from 46 of the world’s biggest investment banks and asset management firms, Bloomberg News found the word inflation appeared 224 times. The word COVID appeared just 36 times. The study concluded that “surging prices hang over nearly every scenario envisaged” by strategists in 2022.

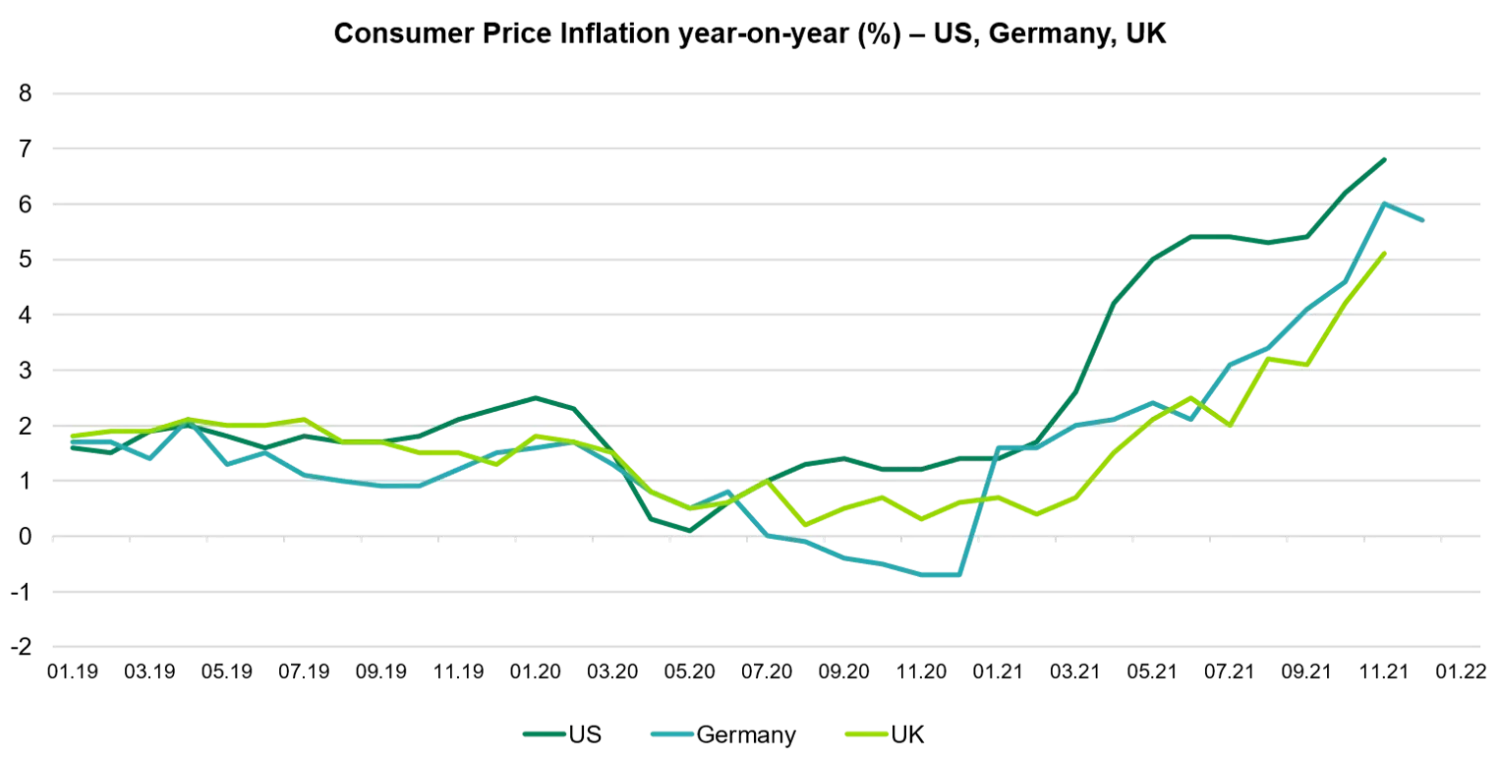

The debate over how ‘transitory’ inflation would be as global economies emerged from the COVID-induced shutdowns of 2020 dominated the markets in 2021, but by year-end the data appeared to have ended the argument. In November US consumer price inflation (CPI) hit 6.8%, its seventh consecutive monthly reading above 5%, while UK CPI hit a 10-year high of 5.1% and German CPI climbed to 5.2%, its highest reading since 1992.

The well-known maxim that ‘inflation is bad for bonds’ is partly based on the fact that inflation erodes the value of the coupons and principal fixed rate bondholders receive in the future. From a portfolio management perspective, the more pertinent challenge of rising inflation is that it tends to provoke interest rate hikes, which can have implications for everything from US Treasuries to high yield and emerging markets bonds.

