Tariffs are the noise. Housing is the signal.

Much of the discussion around inflation over the past few months has centred on the potential for US tariffs, a focus that has only intensified following Donald Trump’s inauguration on Monday. Will Trump implement an “across-the-board” tariff? Which countries will he focus on? What will the inflationary impact be, and how will the Federal Reserve (Fed) react?

While we have started to see evidence that the initial “worst case” tariff fears were potentially overdone, we have little doubt that we are going to get them in some form.

Since the November election we have had a run of slightly stronger US inflation prints (barring last week) and a hawkish Fed meeting in December that took two interest rate cuts out of the central bank’s own ‘dot plot’ projections for 2025. Digging through the latest Summary of Economic Projections (SEP) we can see what the driver of this shift has been, with Fed members’ uncertainty around headline and core inflation having shifted higher since the September meeting and the risks to inflation almost exclusively regarded as “weighted to the upside”. In the Q&A at the end of his December press conference, Fed chair Jerome Powell also confirmed that some members of the committee had started to include some potential policy impacts from the incoming president in their projections.

We agree with the idea that the risks to inflation are largely weighted to the upside. That to us seems pretty clear, and markets have quite quickly come to reflect this with breakevens and survey-based inflation expectation measures shifting higher since Trump’s election victory (it is worth noting that the biggest driver of the recent rise in nominal yields has been term premium, but that is a topic for another blog).

That said, we think tariff fears are ultimately “noise” for the underlying trends within inflation. That doesn’t mean markets wouldn’t react to a tariff-driven increase in prices, but we view the potential inflationary impact of tariffs more as a one-off level shift that could delay the underlying downward trend in inflation rather than disrupting it in the longer term. We believe the Fed would take the same view, as tariffs are a tax on certain goods in the Consumer Price Inflation (CPI) basket. If VAT were increased tomorrow, we doubt the Fed would be hiking rates in response.

Housing the key driver of US inflation

The focus therefore should remain on wages and, more importantly, housing. Why do we think housing is the most important driver at the moment? For the simple reason that, as Exhibit 1 shows, taking housing out of the equation puts both headline and core US inflation at target.

Exhibit 1: Headline and core US inflation ex-Shelter

Source: Macrobond, TwentyFour, 24 January 2025

At 4.6%, Shelter inflation is running around 1.3 percentage points above the five-year pre-Covid average. Given this is around 36% of the overall headline CPI basket (housing including fuels, utilities, furnishings etc. is 45% of the overall) then a normalisation of this towards the average would drive a 0.5 percentage point reduction in CPI. As such, it is difficult to have conviction around whether the underlying trends on inflation are moving towards target without having a view on where the Shelter component is heading.

