Investors could face another decade of income scarcity

The coronavirus pandemic has brought about perhaps the greatest– and fastest – repricing of risk fixed income investors have ever witnessed.

As the threat of COVID-19 became clearer in March, we saw investors sell assets almost indiscriminately in a rush to build up cash, bond market liquidity evaporated and credit spreads soared to crisis levels with record speed. While March was one of the most uncomfortable months I can remember in 30 years of working in fixed income, the brutal sell-off has in our view created some of the best value opportunities bond investors are likely to see for several years.

The shock

The new coronavirus has been an unprecedented shock for the global economy, with major economies around the world forced into standstill and many firms seeing revenues evaporate virtually overnight. We have entered a deep recession, which we think will most likely translate into negative year-on-year growth until the second quarter of 2021, and it could be long after that before we return to the productivity levels of Q4 2019. We have already seen China’s economy shrink by 6.8% in the first quarter and a staggering 22 million jobless claims in the US, and we expect there to be plenty more negative headlines to come. On the positive side, in contrast to the previous recession triggered by the global financial crisis in 2007, governments and central banks have acted swiftly and with conviction, with trillions of dollars’ worth of support for markets, firms and individuals.

The opportunity

For fixed income markets, in our view the first important ramification of COVID-19 is that interest rates look set to remain near zero for “an extended period of time,” to borrow a phrase from the central bankers’ handbook. In fact, we may not see a meaningful rise in interest rates for much of the next decade. It is worth remembering that it took the US Federal Reserve until late 2018, a full 10 years after it cut rates to zero following the collapse of Lehman Brothers, to reach a high point of 2.25-2.50% for its Fed Funds rate. Policymakers around the world swiftly cut base rates back to their lower bounds at the onset of this crisis, and it is hard to see them reversing course quickly while economies are shepherded through recession and recovery.

For investors, we think this means cash will not be a viable asset class going forward and income will once again be a scarce commodity. The good news is, there is now plenty more income to be captured in the bond markets.

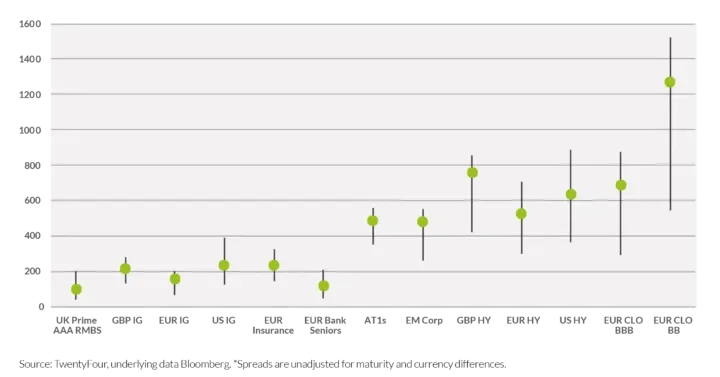

In the chart above, the green circles show credit spreads as of April 15 for a range of sectors. The bottom of each black line shows the level as of January 2, while the top shows spreads at the peak of the sell-off, which fell on or around March 24. For us, this chart demonstrates how much markets overshot, and how much potential value they still offer at today’s levels.

We entered 2020 with credit looking fully-priced pretty much across the board, and with a meaningful exposure to risk-free rates products such as US Treasuries looking a sensible and necessary hedge against likely spread widening in riskier assets. The March sell-off rapidly turned this situation on its head, with in our opinion credit going from looking quite expensive to looking very reasonable in record time amid some of the most extreme trading conditions we can recall.

In a world where it looks like income will remain a scarce commodity for the foreseeable future, we think some of the yields on offer now represent an attractive medium and long term opportunity for fixed income buyers.

The strategy

What can investors such as ourselves do to try to benefit from this opportunity?

First, we believe active managers will have a distinct advantage over passives in navigating this period. For bond investors, recession typically means a sharp pick-up in the default rate and a significant bias towards downgrades over upgrades. We would not be surprised to see a 10% high yield default rate in 2020, and would expect at least 10 downgrades for each upgrade. It should be impossible for passive funds to avoid every one of these. This won’t be easy for active managers either, but relative value research has often been proven to be better rewarded at the beginning of a cycle than at its end. With flexibility and diligent credit research, I think there is a good chance of helping to identify the likely winners and losers as the global shutdown plays out.

Clearly, the economic and market backdrop has changed materially since the start of the year, and so must our thinking. Here are three themes to consider which we think will be important going forward:

- Increase credit spread duration with longer dated bonds. We expect credit markets to lead the recovery, as investors will have a greater degree of comfort in solvency and coupon payments than they will in earnings expectations and dividend payments from equity. Given we think income will continue to be a scarce commodity, one way to improve income is by locking in yields for longer with longer dated bonds. A lot of bad news looks to have been priced into bond markets very quickly during the sell-off, and while investors should not be expecting a straight line recovery in spreads, the income from these bonds can still generate attractive returns even in the absence of a recovery. One example could be BBB rated assets that have fallen just as much as the BBs and single-Bs because of the indiscriminate selling. While earlier on in the cycle investors tend to prefer gaining yield by taking more credit risk, at this point we would prefer to gain yield by taking more maturity risk.

- Avoid the default zone by committing to higher quality credit portfolios. Locking in higher yields is no good if it comes at the expense of defaults and downgrades. CCC rated bonds typically account for around 95% of defaults, with single B taking nearly all of the remainder, but given the nature and cause of this recession, we should also be mindful of some higher rated companies jumping to default before their downgrades happen. In addition, we expect to see very strong sectoral biases. In our view it makes sense to be looking at sectors with greater earnings transparency and the most robust balance sheets, while trying to avoid sectors that are highly cyclical and look to be most at-risk, such as retail, transport, leisure, auto manufacturers, commodities and real estate companies, to name a few. There will be a time for buying lower rated companies or into the sectors mentioned above, but we don’t think that has arrived yet.

- Decrease reliance on government bonds for protection. Government bonds (principally US Treasuries) proved their worth as a negatively correlated risk-off play at the start of this crisis, but they may not offer the same protection going forward; risk-free yields are so low that they cannot travel much further now central banks have taken base rates to their lower bounds. With huge supplyahead to fund enormous fiscal expansion, along with the risk of inflation that this brings, we can see central banks’ next policy aim being yield curve targeting. It could well be the case that central banks own the long end while portfolio managers own the front end of government yield curves, mainly for liquidity purposes, as ‘risk-free’ bonds could become return-free too.

The way ahead

Fixed income investors have witnessed what will likely go down as a once-in-a-decade repricing of risk. While we are far from seeing the other side of the COVID-19 crisis or the economic downturn, we may well look back at March and April 2020 as the best entry point of this decade for fixed income credit markets.Market and economic conditions have shifted at incredible speed.

We believe active managers have to adapt their thinking and implement changes to portfolios as they seek to capture the opportunities created. Once we work our way through this most challenging period for the global economy, investors will likely face many of the same challenges of the past few years. Interest rates will most likely remain low, income will remain scarce, and in our view fixed income will remain as one of the better solutions.

Mark Holman, CEO & Portfolio Manager