ABS liquidity is there when you need it most

In late September the new UK government’s ‘mini-Budget’ triggered a savage sell-off in Gilts, forcing UK pension funds running liability driven investment (LDI strategies) to sell liquidity assets to raise cash to cover margin calls. Asset managers, in particular those offering LDI strategies, faced large redemptions from pension funds and became forced sellers of investment grade ABS and CLOs to meet their short-term liquidity requirements.

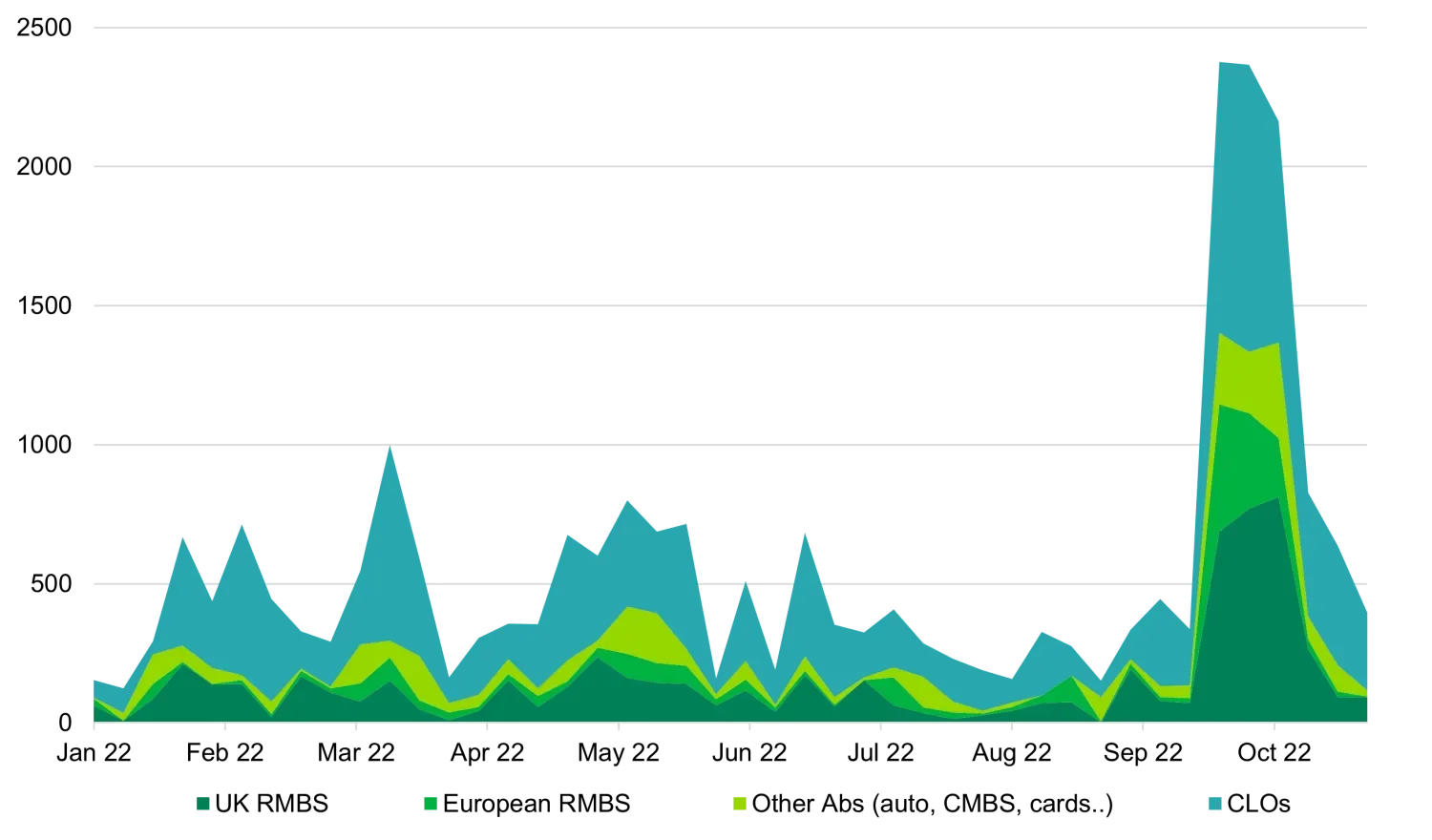

This resulted in an unprecedented scale of selling in ABS for three consecutive weeks. Between finance minister Kwasi Kwarteng’s mini-Budget announcement on September 23 and his resignation on October 14, the volume of ABS and CLO bonds listed via Bids Wanted in Competition lists (BWICs) totalled €6.9bn, roughly equivalent to the quarterly volume seen in Q1 and Q2 2022. That was the publicly reported volume. We understand even more bonds changed hands away from the public eye via bilateral trades, including portfolio sales. The selling was mostly concentrated in the AAA and AA rated tranches of UK RMBS and European CLOs; asset managers have been large buyers of these assets for pension funds in recent years, but to us this also highlights that the motivation for the selling was liquidity rather than credit concerns.

ABS and CLOs weekly BWIC Volume YTD (€mm)

Source: Citi Velocity, 31 October 2022

BWICs have proven to be an efficient method of raising liquidity, since this client-to-client trading gives sellers direct access to the broader market and compliments dealers’ liquidity. The post-mini-Budget period was one of the largest liquidity events we have seen since the global financial crisis, and it was certainly the largest volume of pension fund selling we have witnessed since 2008.

