European ABS looks mispriced and set for Q4 rally

Having fallen behind other markets in the post-COVID rally due to a lack of direct central bank support, we believe European ABS is set to outperform other parts of fixed income in the coming months as supply wanes and investors look to pick up on what we think could be a compelling relative value opportunity.

- We believe the inflated credit spread in European ABS could be one of the best answers to the income scarcity brought on by central banks’ response to the pandemic

- ABS is currently yielding 200-300bp over corporate bonds at the BBB level, despite no evident deterioration in credit performance as a result of COVID-19

- This gap should close if investors move in looking for relative value against other sectors which have recovered more strongly, causing ABS to outperform in Q4 and into 2021

For the vast majority of risk assets, 2020 has been a tale of swift and sharp recovery from the turmoil unleashed by COVID-19 towards the end of Q1. Buoyed by unprecedented measures from both central banks and governments, US equities in particular have made well publicised new highs and corporate bonds have seen a virtually V-shaped recovery from the lows of March, when the economic toll of the pandemic first became apparent.

Euro high yield bond spreads, for example, had tightened in to 404bp by October 23, some 300bp inside the peak they hit in March. It is the same story for euro investment grade corporate bonds, which now sit well below 100bp having more than halved from their COVID sell-off peak.

However, there has been one part of European credit that seems to have missed the full force of the post-COVID rally: European ABS.

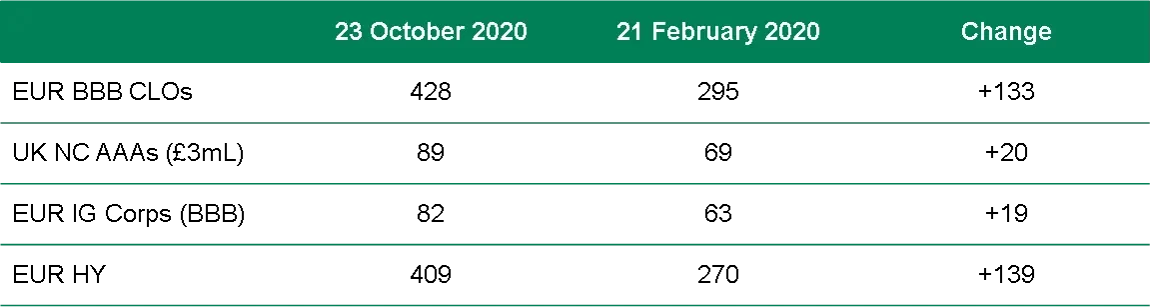

Having suffered the same sharp sell-off as other credit markets back in March, European ABS spreads have experienced a much shallower recovery trajectory to date. AAA rated UK non-conforming RMBS spreads remain 20bp off their pre-COVID tights, for example, while BBB CLO spreads are still some 133bp higher than they were in February.

Chart 1: ABS/CLOs vs. high yield/IG spreads (bp)

Central banks have left ABS behind

So why has ABS missed the rally? In our view, the answer is central banks.

Faced with the dire economic consequences of a global pandemic, central banks have flooded the major credit markets with liquidity. The European Central Bank and Bank of England both ramped up their bond purchase programmes, as did the US Federal Reserve, which also broke new ground by becoming a buyer of high yield and ETF markets for the first time.

By contrast, ABS has enjoyed virtually zero direct support. The ECB has been a buyer of certain European ABS sectors through its purchase programme since 2014, but its net purchases in the asset class have been just €1bn in the first eight months of 2020, compared to the tens of billions per month it has committed to regular corporate bonds. Collateralised loan obligations (CLOs), European ABS’s second largest sector by outstanding volume at €140bn, are not on the ECB’s shopping list, while UK RMBS, another huge portion of the market, also receives no direct support from the BoE.

