Investor Nervousness Priced In?

Fixed income markets have experienced a reasonable correction over recent weeks and, for higher-yielding indices at least, their first negative period so far this year. Similar to the weakness witnessed in Q1, a sell-off in Rates markets has driven volatility, with the additional headwinds of an increase in the Delta variant, a global energy crisis and concerns that inflation may prove less than transitory due to ongoing global supply chain issues playing their part. As a result, questions now hang over the future strength of worldwide growth, dampening business and investor sentiment, despite the recent upbeat IMF report.

However, the sell-off in most credit sectors has been relatively orderly so far, but it is worth taking stock of the move in spreads. In our opinion, investors have already priced in a reasonable amount of negative news.

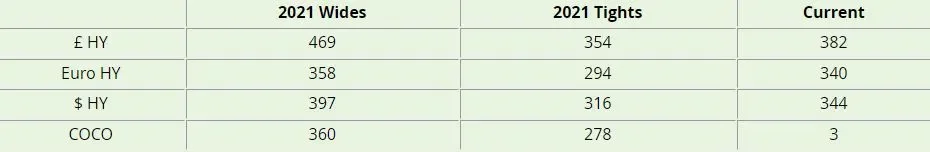

For example, the European high-yield index has probably experienced one of the most significant moves, which has reversed much of the spread tightening observed this year. Currently, the Spread to Worst vs Governments for the Euro high-yield index is 340bps, or 46bps wider than the tights of the year, a level reached as recently as 17th Sept, and this is enough to take spreads back to levels last seen at the start of February. The Sterling high-yield index has fared better, despite pronounced moves sending Gilt yields wider, and currently offers 382bps of spread, 28bps wider than the tights seen on the 23rd Sept and the index has fluctuated around this level since April. Meanwhile, the dollar index is currently 28bps wider at 344bps of spread and has fluctuated between approximately 350 – 316bps since the start of April. Finally, the COCO index is 33bps wider, at 311bps – a level first reached in February this year.

Table 1: Spread to Worst vs Governments

Investors face more challenging markets, and Rates are a contributing factor; traders are now anticipating a BOE base rate of 1% by the end of next year. Meanwhile, interest rate swaps are pricing in the first change in monetary policy from the Fed in Sept 2022. In addition, an easy resolution to supply chain disruption looks increasingly unlikely, and the UK looks particularly vulnerable due to a lack of HGV drivers – again, an issue unlikely to see a quick or permanent solution. All of this is feeding into the inflation debate, with even Fed members beginning to doubt their “transitory” message.

However, despite the recent downgrades to growth by various investment banks, growth still looks robust – it has been slowed but not extinguished. In addition, despite the weakened sentiment, it is difficult to argue that fundamentals for credit are not very strong, with technical drivers still in place.

Slower growth is not by itself bad for credit – lower growth tends to lead to lower earnings – a headwind for equities, but not necessarily credit. Accordingly, spreads are more generous again, especially in Europe, and investors have already absorbed a reasonable amount of negative news.

Given that backdrop, stopping investors from becoming more constructive will necessitate a lengthy continuation of the bad news.