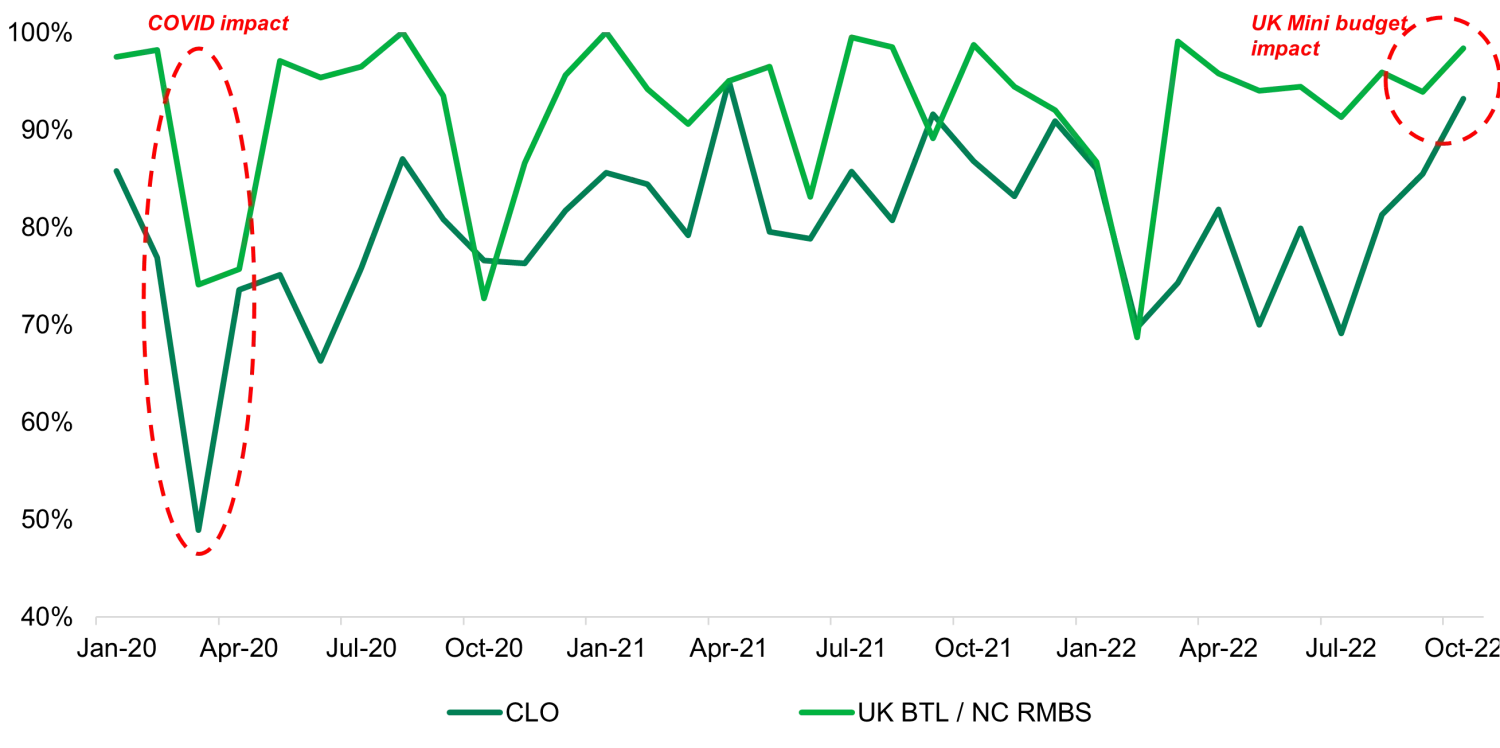

While the cost of liquidity certainly rose, bid-offer spreads on AAA and BBB rated RMBS and CLO bonds remained relatively stable at 0.5%-1% and 2%-3% respectively through the period. Bonds did trade and the asset class did exactly what it was supposed to do. In fact, the proportion of bonds trading on BWICs was very high, sellers were able to meet their large liquidity requirements and the higher yields attracted new buyers. As shown in the chart below, the proportion of CLO bonds listed on BWICs in September and October that were ultimately traded was between 85% and 93%, compared to a low of 49% during the COVID-19 triggered sell-off in March 2020.

% of bonds trading BWIC

Source: Morgan Stanley, 31 October 2022

Pension funds were selling – who was buying?

The heavy supply and the urgent need for cash led to a sharp decline in bond prices to dislocated levels, but liquidity was better than expected. Dealers were more willing to put balance sheet to work, as they were able to rotate their books given the high level of appetite from investors to buy high quality bonds at wider levels on the other side. Some dealers also took the opportunity to increase balance sheet, as opposed to reducing their risk limits as many did during the COVID sell-off. Bank treasuries, a typical buyer of AAA UK RMBS in the primary market in large size, have stepped into the secondary markets over the past few weeks and absorbed a large volume of UK Prime RMBS at a yield of around 5%, as well as UK Buy-to-Let and non-conforming RMBS AAAs at yield of more than 6%. As the cash price of AA rated CLOs dropped by 5-7 points into the mid-to-high 80s, the convexity and yield of 6.5% in euros attracted hedge funds and private equity buyers . The demand from US buyers has been particularly strong as these lower levels made European ABS cheap compared to domestic bonds.

Why was ABS at the forefront of UK pension funds’ liquidity needs?