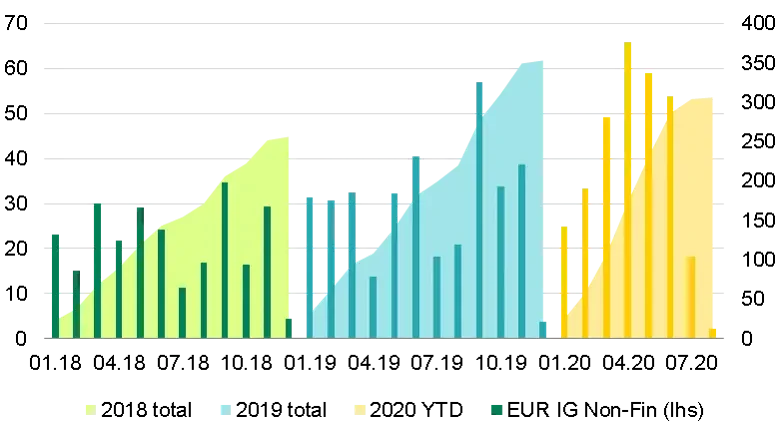

The effect of this can be seen in the divergence of issuance volumes between European ABS and European corporate bonds in the second quarter of 2020, when primary bond markets restarted following the initial shock of COVID-19.

Chart 2: ABS has lacked primary market momentum

Euro IG non-financial issuance (€bn)

European ABS issuance (€bn)

Source: Morgan Stanley, 26 August 2020

As Chart 2 shows, the ‘shock and awe’ of central bank buying had the desired effect on corporate bonds, helping to restore investor confidence quickly and tightening spreads, such that just weeks after the COVID-19 sell-off we saw record supply in both the IG and high yield markets.

By contrast, syndicated European ABS supply dived in Q2 as wider spreads made deals unattractive for issuers, and it has remained subdued. Without the same support from central banks, ABS issuers favoured private and club syndications in the aftermath of the Q1 sell-off to ensure certainty of execution. This lack of publicly syndicated supply meant ABS spreads missed out on the positive spread momentum being generated in corporate bonds; the primary market can be a key reference point for investors after a period of volatility, and without a clear signal of the spreads issuers can achieve in primary, many lack the confidence to step back into the market in the kind of size that would be expected to drive spreads tighter.

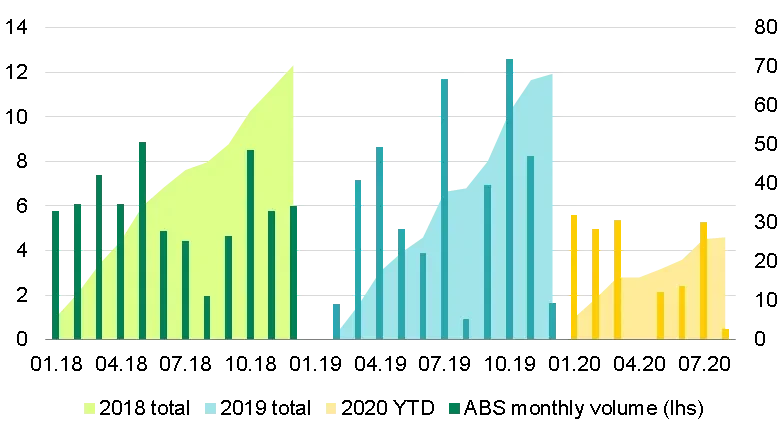

The result is that as we move into Q4, European ABS bonds are showing an unusually high premium over corporate bonds of the same rating, and therefore in our view represent a positive relative value opportunity.