Source: TwentyFour, Bloomberg, January 10th 2022

It is undoubtedly true that inflation is bad for some bonds. But for active fixed income fund managers who have a global bond market of over $120 trillion1 to select from, there are a few tactics that we believe can help mitigate the impact of inflation, and today we see a number of opportunities out there that we think can help investors thrive in this environment.

1) Keep duration low

In fixed income, the key anxiety around inflation is that it typically means losses in rates markets such as US Treasuries, which in turn can impart losses on credit products where the spread is too slim to absorb the rates weakness.

Investors had a sharp reminder of this risk in the very first week of 2022 when 10-year UST yields shot up to a nine-month high of 1.73%, after minutes from the Fed’s December meeting suggested rate hikes could arrive sooner than markets had been pricing in. In our view this story is only just starting to play out; with US unemployment dropping to 3.9% in December and inflation running at a 40-year high, the conditions for Fed tightening have clearly been met and the central bank has a very thin line to tread.

Therefore, our first strategy for beating inflation with bonds is to keep duration low. This can be achieved partly through portfolio construction – avoiding longer dated government bonds completely and holding short dated rates for liquidity purposes only, for example – but with our conviction about rising yield curves we think hedging rates exposure with an interest rate swap where appropriate makes sense given its relatively low cost. Our favoured hedge curve would be GBP given the low carry costs and our expectation that 10-year Gilt yields will rise to 1.40% by year-end. The euro curve would be a good alternative but not quite so compelling in our view.

2) Look at floating rate bonds

For long-only fixed income investors, there is no perfect hedge against inflation since it is impossible to remove duration risk from a portfolio completely (that is if you still want to hold assets that might give you a return). Inflation-linked government bonds such as US TIPS aren’t as effective as you might think, and while tactical interest rate swaps as mentioned above can offer some protection against rising yield curves, they should be sized with care as they can quickly become the dominant position in a portfolio.

Therefore, our second strategy is to look at floating rate bonds, which do not add interest rate risk to a portfolio because their coupons rise in line with every rise in base rates. Leveraged loans should get good support from this, as should all of the European asset-backed securities (ABS) market. For investors looking to take advantage of both these sectors, European collateralised loan obligations (CLOs) are one of our top picks for 2022, with the best results likely to be found lower down the ratings spectrum. We think BB rated European CLOs could return around 7% this year, made up mostly from the high carry on offer here.

3) Focus on yield and roll-down

Strategy number three is to focus on yield and roll-down. Yield can be one of our most effective weapons against inflation since it helps to cushion a portfolio against the corrosive impact of rising rates, while roll-down – the natural spread compression that occurs as bonds approach maturity – can significantly mitigate duration risk in a portfolio.

It is well-documented that the relentless rally in risk assets generally since the worst of the COVID-19 crisis some 18 months ago has left yields in many sectors of fixed income looking expensive relative to historic pricing, but with credit fundamentals looking extremely strong we think this is justified and still see pockets of value to target.

Subordinated bank debt, and more specifically the Additional Tier 1 (AT1) debt issued by European banks, is another of our top picks for 2022. Banks are traditionally more immune to inflation than other industries, and they tend to benefit from rising interest rates. The sector also proved its resilience through the 2020 crisis, with banks retaining and even growing their capital bases despite challenging economic conditions. At present, there are many well-capitalised institutions with AT1 bonds offering what we consider to be healthy looking yields; for example if they came to the market right now we would expect a BBB rated AT1 deal with a five-year call from a single-A rated bank to come at a yield of close to 5%.

We also think hard currency emerging market corporate bonds have the potential to outperform markedly this year as growth and earnings are expected to catch up with those of developed markets. However, this comes with the caveat that this opportunity could evaporate quickly if the Fed does embark on a more aggressive tightening cycle than it has been communicating; we said this wasn’t a Q1 trade in our annual outlook, and the market reaction to those Fed minutes has perhaps already validated that view. However, with the EM high yield bond index yielding 7.4%2, we think there should be opportunities here for investors who are patient and get their timing right.

When it comes to roll-down, this is a defensive tactic that we think is best employed when markets are well-priced, typically in mid-to-late cycle. Early in an economic cycle when most assets are looking cheap relative to historical averages, we would normally target longer dated bonds to lock in higher yields for longer. However, credit now looks to be in mid-cycle and over the last 18 months credit curves have flattened at the long end. As we move towards the next stage of this rapidly progressing cycle, we are seeing the short end steepening as rate hikes are being priced in, and thus expect shorter dated bonds (especially those in the three- to five-year bracket) to offer investors the most in terms of roll-down gains. Importantly, however, targeting this roll-down at the short end of the curve is only really effective if you’re buying bonds with enough spread to absorb anticipated rate rises.

___________________________________

1 SIFMA, July 2021, 2 ICE BofA High Yield Emerging Markets Corporate Plus Index, January 10th 2022