Pension funds’ sudden liquidity need was rates-driven, and both RMBS and CLOs are floating rate products. Therefore they suffered far smaller drops in cash price in the sell-off than the fixed rate bonds in fund portfolios, making them the prime candidate for raising liquidity while incurring the lowest losses.

For example, between the end of August and the peak of the mini-Budget sell-off, Nationwide Building Society’s senior secured bonds dropped 7 points to a cash price of 87. By contrast, the same issuer’s prime RMBS bonds dropped by just 1.5 points to a cash price of 97.5 over the same period. With a similar maturity and yield, both bonds dropped somewhat in value due to spread widening, but as the senior secured bonds have a fixed rate coupon the cash price dropped significantly more. Therefore, selling ABS at a higher cash price seemed an obvious option to limit capital destruction, rather than selling corporate bonds where, in our opinion, pension funds would have found it difficult to raise liquidity in large size at that time, given the level of uncertainty around Gilt yields.

The recent liquidity crisis has put ABS in the spotlight, but for a good reason. First, the ABS market has done its job in providing liquidity to UK pension funds, and has comfortably absorbed an unprecedented level of supply in a short period of time, probably even better than we expected. Second, it has highlighted the attractiveness of the asset class from a yield and credit perspective, with multiple buyers stepping in.

Ultimately of course the Bank of England helped to restore stability by stepping in to buy long dated Gilts, which helped to stabilise the pension fund selling. Selling in the ABS market has in turn slowed down, and we have seen BWIC volume normalise in recent weeks with more diverse sets of bonds by rating and sector listed for sale. In the coming months, we would expect to see pension funds and consultants consider some rebalancing as a lot of (floating rate) liquidity has been used. They have sold comparatively little of their corporate bond and illiquid asset holdings, and thus a rebuilding of liquidity via ABS purchases could happen in the coming months, which should ultimately help tighten spreads to more normal levels.