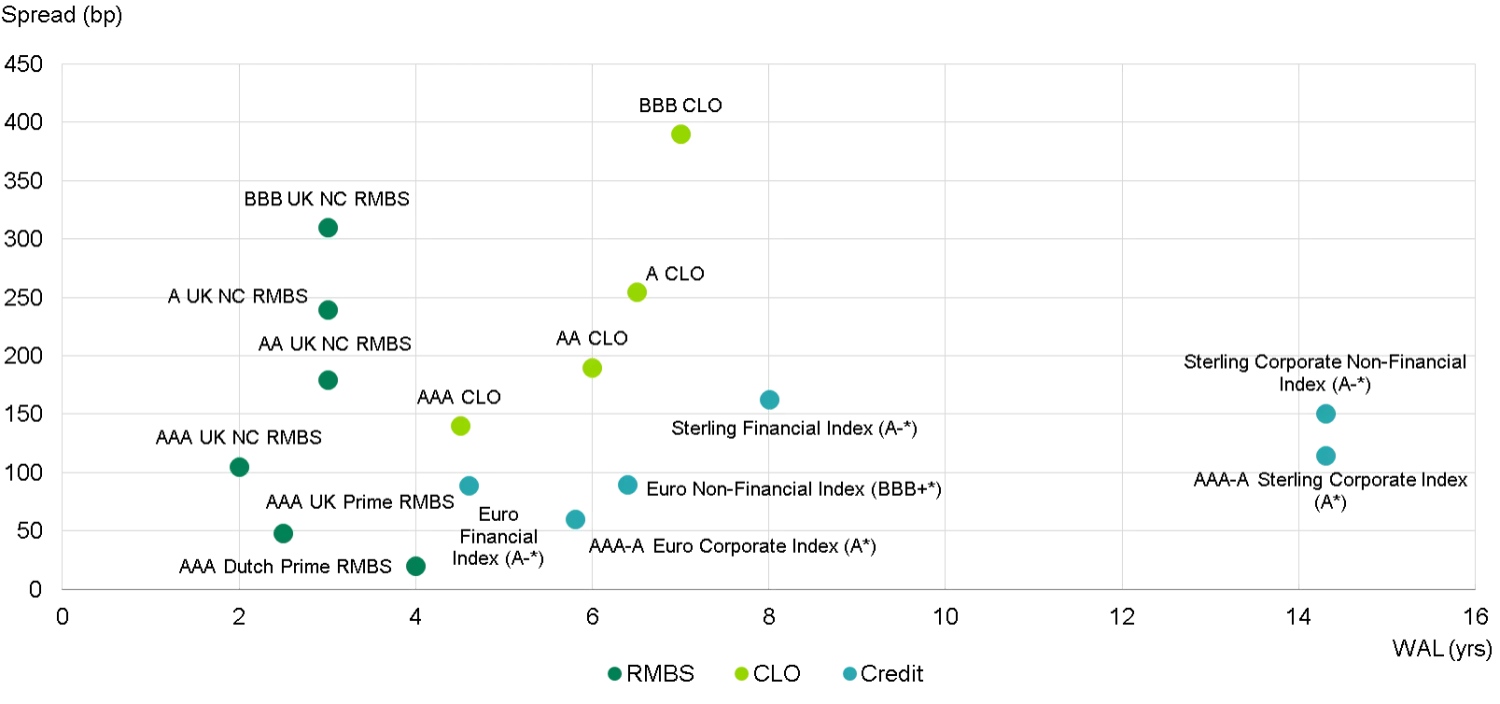

As Chart 3 shows, AAA rated UK NC RMBS is currently yielding more than the euro non-fin IG index, which is both longer dated and lower rated. For BBB CLOs, the premium to comparable corporate bond risk can be worth hundreds of basis points.

Chart 3: Relative value, IG ABS vs. credit

Average credit rating of index. It is not possible to invest directly in an index and they will be unmanaged. Source: MS, Citi, ICE BofAML Indices, Bloomberg, TwentyFour. 6 October 2020

Relative value opportunity may be short-lived

This is not the first time ABS has traded at what we consider to be an unjustified premium to corporate bonds, and this is why we believe this relative value opportunity may be short-lived.

When the ECB first began its asset purchases back in 2014, we saw a similar gap open up as central bank support drove corporate bond spreads tighter, leaving ABS spreads trailing.

On that occasion, investors eventually spotted the relative value in ABS and many shifted their allocations accordingly, ultimately driving spreads in sectors such as Auto ABS and Prime RMBS to record lows. Given the size of the premium we see today, we expect the same shift to occur very soon.

As a consequence we expect the underperformance of European ABS relative to corporates we saw in the first half of 2020 to turn into outperformance in Q4 and into 2021.

Technicals appear to be stacked in favour of ABS

While we think the spread premium alone should be enough to drive demand for European ABS up in the coming months, the supply side of the equation could also help drive positive performance for ABS bondholders going forward.

A key component of the central bank response to COVID-19 in both Europe and the UK has been ultra-cheap financing for banks, and we believe this cheap funding is making the spreads achievable in the ABS market look extremely expensive, resulting in a drag on supply that we expect to last well into 2021.

