BoE: Lender of (not so) last resort

Last week, the Bank of England (BoE) published a speech by its Executive Director for Markets, Victoria Saporta, in which she laid out the central bank’s evolving role as a lender to the UK banking system. More specifically, the speech highlighted how the BoE expects to see UK banks having a greater reliance on its funding facilities going forward.

Strong UK savings bode well for bonds

Excess savings have been at the centre of heated debates among economists and market participants ever since the pandemic.

Australian ABS: Demand Down Under

The Australian ABS market has continued its red-hot start to the year with record issuance in the last two months – the 17 new deals priced in May for a total of A$12.3bn were followed by 13 deals in June adding a further A$8.5bn. For context, before May the post-2008 record for deals printed in a single month stood at 10 and the largest monthly volume at A$9.3bn.

Astonishing July demand shows appetite for mezz ABS

A consumer loan ABS issued last week by Consors Finanz, a fully-owned subsidiary of BNP Personal Finance, highlights the remarkable appetite investors are currently showing for mezzanine ABS bonds.

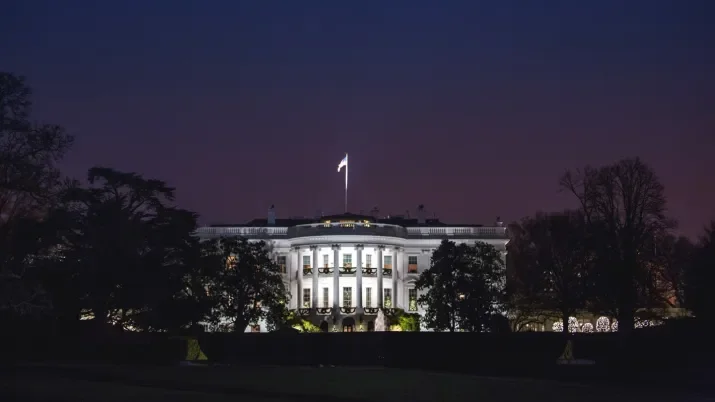

Politics won’t trump data for the Fed

The last few weeks have seen former President Donald Trump establish a lead over current President Joe Biden across polls in the run-up to November’s US election. Even though it is early days and a lot can change before November (including the Democrat candidate), it is worth considering what a second Trump term might mean for the world economy and for fixed income markets.

Thames Water: Government must deploy the life raft

Back in April we looked in detail at the challenges and potential outcomes facing Thames Water, the debt-laden UK utility company battling to avoid government intervention. On the back of a lacklustre set of financial results and being placed into a “turnaround oversight regime” by the regulator Ofwat, Thames Water’s situation took a further turn for the worse last week.

Wages continue to rein in pace of ECB rate cuts

Last month saw the European Central Bank (ECB) get their cutting cycle underway with a 25bp cut in the deposit rate to 3.75%. However, any expectations for a rapid series of reductions after the first move were tempered by President Christine Lagarde, who at the subsequent press conference was clear that the ECB could move in phases in which they left interest rates unchanged.

Investment Grade Quarterly Update – July 2024

Johnathan Owen, Portfolio Management, defines the second quarter of 2024 as another interesting period for financial markets, marked by the first rate cut from the European Central Bank (ECB) in June and President Macron's snap election announcement in France. He outlines what these meant for the Investment Grade (IG) team.

Multi-Sector Bond Quarterly Update – July 2024

A member of our Multi-Sector Bond team takes us on a journey through market sentiment. He highlights its strength in Q1, the reversal in Q2, and the pivotal role of upcoming data as the main driver of risk sentiment moving forward.

Asset-Backed Securities Quarterly Update – July 2024

Elena Rinaldi, Portfolio Management, wraps up the second quarter of 2024 for the Asset-Backed Securities (ABS) team. She notes that while financial markets experienced mixed performance and broader volatility, the ABS market remained relatively resilient and delivered strong performance.

This strange economic cycle is finally starting to look familiar

There is little disagreement among investors and economists that the last few years have been highly unusual in many respects. An inflationary shock in developed markets, one of the fastest rate hiking cycles on record, the worst year in decades for government bonds (2022), and mild recessions with no movement in unemployment are just a few of the dynamics that have strayed from recent norms.

French result supports European spreads but budget concerns remain

After weeks of volatility following President Emmanuel Macron’s decision to call snap parliamentary elections in France, markets were breathing a sigh of cautious relief on Monday after the far-right Rassemblement National (RN) underperformed the polls.

Blog updates

Stay up to date with our latest blogs and market insights delivered direct to your inbox.