Animated explainers

Our animated explainers are a complete visual guide to some of the more complex fixed income assets to feature in TwentyFour portfolios.

What are corporate hybrids and how do they work?

Corporate hybrids are bonds issued by companies that combine characteristics of both debt and equity.

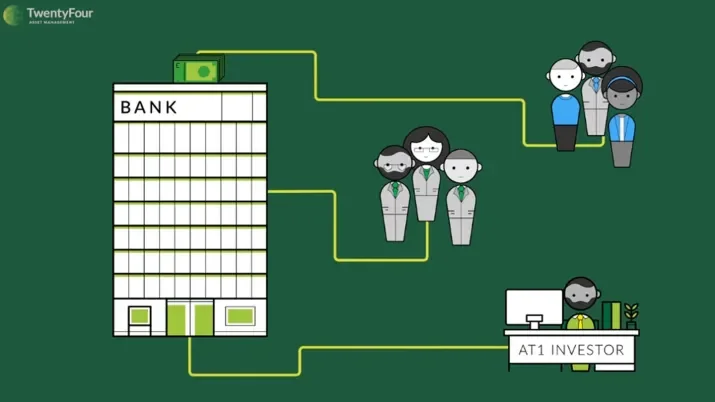

What are AT1 bonds, and how do they work?

Additional Tier 1 bonds, or AT1s for short, are part of a family of bank capital securities known as Contingent Convertibles or ‘Cocos’. They are bonds issued by banks that contribute to the total level of capital they are required to hold by regulators.

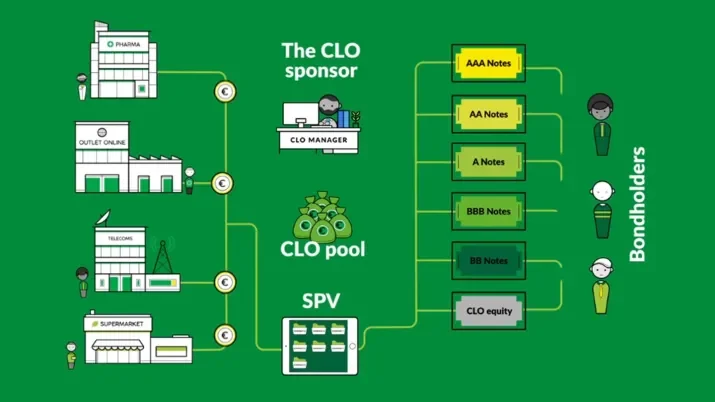

What is a European CLO, and how do they work?

European collateralised loan obligations – or CLOs – are bonds issued to fund a specific and diverse pool of corporate loans to firms of different sizes and in different industries all over Europe.

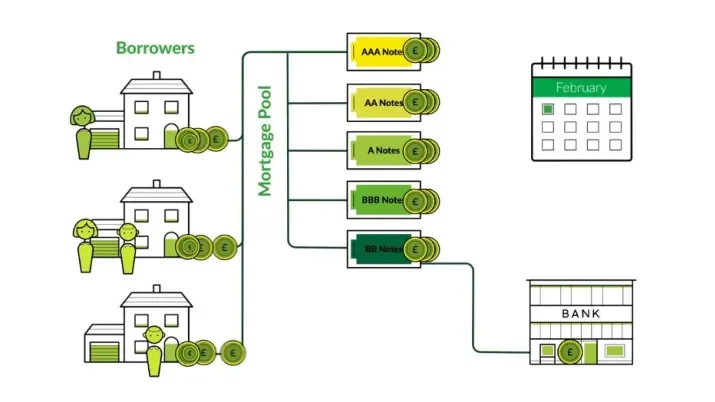

What is an RMBS, and how do they work?

Residential mortgage-backed securities (RMBS) are an under-utilised asset class for many investors, despite boasting some of the lowest default rates across the global fixed income market and offering higher yields and greater investor protections than vanilla corporate bonds of the same rating.