This drying up of supply applies to CLOs as well. The issuance of leveraged loans – the raw material that make up CLO collateral pools – has fallen markedly in 2020 as a result of the COVID-19 pandemic. In addition, issuers face increased costs in building CLOs since investment banks’ risk appetite for ‘warehousing’ the assets has dropped. Barclays analysts recently revised their projection for 2020 CLO supply to €15-18bn, which given around €13bn had been issued by September 30 shows how little more is expected.

Fundamentals look solid, but are expected to deteriorate

So far, we have not seen any meaningful deterioration in credit performance within ABS pools as a result of the economic disruption from COVID-19. For anyone who has looked properly at the credit performance of European ABS through the last recession in 2008/9, that will not come as a surprise.

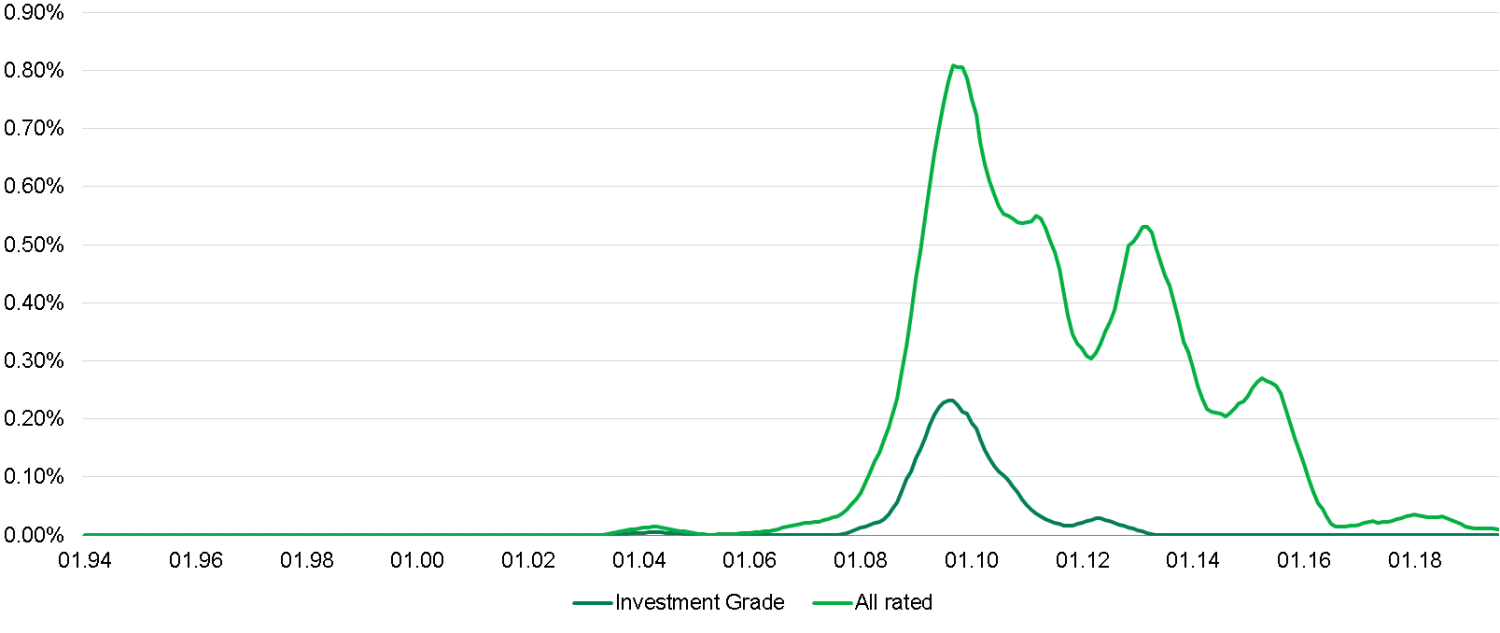

Chart 4: Historical European ABS losses; a reminder

EMEA RMBS, ABS and CMBS – 12m rolling average loss rate

Source: TwentyFour, Moody’s. 20 July 2020

Throughout the ‘great recession’ and in the years since, European ABS performance has been strong. Loss rates on all investment grade European ABS peaked at 0.23% during the GFC, and in a 25-year period going back to January 1994, the average annual loss rate has been just 0.02%.