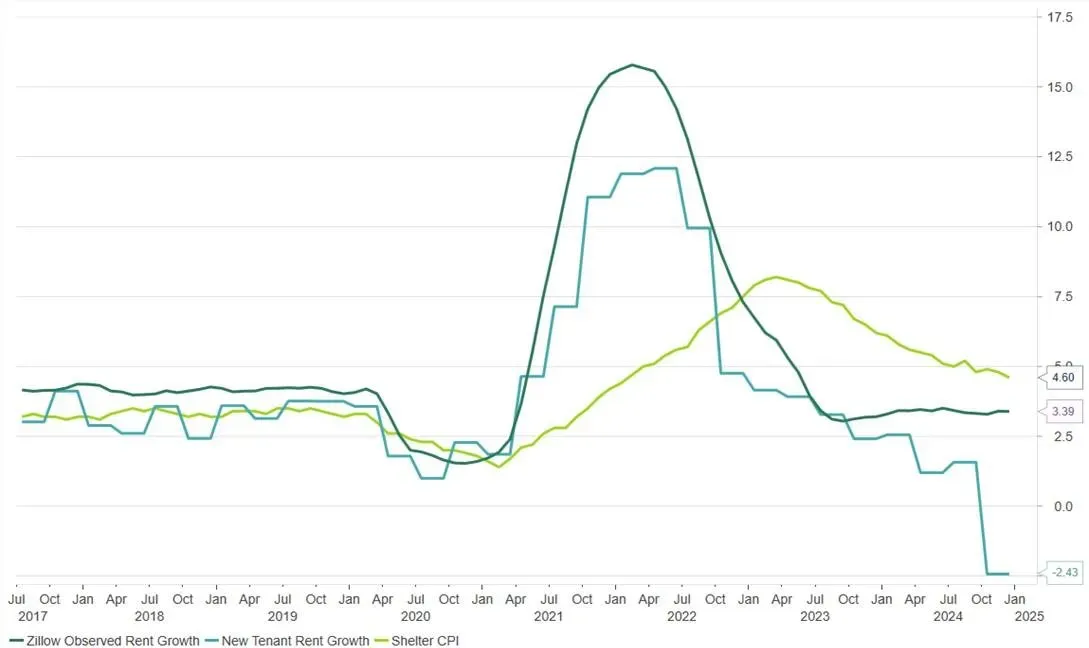

Shelter inflation is comprised of owners’ equivalent rent and tenant rent, with the former effectively estimating the rent a homeowner would be paying if they were renting their house instead. While neither of these measures distinguishes between the rent paid by new tenants versus the rent paid by old tenants, other rent-related indices such as Zillow, CoreLogic and the US labour department’s “new tenant rent” index all show a clear downward trend (see Exhibit 2).

New tenant rent increased sharply in 2022, with the year-on-year growth rate for single-family rents peaking between 13% and 15% depending on the index. Since then, the growth rate has fallen back to pre-Covid levels, if not below, across all of the indices we track. The latest report from CoreLogic, for example, published on Thursday, showed annual single-family rent growth slowing to 1.5% for November, the slowest pace of growth in over 14 years. The latest print of the new tenant rent index meanwhile actually put growth at minus 2.4%, though it’s worth saying this is an experimental data set from the Bureau of Labour Statistics and will most likely be revised higher (and we don’t think this is consistent with actual rent growth in the US at the moment).

Exhibit 2: Rent-related indices on downward trend

Source: Macrobond, TwentyFour, 24 January 2025

This is important, because the trend in Shelter inflation will ultimately be determined by the pace of rent growth for new tenants. Shelter inflation peaked in March 2023 at 8.2% (around 12 months after new tenant rent inflation peaked) and has been slowly declining since, but the “rent gap” – the gap between new rents and continuing rents – remains elevated relative to history. This gap should gradually close as tenants leave existing lease agreements which are then marked up, assuming we do not see a large spike in new tenant rent growth, which we view as unlikely.

Wage growth need not return to pre-Covid levels

Finally, we mentioned wage growth as another important driver of underlying inflation. Recent trends in wage growth have shown a gradual improvement, but wage growth is still slightly above pre-Covid levels. We think there is a “wage gap” component of the trend here too, in that the loss of purchasing power after the inflation spike in 2022 had to be made up for. This gap will close, as it is more difficult to bargain for large wage rises with inflation between 2-3%, following a number of larger wage rounds in previous years.

A key point however is that wage growth does not need to fall to pre-Covid levels to be consistent with 2% inflation, given the rise in productivity growth the US has seen since 2020. Productivity has actually increased over the post-Covid period in the US, while it has fallen in both Europe and the UK. Higher productivity growth can sustain higher wage growth without generating above-trend inflation. This, coupled with a labour market that is less tight than it was in 2019 (lower quit rates, lower hiring rates, lower unemployment and so on), has meant that since the Jackson Hole conference in August the Fed has not regarded the labour market as a source of inflationary pressure.

The upside surprise that has the potential to upset the Fed would be if the new administration’s crackdown on migration reduces the labour supply meaningfully. Legal net migration in the US in 2024 was a record high 2.7m people, close to three times the peak year pre-Covid. If legal and/or illegal immigration decline substantially going forward, we could see wage pressure building up. At this stage it is impossible to estimate what the impact will be and how quickly any adjustment might happen, but it is definitely something that we and no doubt the Fed will be keeping a close eye on.

We continue to think the underlying disinflationary trend within CPI, and particularly in housing, remain on track. While progress on inflation in 2024 was slower than 2023, this makes sense given the importance of the slower-moving housing component in the current gap to the Fed’s 2% target. Tariffs certainly have the potential to delay this progress, but at the moment we don’t see this as a reason to think the underlying trends have to change. The focus therefore should remain on the real drivers of that underlying trend – housing and labour – with an eye on new tenant rent growth and immigration trends as we move through the year.