The ABS losses many people associate with the financial crisis almost exclusively occurred in the US ABS market – which has entirely different characteristics to its European cousin – and the vast majority of those were in sectors with specific problems such as subprime RMBS and CMBS.

Despite this strong performance European ABS was still subject to tighter regulation post-crisis, with stricter rules around loan origination (such as a ban on self-certified consumer loans in the UK), structuring and ratings all intended to make the product simpler and safer for investors.

Chart 5 shows the net impact of these changes, with credit support and loss cushions for a typical European ABS bondholder having increased substantially since 2007.

Chart 5: How do ABS structures compare?

The bonds identified above are used for illustrative purposes only and should not be seen as investment advice or a personal recommendation to hold the same or similar. No assumption should be made as to the profitability or performance of any security identified. Source: RMBS Investor Reports. August 2020

Given they are backed by consumer loans (in the case of RMBS) and corporate loans (in the case of CLOs), ABS as an asset class understandably comes under increased scrutiny in a recessionary environment, as investors try to judge how this will likely impact loan repayments. In the wake of COVID-19 this has been even more acute, given national lockdowns rendered swathes of businesses unable to open and scores of mortgage-paying employees unable to work.

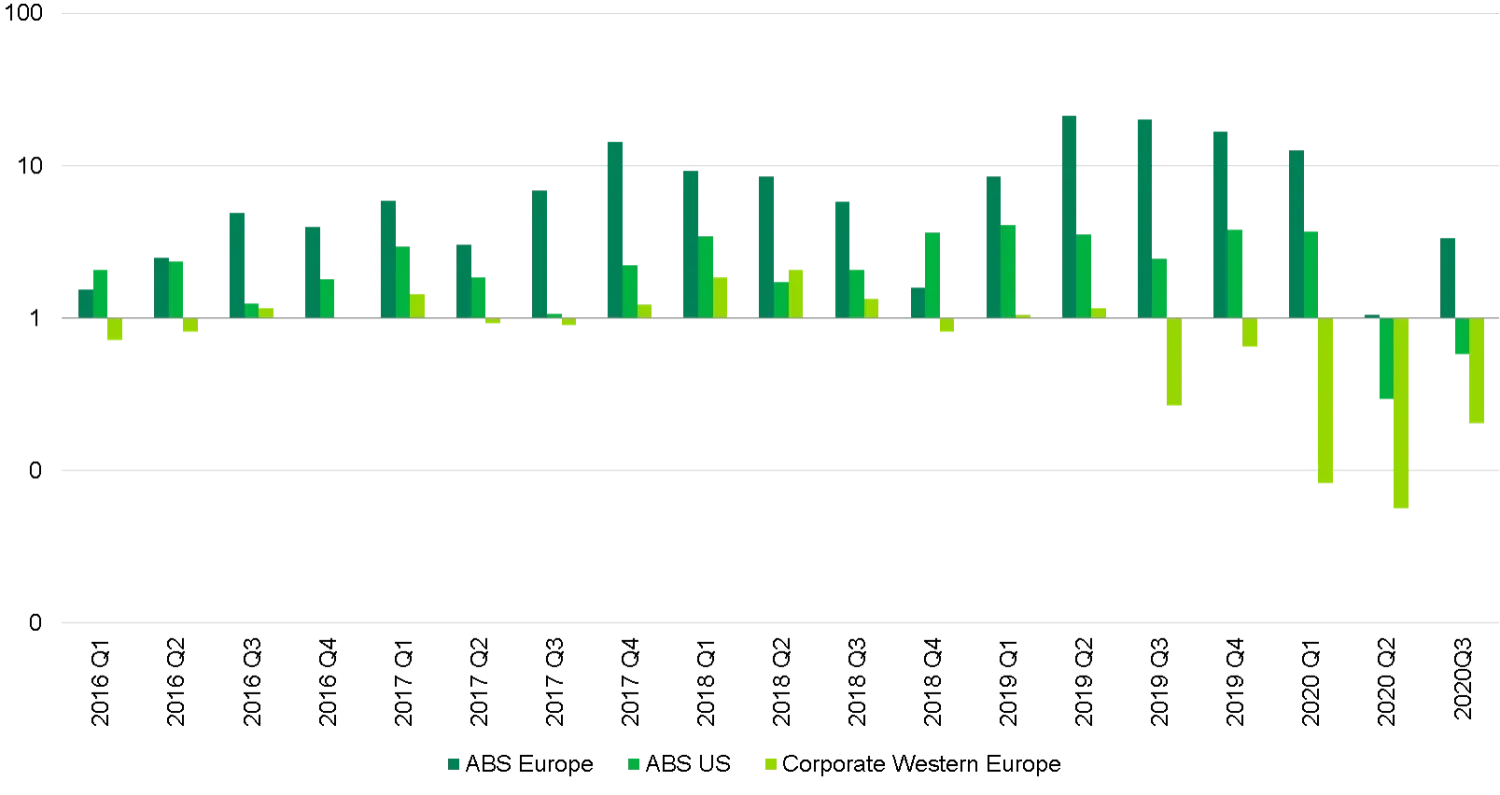

Despite this, credit performance in European ABS has been reasonably stable throughout 2020. As Chart 6 shows, there are more transactions being upgraded than downgraded.

Chart 6: European ABS upgrade-downgrade ratio, 2016-2020

Source: Bloomberg, S&P, Moodys and Fitch (excluding Rating Watch) as of 29 August 2020.

However, economic fundamentals are set to deteriorate. Central banks and governments look to have done a good job of smoothing the impact of a deep recession with a range of measures thus far, but these cannot continue forever and there will be economic pain ahead.

If we take the UK, for example, unemployment is likely to rise substantially once the government’s furlough scheme rolls off at the end of October (its replacement is far less comprehensive), while vulnerable sectors such as leisure and travel will continue to be hurt by more localised restrictions.

Stress testing gives us confidence in ABS credit risk

That said, there is a big gap between our worst case scenario for the economy and what European ABS transactions can withstand before bondholders would suffer any losses. This is due to the structural investor protections built into ABS, such as credit enhancement, excess interest and reserve funds

We like the credit risk in ABS for the historical reasons above, but we cannot be complacent about the economic outlook. That means we will keep stress testing these deals with adverse scenarios far beyond our worst expectations.

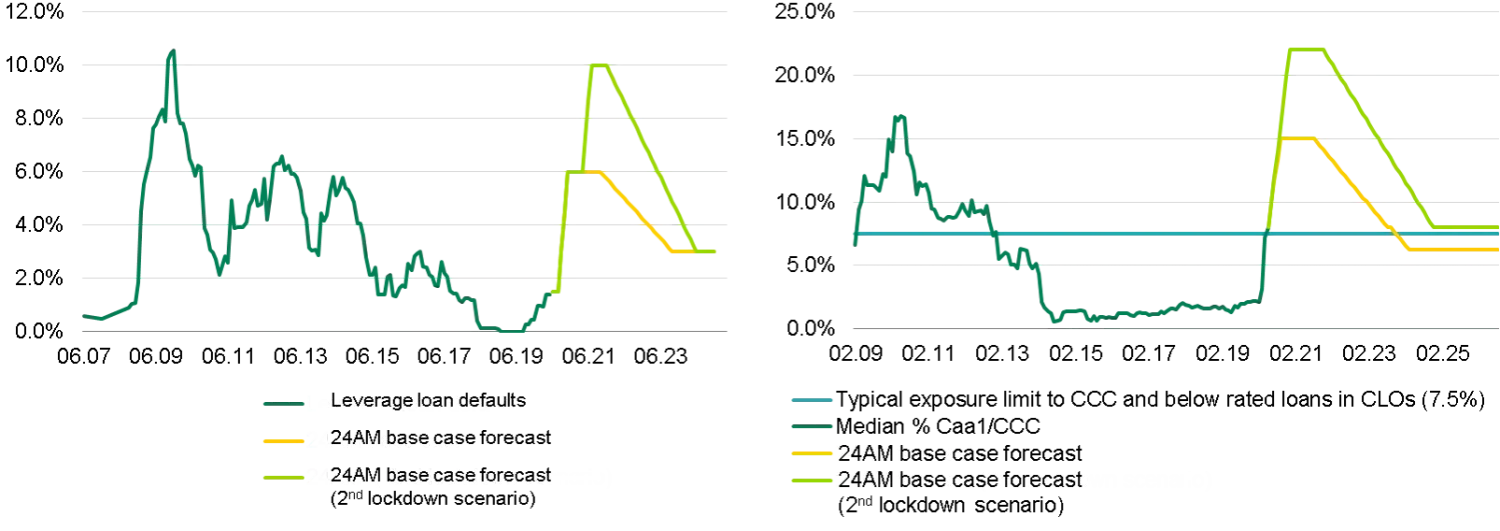

Chart 7: How could CLOs behave in a COVID recession?

Stress tests are a forecast of results based on the scenarios tested and are not intended as a forecast of actual future performance nor are they a reliable indicator of future results. % CCC represents the median % of Caa1/CCC+ or Less in 1.0 and 2.0 CLOs (All CLOs issued from 2007). LHS source: TwentyFour, LCD, Barclays, 19 June 2020. RHS source: TwentyFour, Morgan Stanley before February 2019, Intex thereafter, 19 June 2020.

Chart 7 shows our base case (yellow line) and our adverse scenario of a second widespread lockdown (light green line) for leveraged loan defaults and CCC exposure within CLOs. It is with these parameters that we stress CLO portfolios to see where they “break”, i.e. what level of economic pain the CLO structure can take before bondholders might face any loss of coupon or principal. We also add deal-specific stresses where a CLO has particular exposures to distressed names or sectors most impacted by COVID-19, such as travel, leisure, retail, and oil and gas.

Given the scale of government interventions and higher levels of corporate liquidity going into this recession compared to the GFC, we believe it is reasonable to assume a slightly lower peak of loan defaults this time around. We are therefore modelling a materially bigger impact on defaults and CCC exposure than we saw during the GFC, and we remain very confident in European CLO credit risk.

With their exposure to leveraged corporate loans, CLOs are widely regarded as the European ABS sector most exposed to the economic disruption of COVID-19, which has taken hold again in Europe and is pushing many countries into new restrictions on businesses.

Liquidity often the key to helping capture ABS relative value

How can investors look to harvest that premium most effectively?

First, we think a focus on liquidity will be crucial. For example, as a result of the COVID-19 turmoil, we have had to revisit our definition of a ‘liquidity asset’ in European ABS. Our previous definition was informed by our experience during the financial crisis and other periods of significant volatility such as 2011, 2016 and 2018. However, some of these assets did not perform as we had expected during the extremely volatile period of trading in March and April. Instead it was eligible collateral for the ECB and BoE’s funding mechanisms, and also for the ECB’s purchase programme (such as ‘captive’ German Auto ABS), that gave you cheaper and quicker access to liquidity during the COVID sell-off, and we have shifted the make-up of what we consider our liquidity bucket to reflect this. In some cases this has meant taking a lower credit spread on these ‘liquidity assets’ than pre-COVID, but given the amount of credit spread in the market at the moment (see Chart 3) we are not worried about credit spread at the moment. With the economic outlook uncertain, we will likely see more bouts of credit market volatility in the months to come, and ready access to liquidity will help investors be better positioned to try and take advantage of any buying opportunities more efficiently.

Second, we think that investors should look to embrace credit risk by being relatively pro-cyclical and adding convexity, in order to try to capture that compelling relative value. One approach would be to add discounted assets and longer dated assets, and in our opinion ideally these would be assets that are both longer dated and discounted because of the strength of the positive technical we see in European ABS. As we have said, we don’t want to be complacent about future credit risk, so we would expect investors to focus on trying to capture value in higher rated assets, since there is currently plenty of credit spread available in the investment grade portion of the market without needing to dip into lower rating bands.

Central banks have made credit spread king

The case for European ABS in our view is boosted even further by central banks’ flattening of yield curves post-COVID.

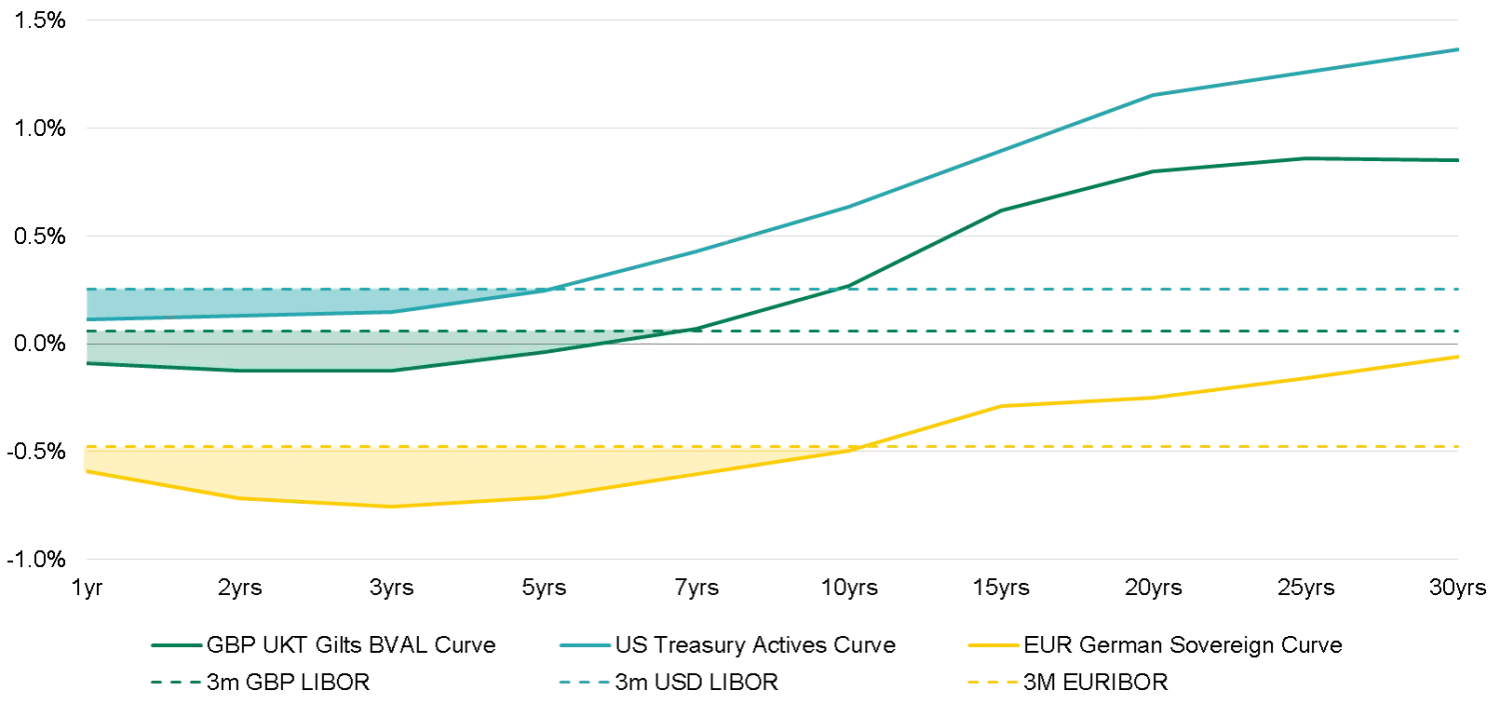

Historically, fixed income investors bought fixed rate bonds to add yield over and above the risk-free rate, since the yield curve was typically upward sloping. But with yield curves hammered pretty much flat by central bank intervention, the case for owning fixed rate bonds over floating appears to be much weaker.

As Chart 8 shows, the rates curves in all the major currencies now yield less than the main floating rate indices, all the way along the curve until you get to either five or seven years, and even then we think the pick-up is less than head-turning. What used to be considered a handsome pick-up on fixed rate risk can now actually cost you some yield, depending on which curve and which point you are looking at.

Chart 8: Global rates curve vs. floating rate

The value of an investment and the income from it can fall as well as rise as a result of market and currency fluctuations and you may not get back the amount originally invested. Source: Bloomberg. 3 September 2020.

In short, the yield curve portion of a bond investor’s yield is now virtually worthless, and therefore we think their focus should be on where they can get the best credit spread. It is clear to us that rates are not going up any time soon, but being in a predominantly floating rate product such as ABS does help immunise you from yield curve volatility and especially at the moment it can pay you more than fixed rate bonds do regardless of credit spread.

In terms of high quality credit spread, we believe European ABS could be one of the best opportunities out there for bond investors today.